Following seven straight months of declining defect risk, the Loan Application Defect Index for purchase transactions remained the same in August compared with the month before. Year over year, the Defect Index for purchase transactions decreased 13.2 percent as compared to August 2017. The Defect Index for refinance transactions is the same as the previous month and is 1.4 percent lower than a year ago.

Rising Mortgage Fraud Risk Linked to Hurricanes

While the overall risk of loan application defects, fraud and misrepresentation have been on the decline, there are regions with the potential for higher defect risk due to the impact from Hurricane Florence. The expected damage to housing is staggering. Based on the National Hurricane Center storm surge estimate, we expect that more than $13 billion worth of homes, according to estimates of current market value, are likely to be flooded with at least a foot of water. Nearly 80 percent of these homes are expected to be in North Carolina. In total, approximately 50,000 residential housing units may be damaged.

"While the devastating impacts from Hurricane Florence in the Carolinas continue to be assessed, it should come as no surprise that in the wake of major natural disasters, the risk of mortgage loan application fraud increases.”

Unfortunately, on top of the damage to tens of thousands of homes, historical data indicates that hurricanes and loan application defect risk go hand-in-hand. Hurricanes, and especially the flooding associated with these natural disasters, create the potential and opportunity for significant misrepresentation of collateral condition.

In the aftermath of Hurricane Sandy in late October 2012, mortgage defect, fraud and misrepresentation risk, as measured by the Defect Index, increased 16.5 percent over four months in the New York metropolitan area. Fraud and misrepresentation risk remained elevated for an entire year after the hurricane, before returning to a level consistent with the national index in late 2013.

Similarly, before Hurricanes Harvey and Irma hit, mortgage risk in Texas and Florida was decreasing. However, following the storms, the trend reversed course in September 2017. Due to flooding in Houston, the Defect Index experienced an 11.2 percent increase in mortgage defect, fraud and misrepresentation risk over 3 months.

Fraud Risk in Carolinas Likely to Increase in the Months Ahead

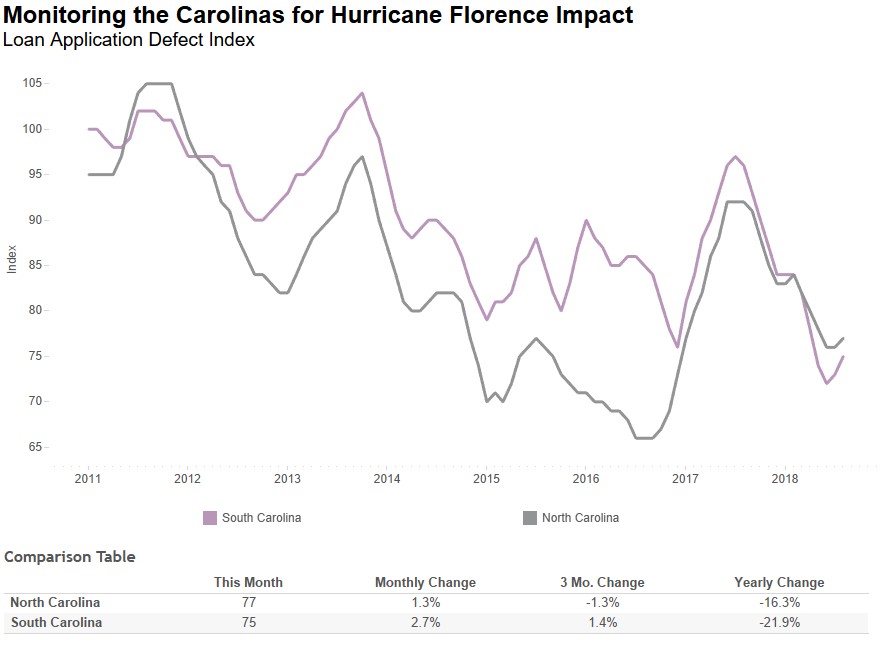

While the devastating impacts from Hurricane Florence in the Carolinas continue to be assessed, it should come as no surprise that in the wake of major natural disasters, the risk of mortgage loan application fraud increases. According to the Defect Index, defect risk levels in the Carolinas were already trending up in recent months, and one should be on the lookout for further increases in risk in the markets impacted.

For Mark’s full analysis on loan defect risk, the top five states and markets with the greatest increases and decreases in defect risk, and more, please visit the Loan Application Defect Index.

The Defect Index is updated monthly with new data. Look for the next edition of the Defect Index the week of October 22, 2018.