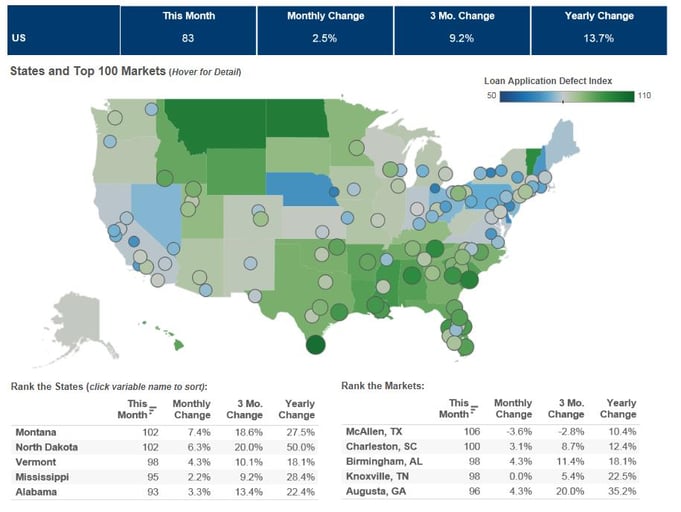

We’ve posted the April First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index increased 2.5 percent in May 2017 as compared with the previous month, and increased 13.7 percent as compared to May 2016. The Defect Index is down 18.6 percent from the high point of risk in October 2013.

“Given the heat wave gripping many parts of the country, this month I am highlighting the loan application defect risk ‘heat wave’ frying several markets in the South, according to the Loan Application Defect Index,” said Fleming. “Southern markets are experiencing some of the strongest growth in housing demand, as people seek the lower cost of living compared to northeastern and western markets.”

For the list of southern markets burning with defect risk, the top five states and markets where defect risk is increasing or decreasing, and more, please visit the Loan Application Defect Index.