Recent Posts by FirstAm Editor

Interview with Yahoo! Finance: Existing-Home Sales Poised for Rebound in May Following April Plunge

By

FirstAm Editor on May 26, 2020

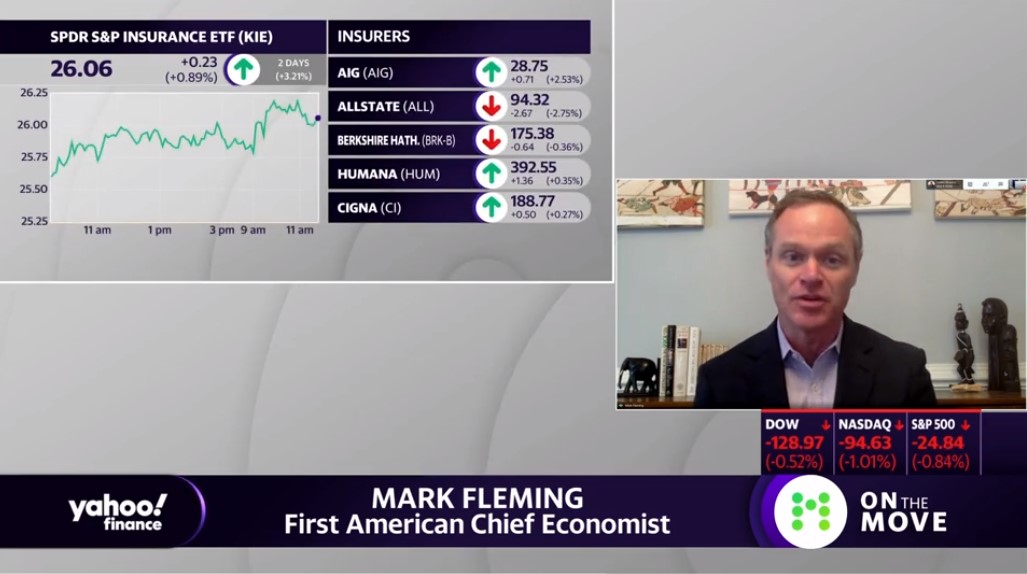

First American Chief Economist Mark Fleming was interviewed on Yahoo! Finance last week, explaining why the April existing-home sales numbers are likely the trough in this cycle and that signs point to a strong May rebound for the housing market.

Read More ›

Interview with Gary Acosta, NAHREP: Why the Housing Market May be Better Positioned than Many Believe Amid the Pandemic

By

FirstAm Editor on April 29, 2020

First American Chief Economist Mark Fleming was interviewed by Gary Acosta, co-founder and CEO of the National Association of Hispanic Real Estate Professionals, last week and discussed his perspective on the state of the housing market amid the pandemic and why the housing market may be better positioned than many believe.

Read More ›

Interviews on CNBC and Yahoo! Finance: 2020 Housing Outlook – Why Persistently Low Mortgage Rates May Help and Hurt Home Buyers

By

FirstAm Editor on December 23, 2019

First American Chief Economist Mark Fleming was interviewed on CNBC and Yahoo! Finance last week, discussing the 2020 outlook for the housing market and how persistently low mortgage rates may both help and hurt home buyers in the year ahead.

Read More ›

Interview on Nightly Business Report: Discussing Surge in Potential Housing Supply

By

FirstAm Editor on September 24, 2019

First American Deputy Chief Economist Odeta Kushi was interviewed on Nightly Business Report last week and discussed the dramatic jump in housing starts to a 12-year high, signaling the potential for some housing supply relief in the near future.

Read More ›

Interview on FOXBusiness: Discussing the outlook for the U.S. economy, Federal Reserve policy and the state of the job market

By

FirstAm Editor on September 6, 2019

First American Chief Economist Mark Fleming was interviewed on FOXBusiness earlier this week and discussed the U.S. economy, Federal Reserve policy and the state of the job market.

Read More ›

Interviews on CNBC and Nightly Business Report: Discussing the Refinance Boom and Tailwinds Boosting the Housing Market

By

FirstAm Editor on September 3, 2019

First American Chief Economist Mark Fleming was interviewed on CNBC and Deputy Chief Economist Odeta Kushi was interviewed on Nightly Business Report last week, where they discussed the refinance boom driven by low mortgage rates and the tailwinds boosting the housing market.

Read More ›

Housing In The News Interest Rates Federal Reserve Affordability