Key Points: Multifamily cap rates have plateaued, but fundamentals and credit trends signal gradual declines beginning in 2026. Distress resolution and improving debt flows will boost transactions, tightening spreads and supporting lower cap rates. The temporary forces that have held multifamily cap rates above potential are easing, which will ...

Read More ›Multifamily Cap Rates Poised to Slip in 2026

Commercial Real Estate Multifamily Market Potential Cap Rate Model Multifamily

Industrial CRE: From Pandemic Darling to the Goldilocks Era

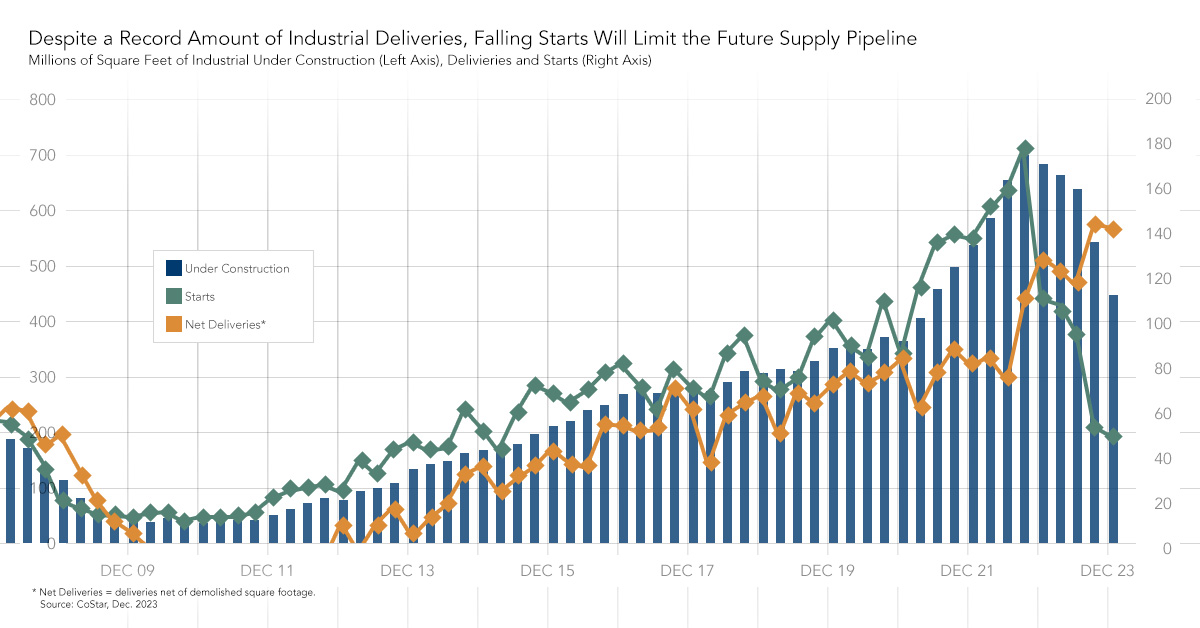

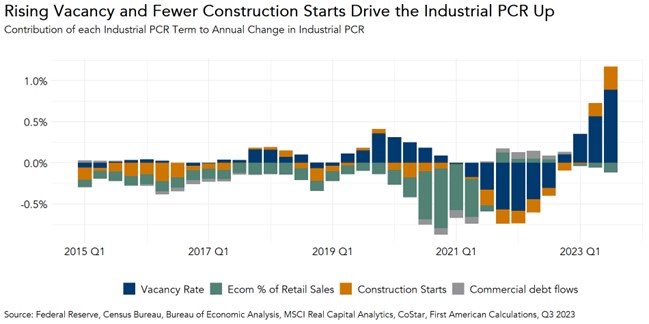

Key Points: The industrial real estate market is stabilizing after a period of rapid growth, with supply outpacing demand, leading to higher vacancy rates and more tenant-friendly conditions through 2025. Construction of new industrial space has slowed significantly, which will allow demand to gradually catch up and prevent prolonged oversupply. ...

Read More ›Commercial Real Estate Industrial Real Estate Potential Cap Rate Model

