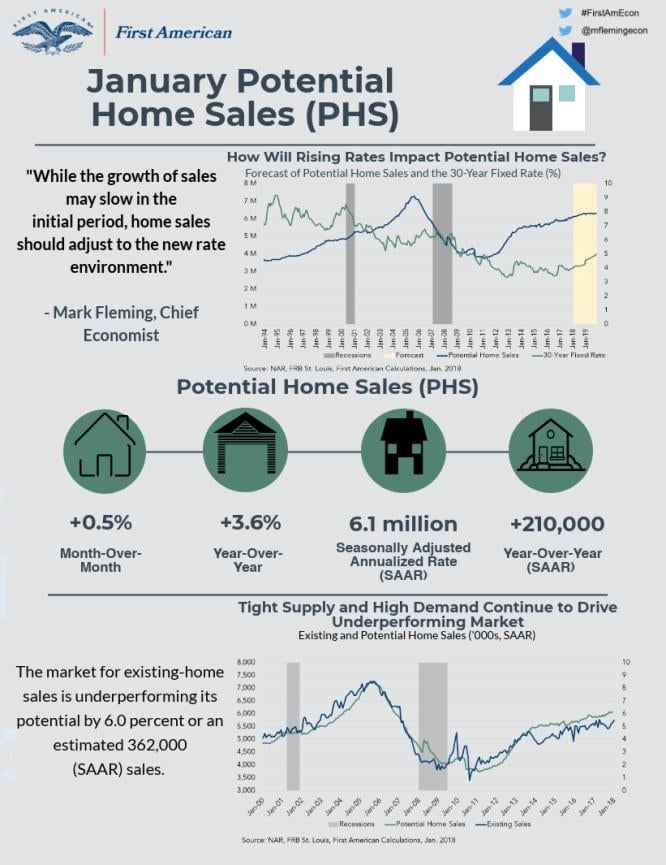

This month, the market potential for existing-home sales increased to a 6.1 million seasonally adjusted annualized rate (SAAR), a 0.4 percent month-over-month increase, and a gain of 210,000 (SAAR) sales from January 2017. The gap between actual market performance (existing-home sales) and market potential (potential home sales) has significantly narrowed as actual existing-home sales have surged in recent months. Nonetheless, the housing market is still underperforming its potential.

According to our Potential Home Sales model, the increase in market potential this month is fueled by faster economic growth, low unemployment and continued low mortgage rates. The Federal Reserve (Fed) did not hike rates this month, however, the CME Group FedWatch views future rate hikes as nearly certain. In fact, just the expectation of future Fed rate hikes has actually pushed interest rates higher. The 30-year, fixed-rate mortgage rate increased to 4.32 percent last week, up 40 basis points from the beginning of the year. This is the fourth consecutive week of rising rates.

“There are a variety of reasons why people buy homes that are completely independent of mortgage rates. A gradual rise in mortgage rates won’t change that.”

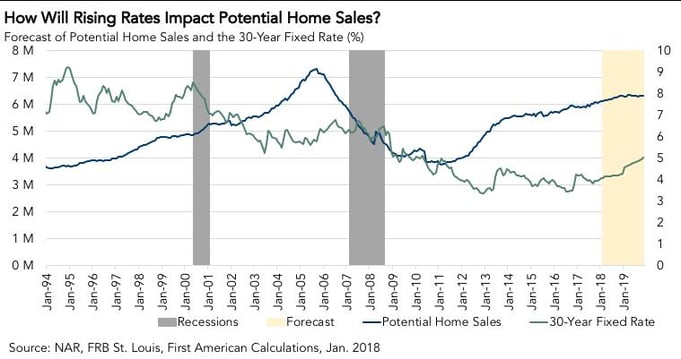

The consensus among economists is that 30-year, fixed-rate mortgages will approach 5 percent by the end of the year. Rising mortgage rates typically reduce the affordability of housing, as it means the cost of borrowing increases. So, the question is: how much will rising interest rates impact the amount of home sales?

Our Potential Home Sales model forecasts what the market potential for home sales should be given current economic, demographic, and housing market environments. Potential home sales, while currently at a level of 6.1 million SAAR, are expected to reach an estimated 6.29 million SAAR by the end of 2019, despite a rising rate environment. However, while the yearly growth rate in potential sales is currently at 3.6 percent, it is expected to slow to just below 1 percent by the end of 2019.

Historically, a 30-year, fixed-rate mortgage of 5 percent is still a very low rate. In fact, the mortgage rate has been greater than 5 percent in 38 of the last 46 years, so it is unlikely that large numbers of home buyers will be dissuaded by a modest increase in mortgage rates. There are a variety of reasons why people buy homes that are completely independent of mortgage rates. A gradual rise in mortgage rates won’t change that.

What Insight Does the Potential Home Sales Model Reveal?

When considering the right time to buy or sell a home, an important factor in the decision should be the market’s overall health, which is largely a function of supply and demand. Knowing how close the market is to a healthy level of activity can help consumers determine if it is a good time to buy or sell, and what might happen to the market in the future. That is difficult to assess when looking at the number of homes sold at a particular point in time without understanding the health of the market at that time. Historical context is critically important. Our potential home sales model measures what we believe a healthy market level of home sales should be based on the economic, demographic and housing market environments.

About the Potential Home Sales Model

Potential home sales measures existing-homes sales, which include single-family homes, townhomes, condominiums and co-ops on a seasonally adjusted annualized rate based on the historical relationship between existing-home sales and U.S. population demographic data, income and labor market conditions in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. When the actual level of existing-home sales are significantly above potential home sales, the pace of turnover is not supported by market fundamentals and there is an increased likelihood of a market correction. Conversely, seasonally adjusted, annualized rates of actual existing-home sales below the level of potential existing-home sales indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted annualized existing-home sales may exceed or fall short of the potential rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent potential home sale estimates are subject to revision in order to reflect the most up-to-date information available on the economy, housing market and financial conditions. The Potential Home Sales model is published prior to the National Association of Realtors’ Existing-Home Sales report each month.