Recent Posts by Mark Fleming

Mark Fleming is the chief economist for First American Financial Corporation and leads First American’s Decision Sciences team.

Does High Rise = High Risk?

By

Mark Fleming on February 28, 2018

First American’s proprietary Loan Application Defect Index examines January 2018 data on the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications.

Read More ›

How Wage Growth Both Helps and Hurts Housing Affordability

By

Mark Fleming on February 26, 2018

Earlier this month, the Bureau of Labor Statistics reported that average hourly earnings increased in January by 2.9 percent compared with a year ago. This was a big splash of economic news that had ripple effects on the housing market, as the 2.9 percent increase in wages surpassed expectations.

Read More ›

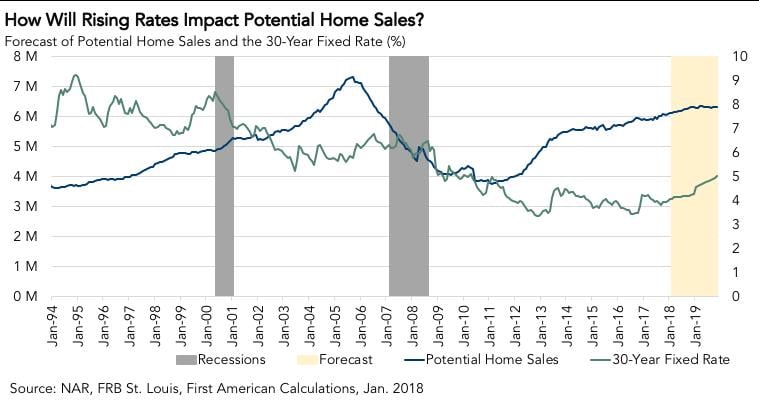

How Will Rising Rates Impact Home Sales?

By

Mark Fleming on February 20, 2018

This month, the market potential for existing-home sales increased to a 6.1 million seasonally adjusted annualized rate (SAAR), a 0.4 percent month-over-month increase, and a gain of 210,000 (SAAR) sales from January 2017. The gap between actual market performance (existing-home sales) and market potential (potential home sales) has significantly ...

