After the recent bank failures, a good deal of attention has been paid to commercial real estate (CRE) debt held by banks of different sizes. But banks aren’t the only CRE lenders. Insurance companies, mortgage REITs, and private debt funds that lend investors’ money also regularly make CRE loans. Taken together, banks of all sizes only account for approximately 40 percent of all outstanding CRE mortgages.

Even though a greater portion of CRE debt is held by nonbank lenders, greater attention has been paid to bank exposure to CRE due to the potential risk posed to depositors by bank losses. The all-important question for the banking sector is if banks face significant unrealized losses on their CRE loans, as they have with their bond portfolios, will the uninsured deposits held by those banks remain safe?

“Smaller banks with maturing mortgages on underperforming buildings will soon have to decide what to do with them, especially if those buildings are now worth less than the value of their loans.”

Smaller Banks More Exposed to CRE Loans than Large Banks

When a commercial property loan matures, the owner needs to refinance, sell the building to pay off the debt, or give the building to the bank. If the bank has to seize collateral held against a loan, it wants the value of that collateral to cover the value of its outstanding debt. If it doesn’t, then the bank takes a loss. A bank with greater concentration in CRE loan assets could be more exposed to losses in the event of an industry-wide decline in CRE prices.

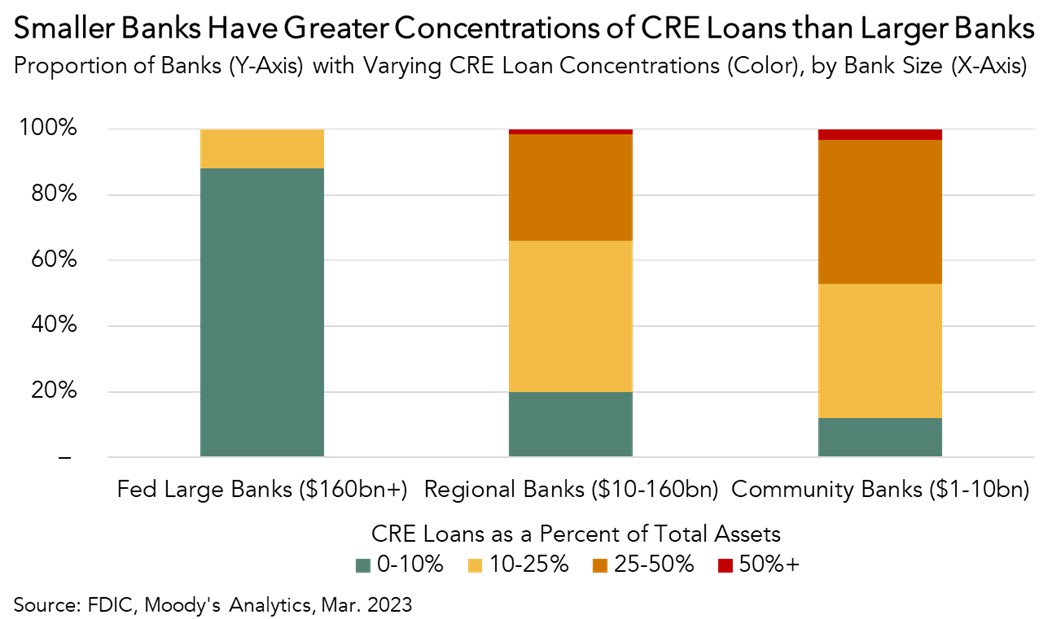

Small banks, which the Federal Reserve defines as banks not in the top 25 by asset size, have a greater proportion of their assets in CRE mortgages than larger banks. According to data from Moody’s, only 12 percent of large banks have more than 10 percent of their assets in CRE loans. However, 80 percent of regional banks have over 10 percent of their total assets in CRE loans. Smaller community banks have even more of their balance sheets allocated to CRE loans. Generally, the smaller the bank, the greater the concentration of CRE assets.

Keeping it in Perspective

Regional and community banks play an important role in credit markets by extending credit to owners of smaller commercial properties who might not be worth the time for larger banks. One consequence of this role is greater exposure to properties that, with higher interest rates, could now be facing price declines and upcoming loan maturities. Smaller banks with maturing mortgages on underperforming buildings will soon have to decide what to do with them, especially if those buildings are now worth less than the value of their loans. While important, these regional and community banks represent only a part of the overall CRE lending landscape that includes bank and nonbank lenders alike.