Multifamily Poised for Resilience Amid Macroeconomic Turbulence

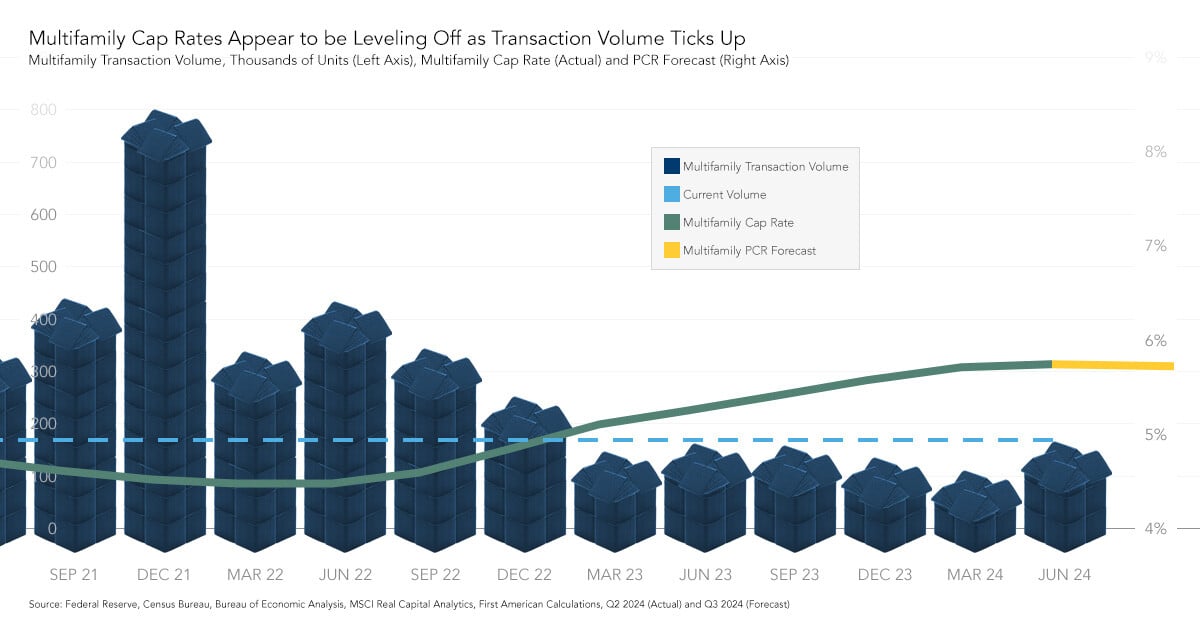

Key Points: Multifamily cap rates have stabilized at around 5.7 percent after peaking in early 2024. First American’s Multifamily Potential Cap Rate Model predicts a slight decline in multifamily cap rates by year’s end, driven by rising sales activity and renter household formation. While certain markets are oversupplied, the national scarcity of ...

Read More ›Commercial Real Estate Multifamily Market Potential Cap Rate Model Multifamily

Why DeepSeek May Signal Greater Data Center Demand, Not Less

Key Points: Technological advancements like DeepSeek may paradoxically increase overall data center demand despite improved efficiency. Constraints on data center supply include significant requirements for electricity and water, as well as specialized expertise for construction and operation. The strong, long-term demand drivers for data centers ...

Read More ›Multifamily Cap Rates Are Poised to Decline in 2025

Key Points: Multifamily cap rates appear poised to decline for the first time in nearly two years. Using First American’s Multifamily Potential Cap Rate Model, we forecast that multifamily cap rates are likely to gradually decline throughout 2025. The return of declining cap rates would be a sign that buyers are becoming more comfortable with ...

Read More ›Commercial Real Estate Multifamily Market Potential Cap Rate Model Multifamily

Have Multifamily Cap Rates Peaked?

The last three and a half years have been a whipsaw of a ride for the multifamily market. Following the surge in leasing demand during the pandemic, demand to own apartment buildings boomed, which drove transaction volume to record highs. Shortly thereafter, the Federal Reserve began raising interest rates to combat inflation that turned out not ...

Read More ›Commercial Real Estate Multifamily Market Potential Cap Rate Model Multifamily

