Why Educated Millennials Still Hold the Key to Future Homeownership Demand

By

Odeta Kushi on October 10, 2022

The fall usually marks the beginning of the school year, seasonally cooler weather and a seasonally cooler housing market. But, this year, the housing market’s typical autumn slowdown is more pronounced as rapidly rising interest rates discourage buyers and sellers from entering the market. The housing market is not immune to business cycles, and ...

Read More ›

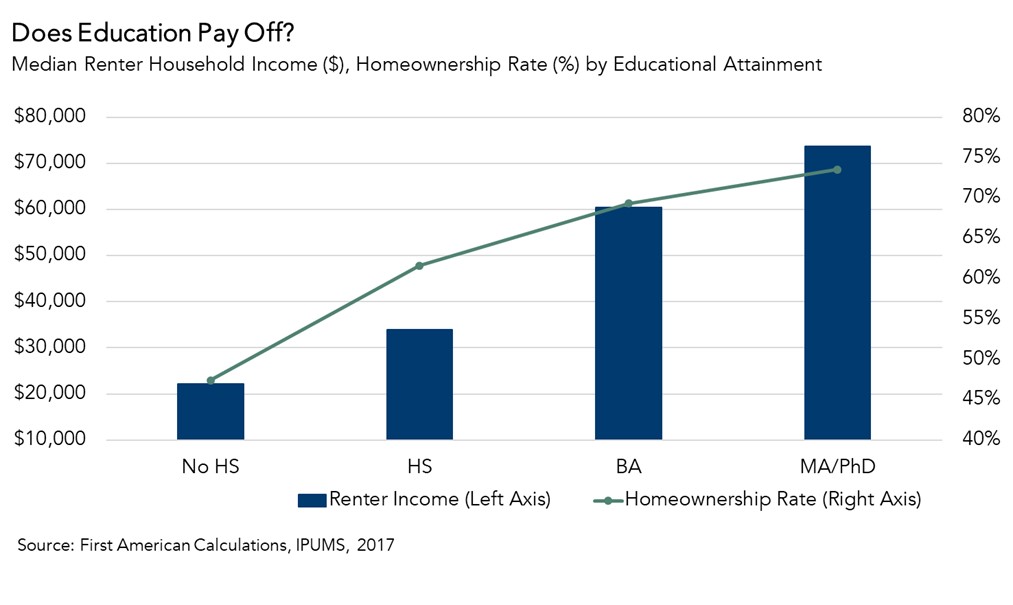

Does Greater Educational Achievement Increase the Likelihood of Homeownership?

By

Odeta Kushi on October 14, 2021

We’re often told that education is the key to a more secure financial future. Most people spend at least 12 years of their lives as students and even more if they pursue higher education. But does more education equate to increased earning potential? And, if so, does the increased earning potential translate to a greater likelihood of becoming a ...

