As the Federal Reserve further tightens monetary policy by raising interest rates, existing borrowers of fixed-rate debt will be impacted when that debt matures. At that point, borrowers will likely need to refinance at higher interest rates, raising the question of whether or not they can afford costlier debt service. Understanding the quantity of debt maturing over a specific period of time can, therefore, provide some insight into how owners of different asset classes may be impacted by the increased cost of debt.

“Higher interest rates combined with still under-utilized office buildings will likely increase levels of risk to office owners over the next two years.”

Debt Maturities as a Leading indicator for Risk

Commercial Mortgage-Backed Securities (CMBS) maturities, when combined with vacancy rates, can act as a leading indicator for increasing risk to property owners. This measure is particularly useful in analyzing the outlook for the office sector. Rising interest rates limit refinancing options for maturing loans, while the pandemic-fueled increase in remote work has drastically altered the demand for office space.

Many office buildings, especially those that are not a best-in-class asset, remain substantially underutilized. No other asset class is as under-utilized as office. Additionally, according to Trepp, approximately 8.4 percent of office CMBS borrowers have debt service coverage ratios (DSCR) under 1, which means they cannot afford to refinance their existing loan balance at existing interest rates. The exposure is meaningfully higher than for retail (6.2 percent), multifamily (4.6 percent) and industrial (3.6 percent) and indicates that more office buildings are struggling to cover their debt service than other asset classes.

The Scale of Refinance Risk

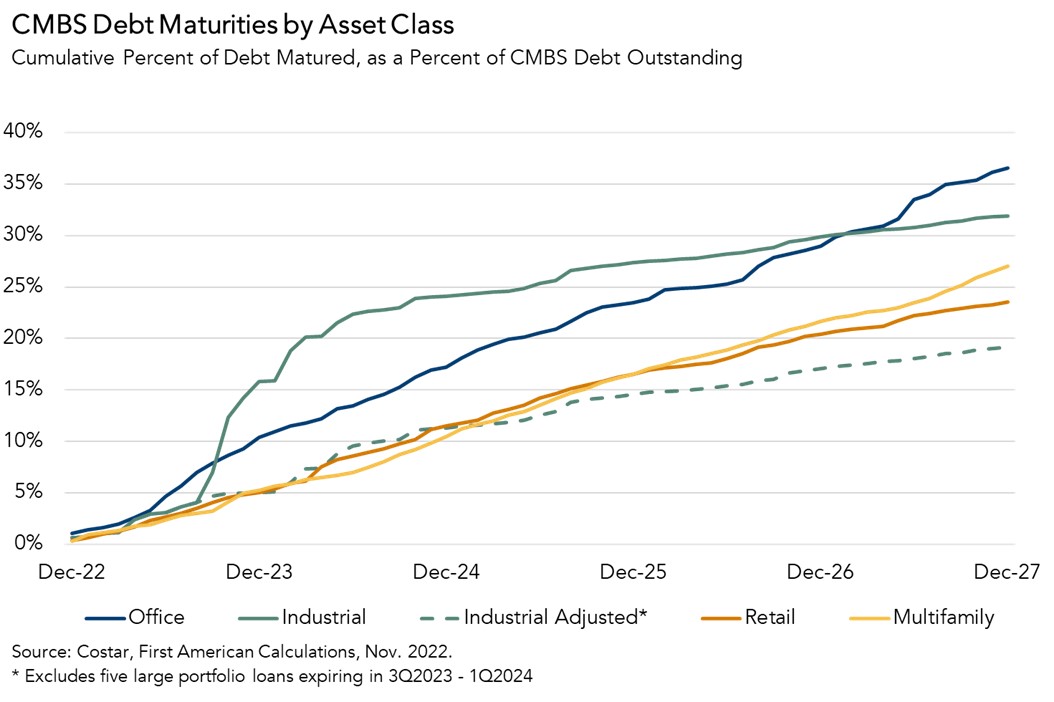

It is possible to get a sense of the scale of upcoming refinance risk by examining CMBS maturities over the next five years, relative to current outstanding debt.

While retail and multifamily exhibit a linear increase over time, implying a relatively unchanging quantity of annual debt maturities, both office and industrial see a sharp increase in 2023 and 2024. After that, industrial maturities stabilize, whereas office maturities continue to increase.

The sharp increase in industrial debt maturities in late 2023 and early 2024 is due to five large portfolio loans worth between $1.2 billion and $4.5 billion. If these industrial portfolio loans are excluded (green dotted line in the chart), office CMBS maturities outpace all other asset classes over the next five years. Additionally, there is over twice as much outstanding office CMBS debt (approximately $240 billion) than industrial (approximately $110 billion).

More importantly, the outlook for the office sector is far less certain than the outlook for industrial. Office buildings in some major cities across the country remain half empty, with vacancy rates creeping up as fewer tenants renew leases and many that do choose to downsize.

Under-Utilized Office Space Poses Added Risk

Approximately 17 percent of all outstanding office CMBS will come due in the next two years. Yet, demand for office space has changed fundamentally as a result of new remote work technology and practices. Higher interest rates combined with still under-utilized office buildings will likely increase levels of risk to office owners over the next two years.