As we enter 2019 and the bulk of the millennial generation ages into their prime home-buying years, is homeownership an attainable New Year’s resolution for millennials?

Millennials’ investment in education is paying off, resulting in higher incomes than previous generations at the same age. Millennials in their 30s have higher median incomes compared with baby boomers when they were in their 30s, and are on track to surpass Generation X, according to First American’s analysis using ACS IPUMS data. A similar trend is playing out among millennial ethnic minorities, who are more educated compared with previous generations of minorities.

“If current millennial home-buying patterns continue, we are likely to see a big shift in where housing demand is strongest. Millennials are pursuing their homeownership dreams and migrating to more affordable, growing inland cities.”

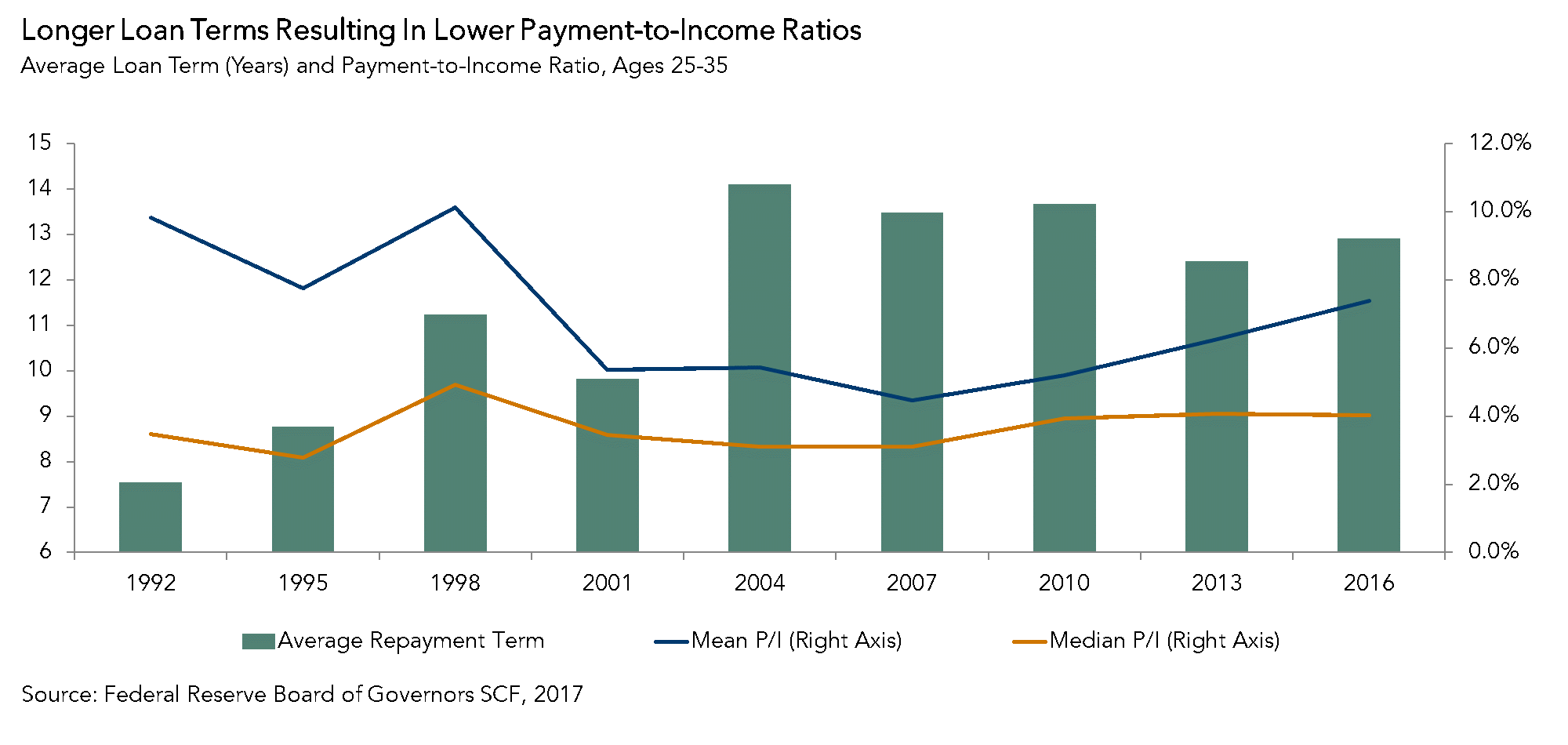

Debunking the Student Loan Myth

Student loan debt is often cited as a significant barrier for millennial homeownership. The argument is millennial student debt levels are much higher than previous generations, making it difficult to save for a down payment.

However, with extended student loan terms, combined with the higher income benefit of the investment in education, resulting in lower payment-to-income ratios, the reality is student loan debt does not present an insurmountable barrier to homeownership. A study by the Federal Reserve found that student loan debt is more likely to delay the timing of homeownership, but it does not necessarily prevent homeownership.