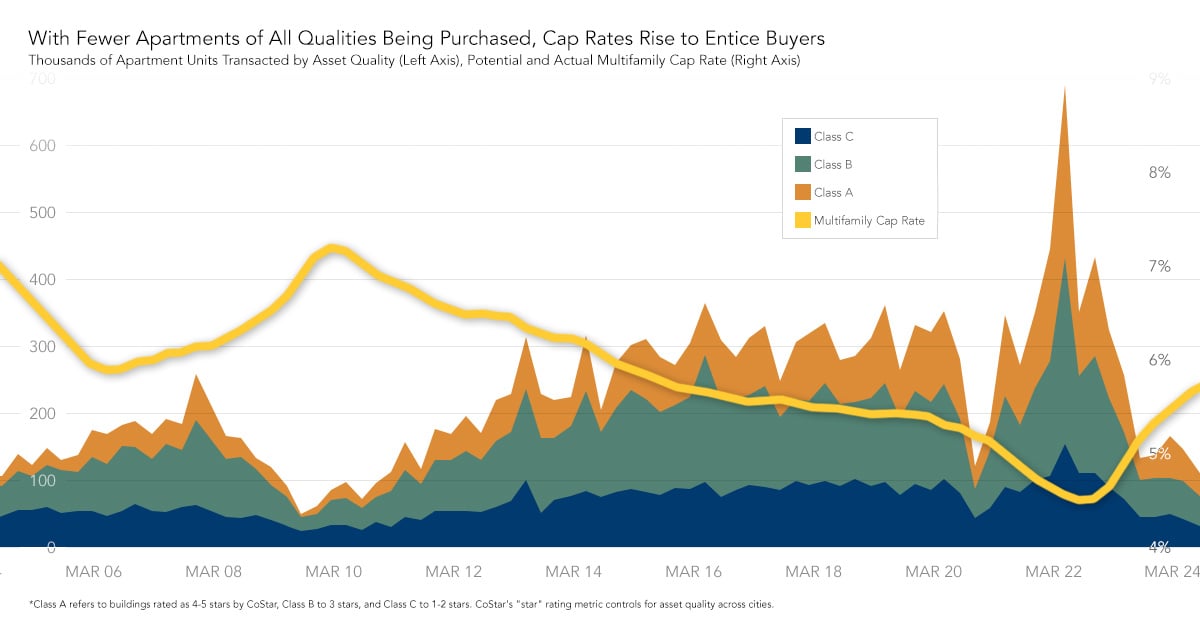

What’s that Apartment Building Worth? Fewer Multifamily Transactions Drive Market Uncertainty

It’s hard to know what apartment buildings are worth nowadays. With multifamily transaction volume at its lowest point in four years, comparable transactions, or “comps”, which are often used as a reference point to estimate value, are few and far between. The limited availability of comps increases the uncertainty of property valuation estimates. ...

Read More ›Commercial Real Estate Multifamily Market Potential Cap Rate Model Multifamily

What’s Behind the Surge in Industrial Cap Rates?

Though the industrial market is softening compared to the pandemic days of double-digit rent growth and record-low vacancy, it is far from weak. Despite slowing rent growth and modestly rising vacancies, demand to lease industrial space remains strong, driven by long-term trends such as rising eCommerce sales, retailers’ need for modern logistics ...

Read More ›Commercial Real Estate Industrial Real Estate Potential Cap Rate Model

Pandemic Aftershocks Drive Industrial Cap Rates Higher

The state of today’s industrial commercial real estate (CRE) can largely be explained as the result of pandemic-related aftershocks. During the pandemic, e-commerce sales soared as millions of stuck-at-home consumers turned to online retailers to purchase goods. Meanwhile, COVID-19 disrupted global supply chains, which made it more difficult for ...

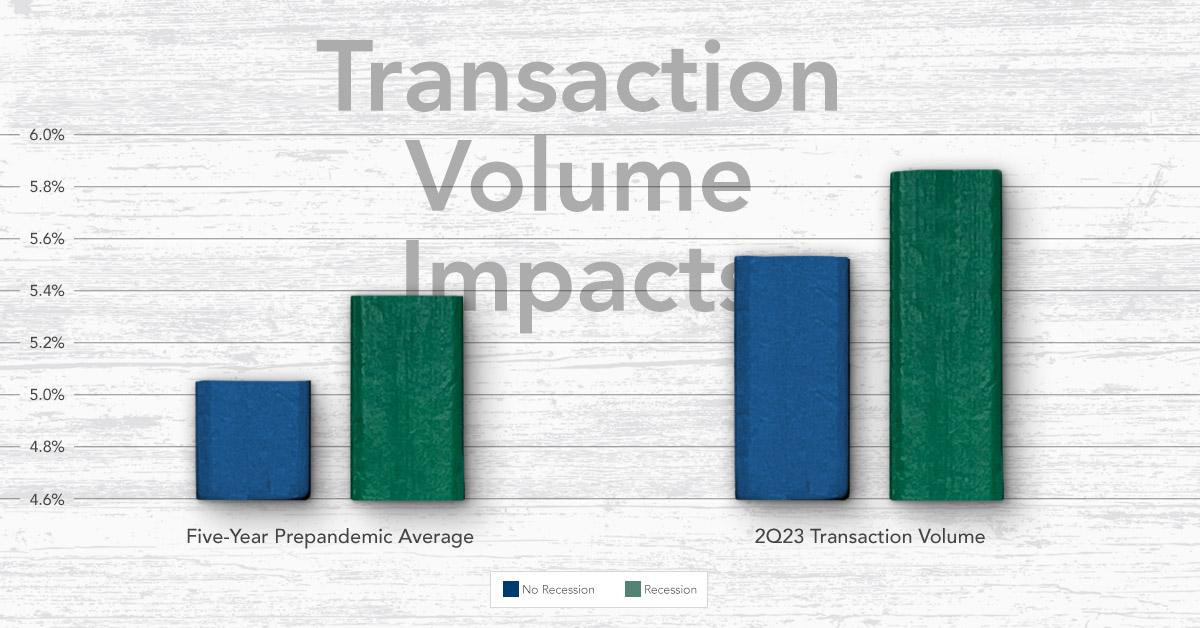

Read More ›What Happens to Cap Rates if…

Multifamily capitalization (cap) rates have now increased for three consecutive quarters, the first time since the Great Financial Crisis. This is a sign that investors are requiring higher yields today in order to purchase a property.

Read More ›

.jpg)