In the initial stages of the pandemic, some sectors of the commercial real estate market suffered. As people shifted to working from home – avoiding travel, visiting retail stores, and dining in restaurants – prices for hotels, retail properties, office buildings and other property types where people traditionally gathered declined. However, as the economy has recovered, the commercial real estate market has rebounded.

“Commercial real estate price growth could continue to outpace commercial real estate income growth, implying property values may not yet have reached their cyclical peak.”

For commercial real estate (CRE) investors, capitalization (cap) rates are an essential metric for analyzing the potential annual return of a commercial real estate investment. Cap rates relate the income generated by a CRE property to its value, which provides investors with a measure of potential return on an investment. For example, a commercial property purchased for $100,000 that generates $10,000 a year in income has a cap rate of 10 percent.

Cap rates provide a good way to compare similar properties with different prices and income-generating potential, as well. They are also used as a risk metric because they indicate the risk associated with the future income-generating potential of a property. One would be willing to pay more for a property with stable and predictable income versus a property with the possibility of more volatile or possibly declining income in the future. Paying more for the stability of future income results in a lower cap rate, while paying less for a property with possibly more volatile future income increases the cap rate.

National Cap Rate at 20-Year Low

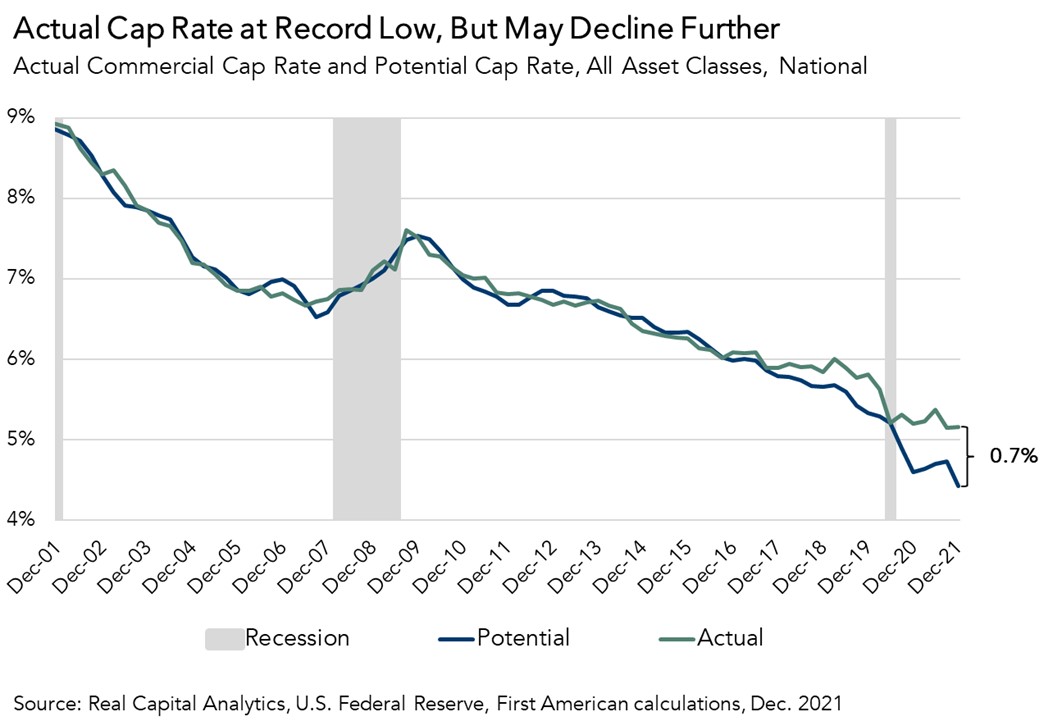

Nationally, the average cap rate across all CRE asset classes (office, industrial, retail, multifamily, hotel, and senior housing) is at a 20-year low, due to today’s low interest rate environment and the limited supply of commercial real estate properties relative to strong post-pandemic demand. CRE investors have bid up prices to own the stream of income that commercial real estate properties can provide. Is it possible for prices to continue to increase? Or will inflation and a rising interest-rate environment reverse the long-term decline of the national cap rate and reduce the pace of price appreciation?

Introducing the Potential Cap Rate Model

To help answer this question, we developed the First American Potential Cap Rate (PCR) Model. Our PCR Model estimates a potential national cap rate based on several CRE market fundamentals, including rental income, prevailing occupancy rates, interest rates, the amount of commercial mortgage debt in the economy, and recent property price trends. When the actual cap rate is significantly above the potential cap rate, as was the case in the fourth quarter of 2021, the model suggests that the CRE market can support a lower cap rate.

Do Commercial Real Estate Prices Have Room to Run?

Except for a brief hiatus during the Great Recession (2007 to 2009) when property prices declined and real estate investment risk was high, the national average CRE cap rate has consistently declined. Since the end of 2017, the potential cap rate has been below the actual cap rate because declining interest rates have reduced financing costs and increased buying power for CRE investors. In the fourth quarter of 2021, the actual cap rate reached a record low of 5.2 percent, while the potential cap rate, according to the PCR Model, was even lower at 4.4 percent. This implies that CRE price growth could continue to outpace CRE income growth and that property values may not yet have reached their cyclical peak.

As the Federal Reserve raises interest rates, financing costs are likely to increase and reduce CRE demand. The potential cap rate, as supported by market fundamentals, may be as low as it can go. However, since the actual cap rate remains above the potential cap rate, the actual cap rate could still go even lower as CRE investors compete with each other for the income streams that commercial real estate provides.

The PCR Model is updated quarterly with new data. Look for the next edition of the PCR Model the week of June 27, 2022.

Fourth Quarter 2021 Potential Cap Rate

- Nationally, the potential cap rate was 4.4 percent, a decrease of 0.3 percentage points as compared with the third quarter of 2021.

- The potential cap rate decreased by 0.2 percentage points as compared with one year ago.

- Currently, the potential cap rate is at its lowest level in more than 20 years, at 4.5 percentage points below its third quarter 2001 peak of 8.9 percent.

Cap Rate Outlook Gap

- In the fourth quarter of 2021, the national actual cap rate was 0.7 percentage points higher than the potential cap rate, suggesting that the actual cap rate could decline further.

- The gap between the actual cap rate and the potential cap rate increased 0.3 percentage points between the third quarter and fourth quarter of 2021.

About the Potential Cap Rate Model

The Potential Cap Rate (PCR) Model estimates cap rates based on the historical relationship between interest rates, rental income, prevailing occupancy rates, the amount of commercial mortgage debt in the economy, and recent property price trends. The PCR Model uses these metrics to establish a potential cap rate level that is supported by these market fundamentals. When actual cap rates are significantly above the potential cap rates, there is a greater chance actual cap rates will decline. Conversely, when actual cap rates are significantly below the fundamental cap rate level, there is a greater chance actual cap rates will increase.

Potential cap rates are aggregated nationally and include all major asset classes: multifamily, retail, industrial, office, and lodging. The PCR Model is updated quarterly.

A cap rate is a measure of estimated yield, or the return, on an investment property assuming no debt is used to purchase it. Cap rates are calculated by dividing an asset’s net operating income (NOI) by its value. NOI is income leftover to an owner after covering operating expenses, but before servicing debt. Since cap rates do not take debt service into consideration, cap rates are a measure of what is called unlevered yield.