Millennials Migrating to Homeownership

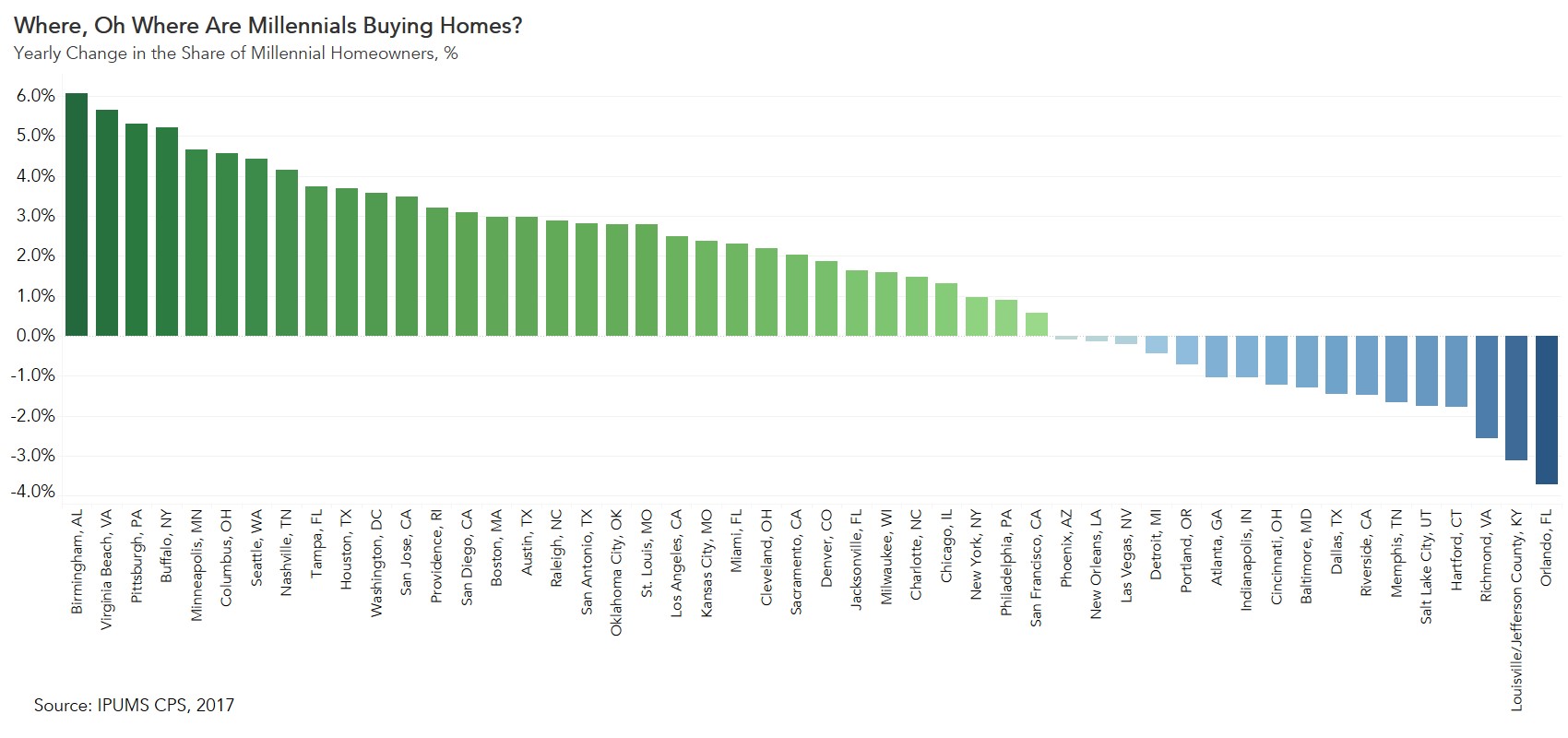

Homeownership demand from millennials is expected to increase, albeit at an older age than prior generations. However, historically tight inventory and a rising mortgage-rate environment presents affordability challenges for potential first-time millennial home buyers. But, housing markets are local, and each market is influenced by different dynamics, so affordability can be very different depending on where one wants to buy.

Supply shortages appear to be easing in some markets, but primarily among higher-priced homes. According to Realtor.com September 2018 data, total housing inventory is down 0.2 percent nationally compared with a year ago, but the supply of homes that cost more than $350,000 increased 10.0 percent. Regionally, housing supply is increasing in large, more expensive cities, such as San Jose, Calif., San Francisco and Nashville, Tenn. This is little consolation for the potential first-time buyer.

Yet, home buyers have choices. Choosing where to live is dependent on many factors, like the availability of jobs in one’s chosen field, where family is located, or even weather or lifestyle preferences. The figure below shows where millennials are achieving the dream of homeownership. The top five cities where the share of millennial homeownership increased the most from 2016 to 2017 were:

- Birmingham, Ala.

- Virginia Beach, Va.

- Pittsburgh, Pa.

- Buffalo, N.Y.

- Minneapolis, Minn.

The future of the housing market will be heavily influenced by millennial buying patterns. While certain demographic and lifestyle choices have resulted in lower homeownership rates among millennials to date, millennial homeownership rates are projected to increase in the near future. Millennials will continue to reap the income benefits from their investment in education. If current millennial home-buying patterns continue, we are likely to see a big shift in where housing demand is strongest. Millennials are pursuing their homeownership dreams and migrating to more affordable, growing inland cities.