Read More ›

Millennials Education Homeownership Progress Index Homeownership

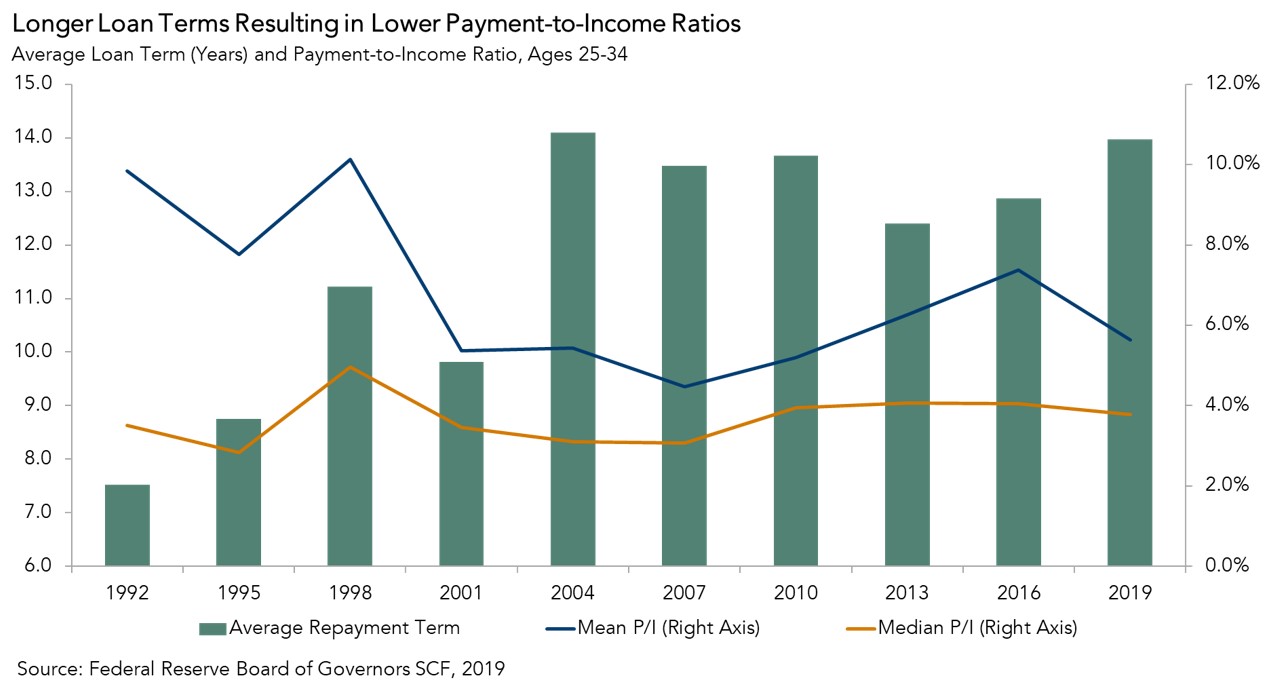

Why the Student Loan Debt Burden is Overstated

By

Odeta Kushi on November 19, 2020

Student loans are often cited as an insurmountable barrier to homeownership for young home buyers. It is true that student loan debt levels are higher today than a generation ago, but is it preventing potential home buyers from saving for a down payment? The recently released 2019 Survey of Consumer Finances data highlights some important trends ...

Read More ›

Rising Millennial Educational Attainment Signals Homeownership Demand Primed for Growth

By

Odeta Kushi on July 9, 2020

Examining critical lifestyle, societal and economic trends can provide a strong indication of the likelihood of owning a home and, in turn, potential homeownership demand. This is the fundamental concept behind our annual Homeownership Progress Index (HPRI). Understanding these forces and tracking how they change over time allows us to measure ...

Read More ›

Housing Millennials Education Homeownership Progress Index Homeownership

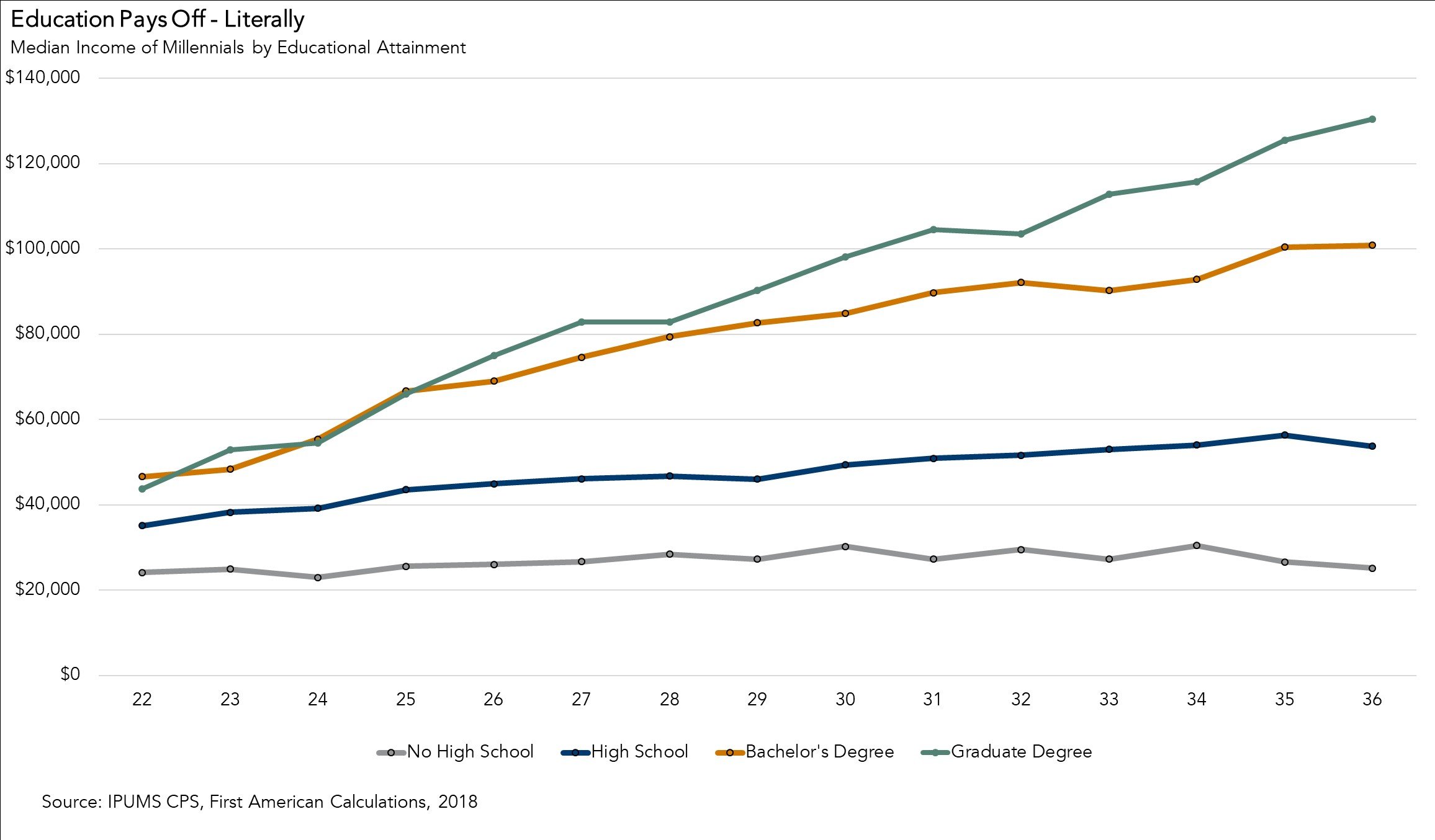

Does Education Really Lead to Greater Earning Power?