Read More ›

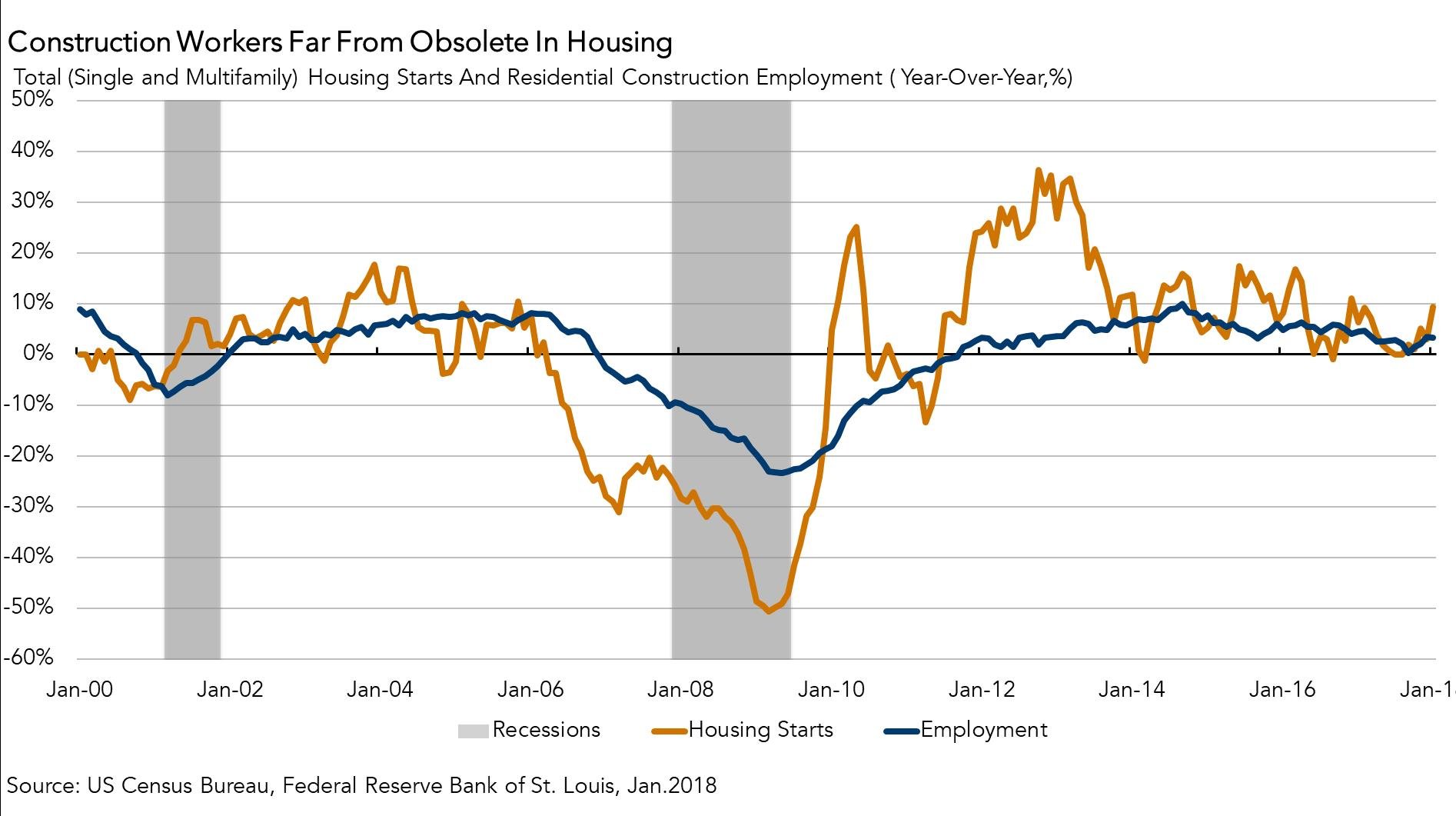

Is Relief for the Housing Supply Shortage on the Way?

By

Mark Fleming on February 17, 2018

As we analyze yesterday’s housing starts data, it’s important to also consider the impact of construction labor on the velocity of new home construction. The employment situation report, released earlier this month, reported an increase of 5,000 residential construction jobs between December 2017 and January 2018. The number of residential ...

Read More ›

Where is house-buying power the strongest?

