Since Commercial Mortgage-Backed Securities (CMBS) are actively traded, their prices fluctuate more than other types of commercial debt as interest rates move. Given this interest rate sensitivity, CMBS provide insight into what trends may evolve in private lending markets, which are larger but less transparent, so they are less likely to quickly indicate changes in the macro-environment.

“Office is the asset class that is most at risk from upcoming fixed-rate debt maturities given the decrease in office space utilization due to the rise of remote work.“

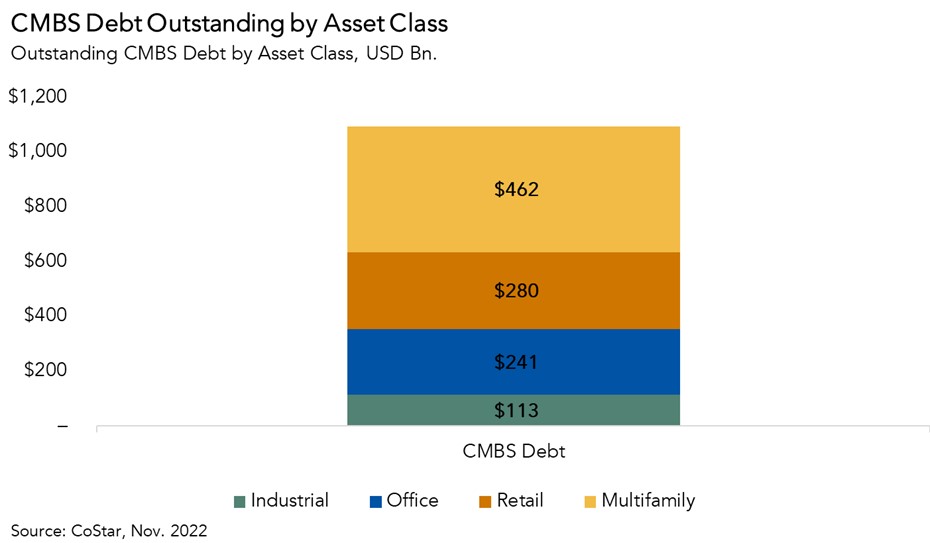

What is the Total Amount of Outstanding CMBS Debt?

Currently, there is approximately $1.1 trillion in outstanding CMBS debt across major asset classes, according to data from CoStar. In terms of dollars, there is more multifamily CMBS debt outstanding than other asset classes, followed by retail, office, and then industrial.

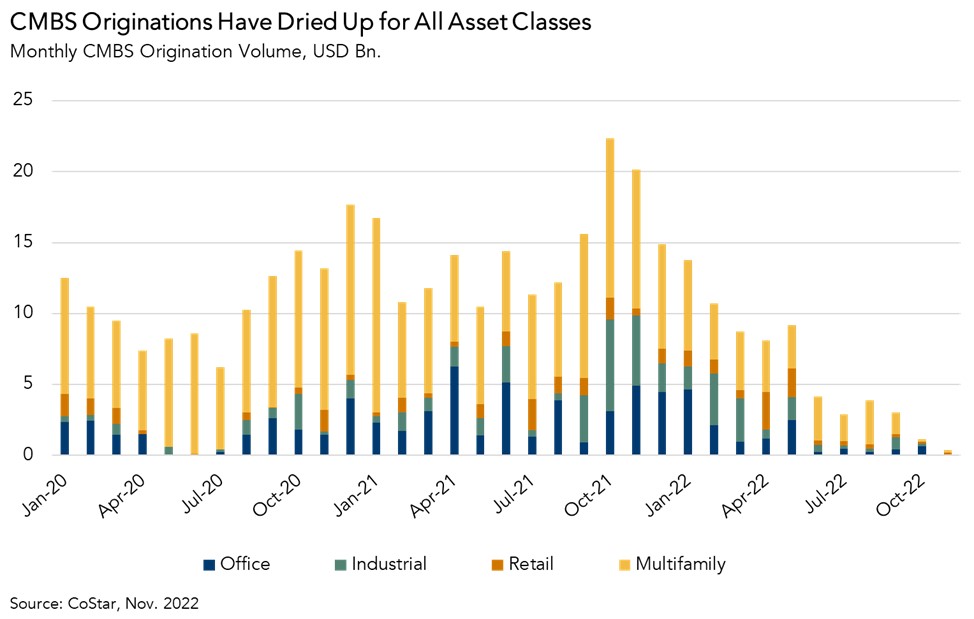

CMBS Originations Dry Up in Second Half of 2022

Rising interest rates impact CMBS in two primary ways. First, higher rates depress the price of existing, fixed-rate CMBS by driving away prospective investors, since greater investment returns can be found elsewhere at similar or equal risk levels. Second, higher rates dampen CMBS origination volume because some borrowers can’t afford the higher cost debt. As interest rates have risen throughout 2022, this is the dynamic that has unfolded in CMBS markets. CMBS originations for all asset classes have dried up almost entirely in the latter half of 2022. Falling CMBS originations is a sign of declining demand to own commercial property, and likely a leading indicator that transaction volumes will remain muted.

