As expected, the Federal Open Market Committee increased the Federal Funds rate last week, and signaled they expect to increase rates further later this year. It’s clear we have entered the rising interest rate environment that many have been predicting for years. With rising rates the new reality for the housing market, earlier this month we examined the possible impact of a dramatic increase in 30-year, fixed-rate mortgage rates on the market potential for sales. We found that even doubling the mortgage interest rate may only reduce the market potential for home sales by about 5 percent.

What If Interest Rates Doubled – the House Price Effect

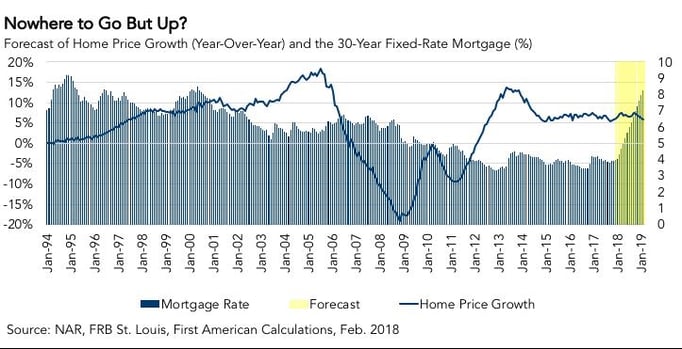

In our extreme hypothetical scenario, where 30-year, fixed-rate mortgage rates doubled, the market potential for home sales was not significantly impacted, but how might house prices react? In addition to forecasting potential home sales based on a dramatic change in the mortgage interest rate, from 4.4 percent to approximately 9 percent, we can forecast what may happen to house prices based on the same interest rate adjustment.

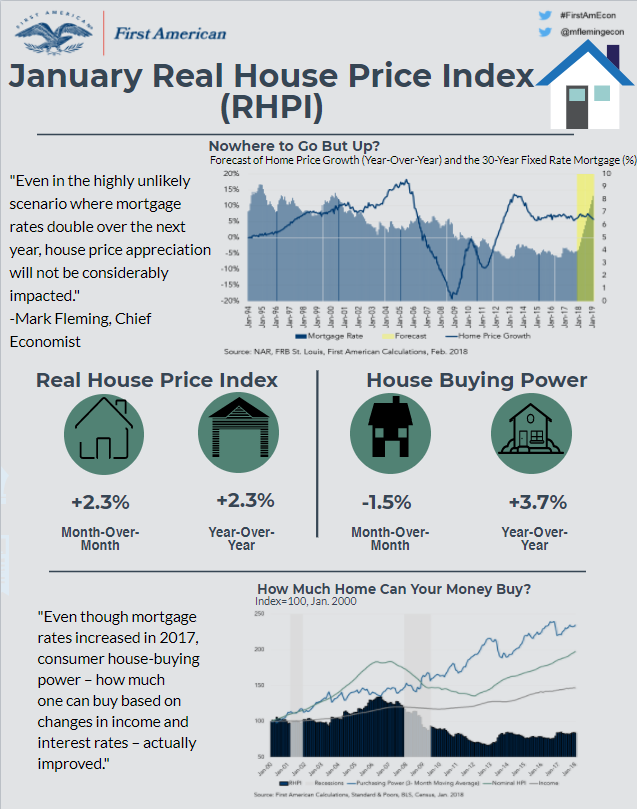

Unadjusted, nominal, house prices increased 6.0 percent in January compared with a year ago, according to our estimate in our Real House Price Index report. Under our hypothetical scenario where mortgage rates double over the next year, our analysis indicates that nominal house price growth would increase above 7 percent as the spring home-buying market heats up, and slow down to 5.8 percent by the beginning of 2019. So, even in the highly unlikely scenario where mortgage rates double over the next year, house price appreciation will not be considerably impacted.

Consumer House-Buying Power Offsets Rising Mortgage Rates

This month’s RHPI report indicates that, even though mortgage rates increased in 2017, consumer house-buying power – how much one can buy based on changes in income and interest rates – actually improved by 3.7 percent in January compared with a year ago. Household income growth has been strong enough to offset higher mortgage rates. As a result of stronger consumer house-buying power, real house prices only increased by 2.3 percent in January compared with a year ago.

As we look ahead, it’s reasonable to expect borrowing costs to increase as mortgage rates rise, in turn reducing consumer house-buying power, which reduces affordability. The good news is that, even in the unlikely case that mortgage rates rise faster than expected, our housing market is well positioned to adapt.

For Mark’s full analysis on affordability, the top five states and markets with the greatest increases and decreases in real house prices, and more, please visit the Real House Price Index.

The RHPI is updated monthly with new data. Look for the next edition of the RHPI the week of April 23, 2018.