By

Mark Fleming on February 14, 2018

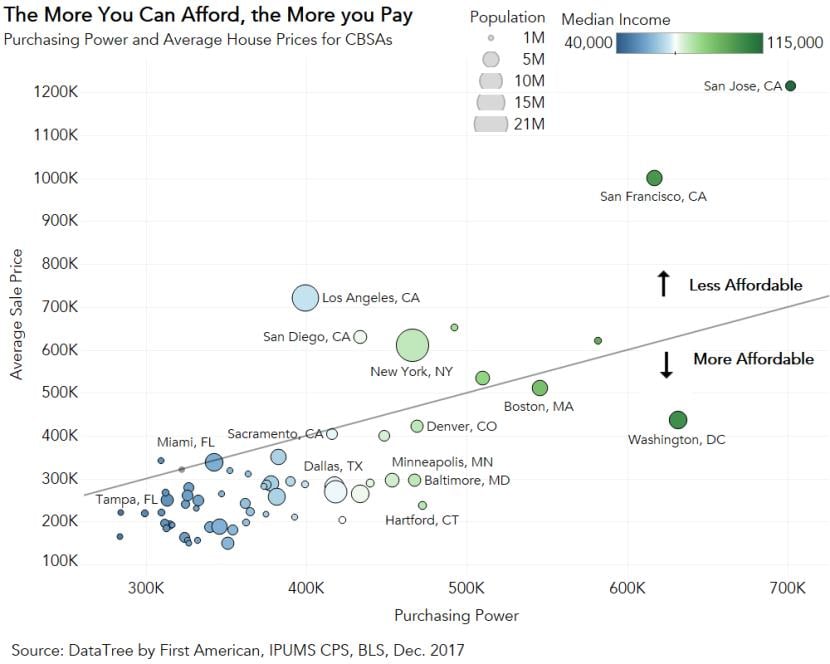

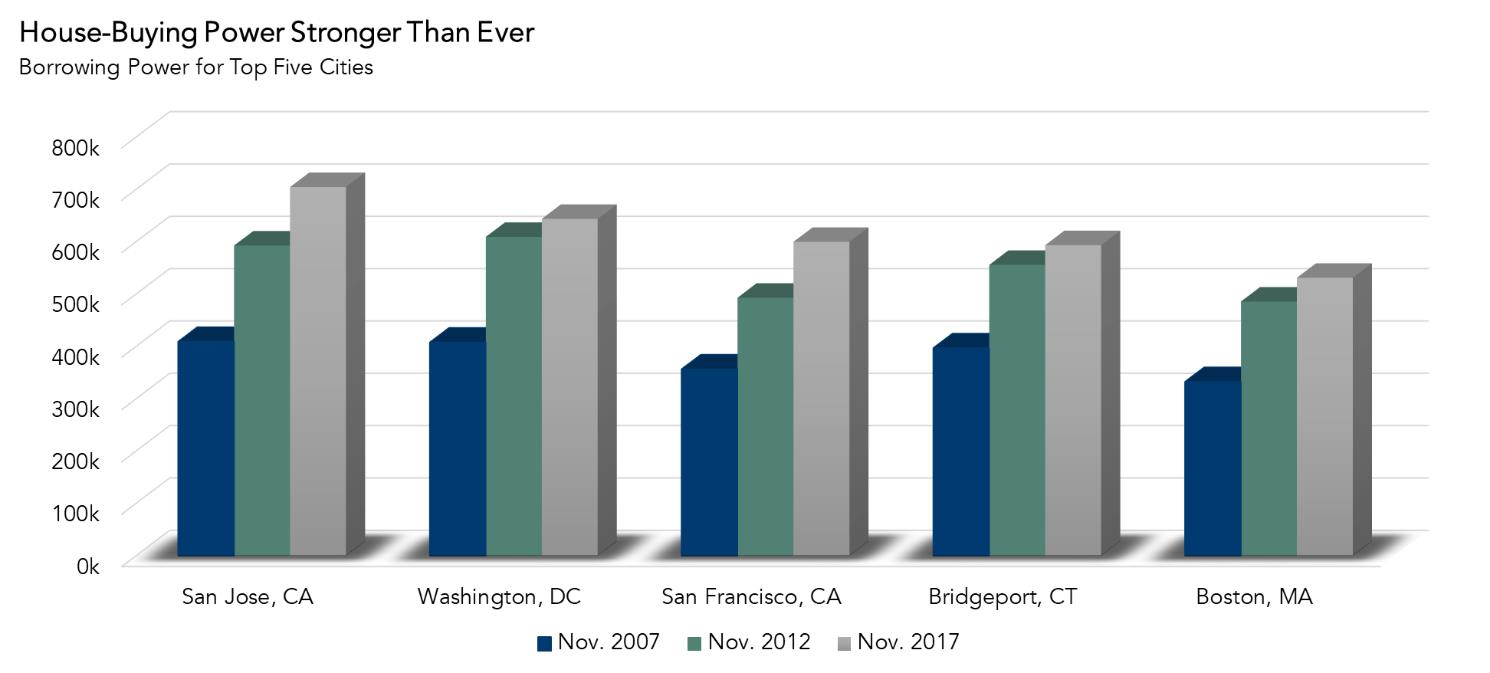

Whether you plan to buy a modest studio or a four-bedroom penthouse, how much you can afford to borrow primarily rests on two main factors: income and interest rates. Income growth seems to be increasing, thus increasing affordability. However, the near certainty of future rate hikes will likely be a drag on affordability.