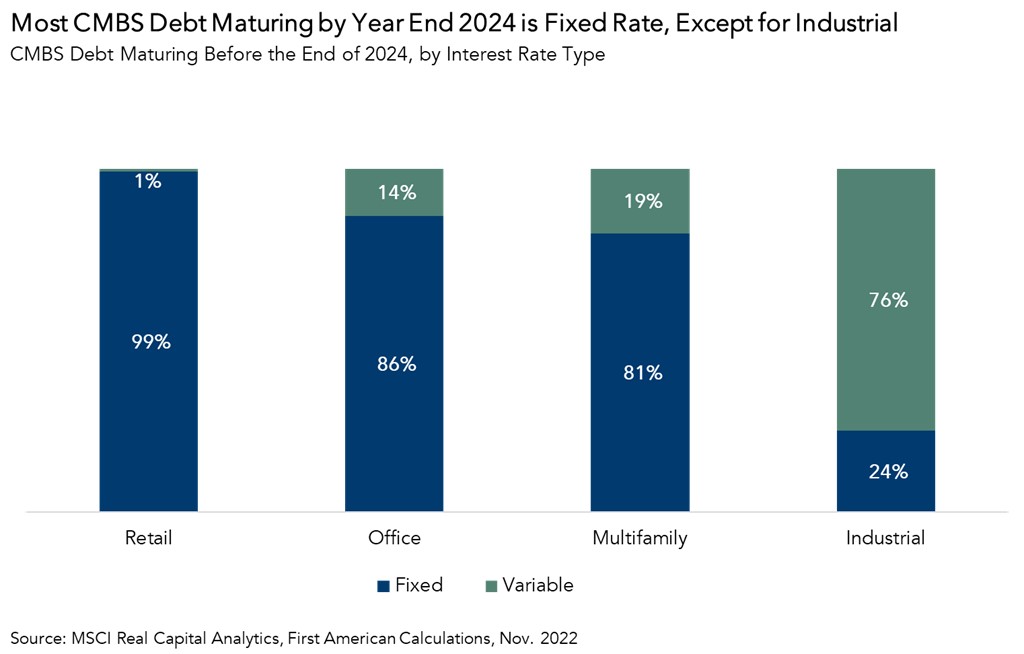

CMBS Debt Maturities, by Interest Rate Type

With the exception of industrial debt, more fixed-rate debt is maturing than variable-rate debt for all asset classes over the next two years. Most retail, office and multifamily buildings with upcoming debt maturities will face a sudden increase in their debt expense if they refinance the full amount of their CMBS. The outlooks for these three asset classes vary meaningfully, but office is the most at risk from upcoming fixed-rate debt maturities given the decrease in office space utilization due to the rise of remote work. Some owners will choose to refinance a smaller portion of their outstanding CMBS debt, but this will require equity capital contributions to cover the difference, which lowers their returns.

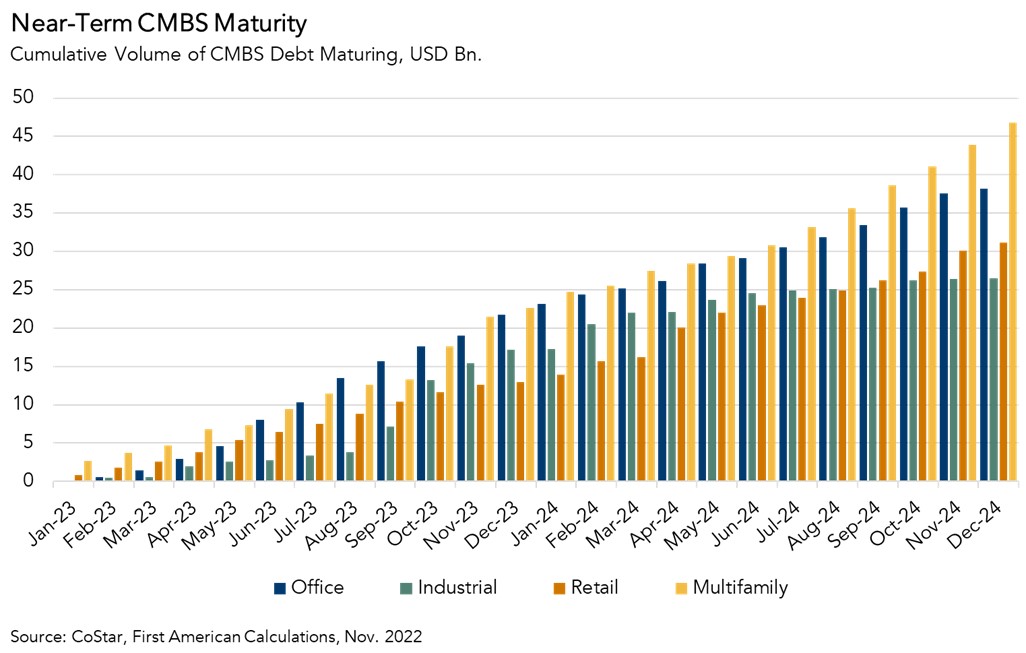

How much CMBS Debt is Maturing in the Next Two Years?

In total, approximately $143 billion in CMBS debt will mature by the end of 2024, equivalent to approximately 13 percent of all currently outstanding CMBS debt. Multifamily debt will comprise the largest portion of this at $47 billion, followed by office at $38 billion. However, the post-pandemic outlook for multifamily differs significantly from the outlook for office. Demand for multifamily space has arguably grown at the expense of demand for office space as remote work shifted hours spent at the office into the home.

So, What’s the X-Factor?

Keep an eye on CMBS, especially for office, as they mature. Approximately 17 percent of all outstanding office CMBS debt matures in the next two years, and many office owners will be looking to refinance at higher rates with half-empty office buildings – increasing the risk that office owners will face depressed cash flows and may be unable to meet their debt obligations.