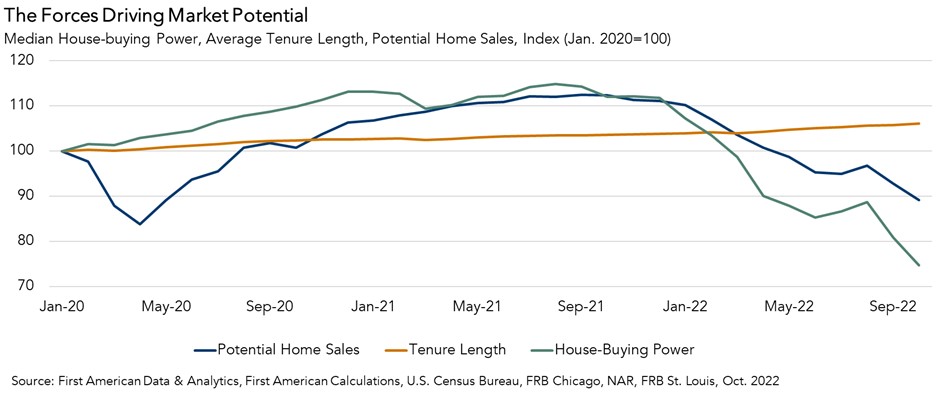

In October 2022, housing market potential fell by nearly 4 percent relative to last month and dropped 21 percent compared with October of last year, a decline of 1,334,000 potential existing-home sales. The steep annual decline in market potential was largely a result of higher mortgage rates, which discourage both buyers and sellers from jumping into the market. To understand what we can expect in 2023, it’s important to examine what influences buyers and sellers, and how those influences shape market potential.

“The housing market, once adjusted to the new normal of higher mortgage rates, will benefit from continued strong demographic-driven demand relative to an overall, long-run shortage of supply.”

Buyers Face an Affordability Crunch

Since October 2021, home buyers have lost $162,000 in house-buying power, primarily due to higher mortgage rates. The 30-year, fixed mortgage rate increased from 3.1 percent last October to 6.9 percent in October of this year. Rising household income prevented the year-over-year loss in house-buying power from being even more severe. The sharp hit to house-buying power prompted a strong pullback in housing demand in October, decreasing housing market potential by 782,000 potential home sales year over year.

Affordability will likely remain a drag on housing market potential until house-buying power recovers, which is unlikely in the foreseeable future, or house prices decline. House prices have already begun to adjust to the reality of higher mortgage rates, which will help bring more balance to the housing market heading into 2023.

Sellers Are Rate-Locked In, But Some May Have Enough Equity to Overcome

Consider that 93 percent of outstanding mortgages had rates below 6 percent in the second quarter of 2022, and with mortgage rates near 7 percent, there is a financial disincentive for homeowners to sell their homes and buy a new home at a higher mortgage rate. As a result, the average number of years that homeowners live in their homes has continued to increase and reached a historic high of 10.65 years in October, growing at the fastest pace since early 2021. The rate “lock-in” effect prevents more housing supply from reaching the market and dampens housing market potential. Homeowners staying put reduced housing market potential by 84,000 potential home sales in October compared with one year ago.

However, high levels of home equity could mitigate the impact of the rate lock-in effect. Homeowners have gained record amounts of equity in their homes due to rapidly rising house prices over the course of the pandemic. For some equity-rich homeowners, moving and taking on a higher interest rate isn’t a huge deal, especially if they are moving to a more affordable place. Higher home prices compared with one year ago boosted housing market potential by 86,600 potential home sales in October, offsetting the lost in potential homes sales due to homeowners staying put.

What Does This Mean for Housing Market Potential in 2023?

The housing market trend to watch in 2023 is whether mortgage rates will go any higher, and if so, by how much. Once mortgage rates peak, housing market potential will likely stabilize. The housing market, once adjusted to the new normal of higher mortgage rates, will benefit from continued strong demographic-driven demand relative to an overall, long-run shortage of supply. Based on current dynamics, it appears the housing market may begin to stabilize in 2023.

October 2022 Potential Home Sales

For the month of October, First American updated its proprietary Potential Home Sales Model to show that:

- Potential existing-home sales decreased to a 5.13 million seasonally adjusted annualized rate (SAAR), a 3.9 percent month-over-month decrease.

- The market potential for existing-home sales decreased 20.7 percent compared with a year ago, a loss of 1,334,000 (SAAR) sales.

- This represents a 47.0 percent increase from the market potential low point reached in February 1993.

- Currently, potential existing-home sales is 1,665,000 (SAAR), or 24.5 percent below the pre-recession peak of market potential, which occurred in April 2006.

First American Deputy Chief Economist Odeta Kushi contributed to this post.

What Insight Does the Potential Home Sales Model Reveal?

When considering the right time to buy or sell a home, an important factor in the decision should be the market’s overall health, which is largely a function of supply and demand. Knowing how close the market is to a healthy level of activity can help consumers determine if it is a good time to buy or sell, and what might happen to the market in the future. That is difficult to assess when looking at the number of homes sold at a particular point in time without understanding the health of the market at that time. Historical context is critically important. Our potential home sales model measures what we believe a healthy market level of home sales should be based on the economic, demographic and housing market environments.

About the Potential Home Sales Model

Potential home sales measures existing-home sales, which include single-family homes, townhomes, condominiums and co-ops on a seasonally adjusted annualized rate based on the historical relationship between existing-home sales and U.S. population demographic data, homeowner tenure, house-buying power in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. When the actual level of existing-home sales are significantly above potential home sales, the pace of turnover is not supported by market fundamentals and there is an increased likelihood of a market correction. Conversely, seasonally adjusted, annualized rates of actual existing-home sales below the level of potential existing-home sales indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted annualized existing-home sales may exceed or fall short of the potential rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent potential home sale estimates are subject to revision to reflect the most up-to-date information available on the economy, housing market and financial conditions. The Potential Home Sales model is published prior to the National Association of Realtors’ Existing-Home Sales report each month.