As mortgage rates rose rapidly last year, the golden handcuffs of low mortgage rates, otherwise known as the rate lock-in effect, was frequently cited as a primary culprit for the ongoing housing supply shortage. And, rightfully so, as according to third-quarter 2022 Federal Housing Finance Agency data, 84 percent of all outstanding mortgages have a mortgage rate at, or below, 5 percent and 63 percent have a rate at, or below, 4 percent.

“With higher mortgage rates deterring many rate locked-in homeowners from selling, free-and-clear homeowners may hold the key to unlocking some much-needed supply for today’s housing market.”

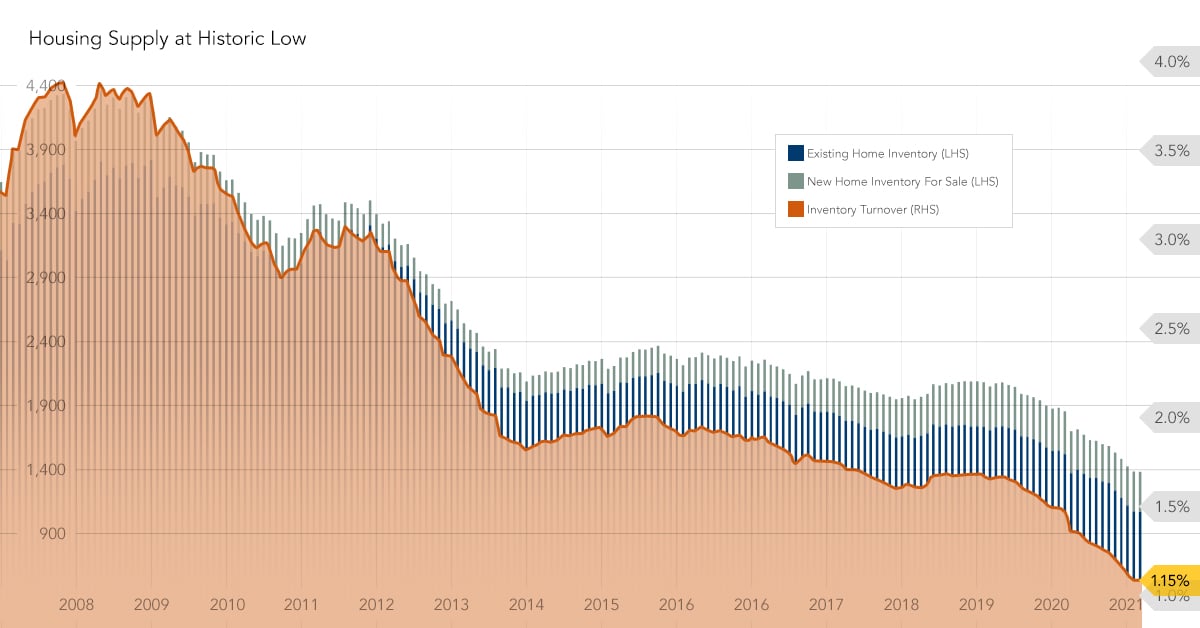

Now that mortgage rates are settling near 6 percent, there is a financial disincentive for homeowners who are locked into low mortgage rates to sell their homes and buy a new home at a higher rate. The golden handcuffs of low mortgage rates restrict housing market turnover and limit more supply from reaching the market. As a result, the average length of time that a homeowner stays in their home has reached an all-time high of over 10.5 years.

However, there is a significant portion of homeowners who are immune from this effect, because they own their homes without a mortgage, otherwise known as being “free and clear.” With higher mortgage rates deterring many rate locked-in homeowners from selling, free-and-clear homeowners may hold the key to unlocking some much-needed supply for today’s housing market.

Free-and-Clear Homeowners are Immune from the Lock-In Effect

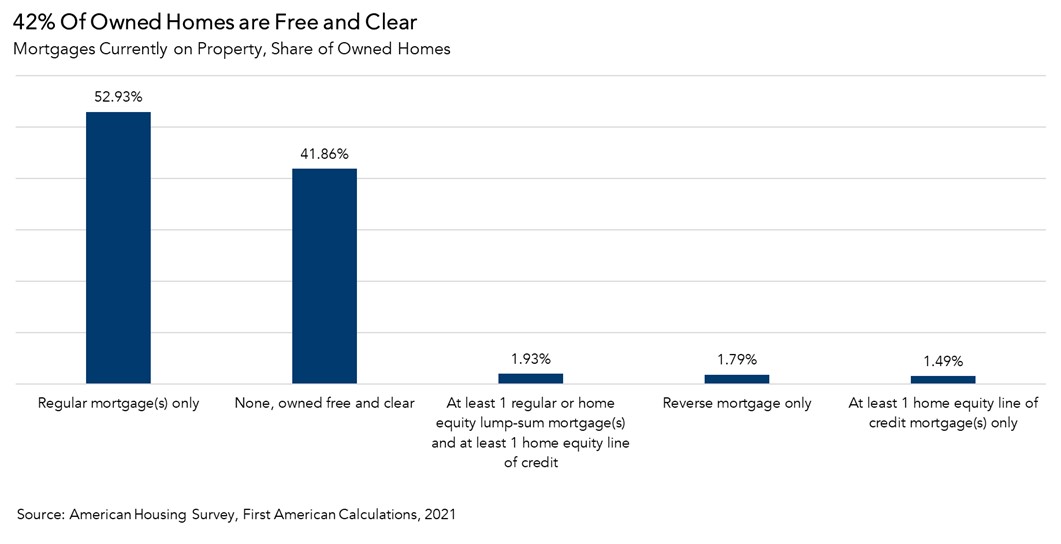

In 2021, 42 percent of all owner-occupied homes in the U.S. were owned free and clear, up from 34 percent in 2011. These free-and-clear homeowners are not disincentivized from selling their homes due to the rate lock-in effect. Additionally, there are mortgaged homeowners that have very low remaining mortgage balances, making them much less immune to the rate lock-in effect, so the number of homeowners that may be rate ‘unlocked’ is ever greater.

Of those who owned their home free and clear, nearly 78 percent were owned by homeowners aged 55 or older. Not surprisingly, older homeowners are more likely to own their homes free and clear. As the Baby Boomer generation, which is larger than any generation before it, has aged, the share of homes owned free and clear has increased. This gives some hope that while many existing homeowners remain rate locked-in, there is a large cohort of older homeowners who are not. However, older households are typically less likely to move than younger ones, which is especially true as seniors today increasingly age in place. So, while some portion of the free-and-clear inventory will come to market in the next decade, it will likely trickle in slowly.

Free-and-Clear Homeowners May Hold the Key

As demand for homes starts to inch up as we approach spring home-buying season, a key question is, will there be more inventory for those potential home buyers to buy? Existing-home inventory makes up the bulk of available home inventory, and many existing homeowners refinanced into sub-3 percent mortgage rates over the course of the pandemic. But there’s a large group of homeowners who are not deterred by higher mortgage rates—those without a mortgage on their existing home or those with a small remaining balance. These homeowners may hold the key to unlocking more supply and, in turn, more home sales.