By

Odeta Kushi on September 13, 2019

Whether it’s parents shuttling their children off to elementary school or students starting their final year of college, back-to-school season is here. We generally spend a minimum of 12 years as a student, more if you pursue a college degree. Along the way, we’re told that education is critical to your ability to earn a decent living.

Read More ›

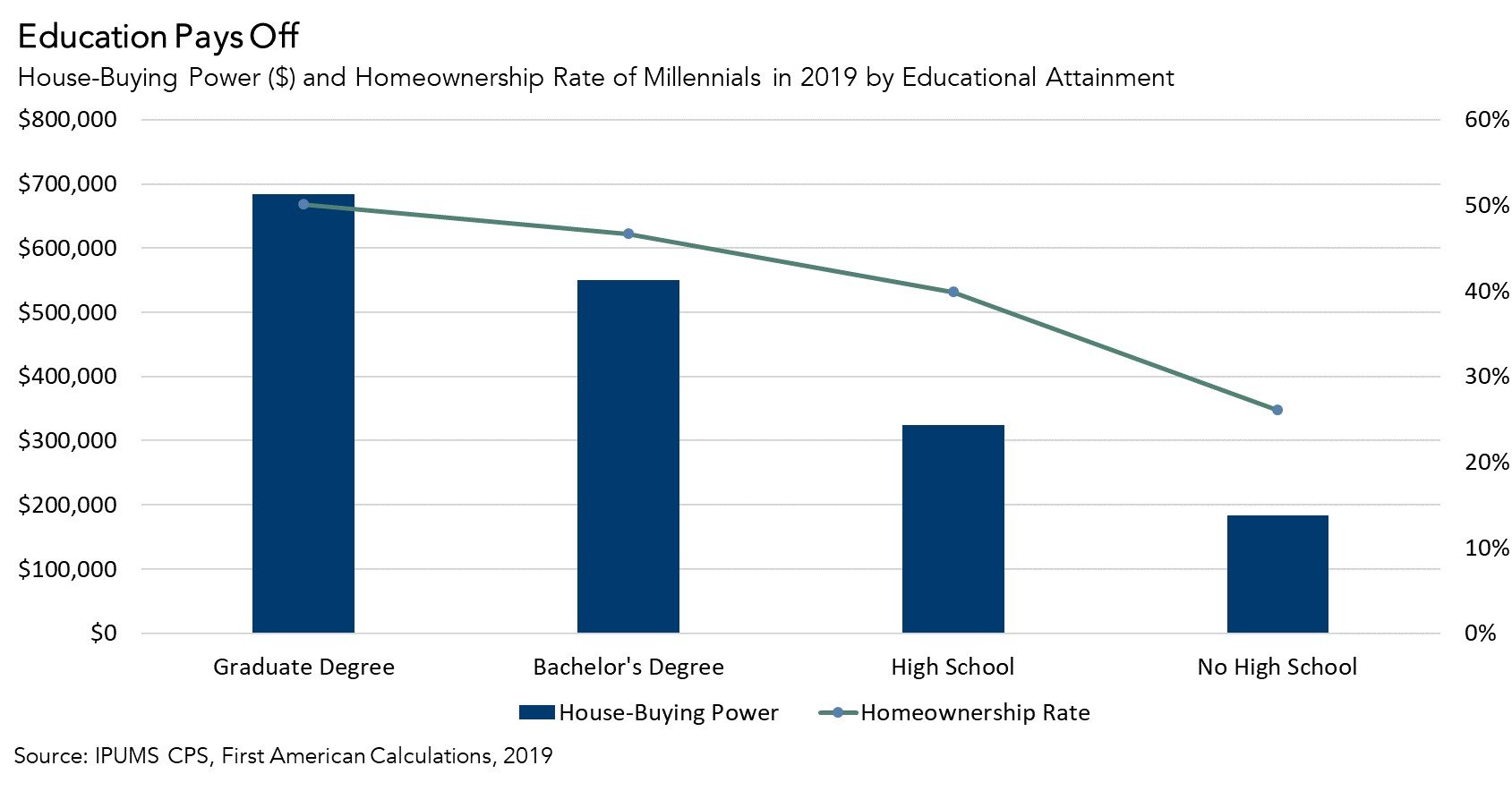

What is the Impact of Student Loan Debt on House-Buying Power?

By

Odeta Kushi on February 15, 2019

Contrary to many reports, student loan debt is not an insurmountable barrier to homeownership for millennials. Student loan debt is more likely to delay the timing of homeownership, but it does not necessarily prevent homeownership. But, this begs the questions, how does student loan debt impact house-buying power? And, is higher education a ...

Read More ›

Millennials Education Homeownership Progress Index Homeownership