Read More ›

The Affordability Crisis That Isn't

By

Mark Fleming on January 29, 2018

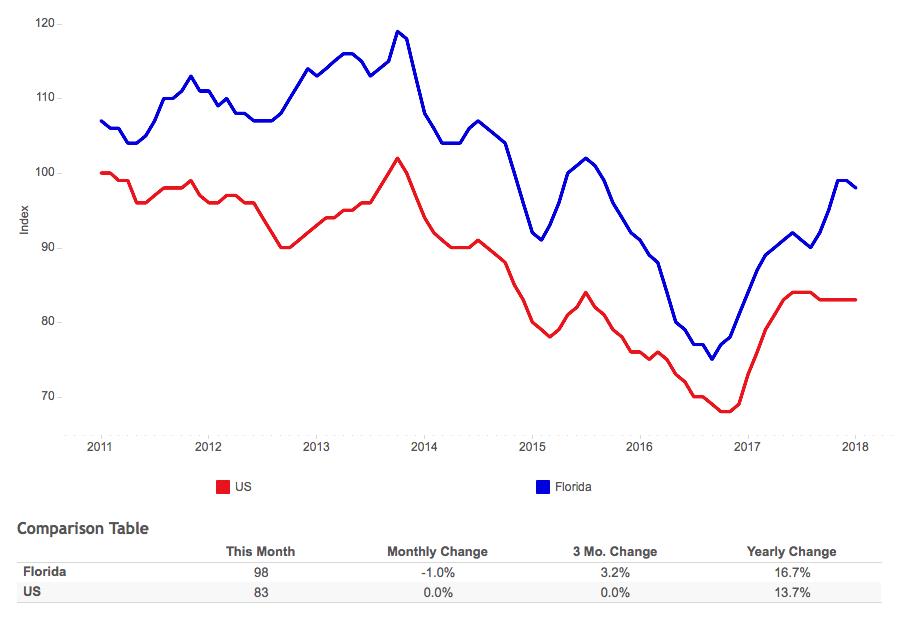

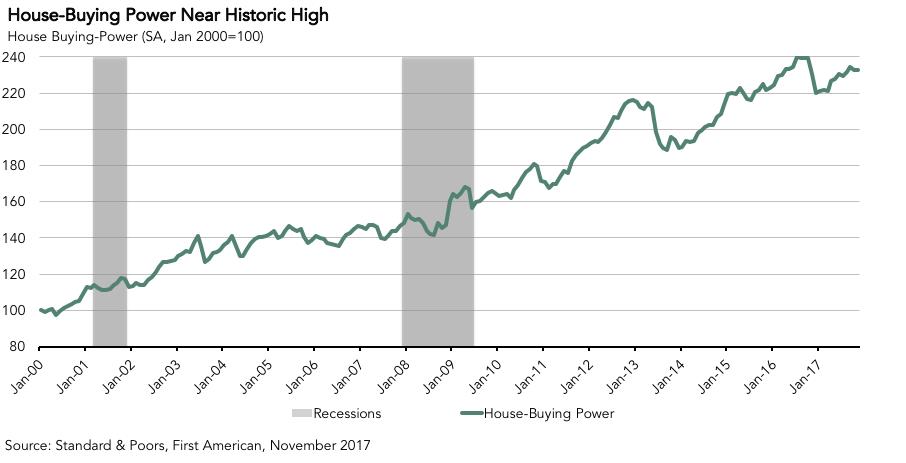

That nominal house prices are growing faster than household incomes is often used as the basis for arguing that we are facing an affordability crisis. It is true that unadjusted house prices grew faster than income between November 2016 and November 2017. Our Real House Price Index (RHPI) showed that unadjusted house prices increased by 6.0 ...

Read More ›