Unlike the two-thirds of Americans who already own a home, potential first-time home buyers did not benefit from the surging levels of home equity driven by rapid house price appreciation. Just as in 2020, low mortgage rates increased house-buying power and simultaneously boosted demand amid record low levels of homes for sale, further accelerating house price appreciation and reducing affordability. Rising house-buying power improves affordability, but when nominal house prices outpace house-buying power, as they did in 2021, affordability falls.

“Real estate is a local phenomenon and there are cities, such as Buffalo, Pittsburgh, and Oklahoma City, where the dream of homeownership for renters may be more attainable than many realize.”

Potential first-time home buyers are nearly always renters, so affordability for first-time home buyers is best analyzed by determining the share of homes for sale that are within the typical renter’s house-buying power.

Nationally, Housing Affordability Declined for Potential First-Time Home Buyers

From the perspective of a potential first-time home buyer, affordability is a function of their house-buying power and the share of affordable homes available for sale. A first-time buyer’s house-buying power is based on the median renter’s income, the prevailing 30-year fixed mortgage rate, and the assumption that one-third of the first-time home buyer’s pre-tax income is used for a mortgage with a 5 percent down payment. The share of homes for sale in any given market that are affordable for the median renter is estimated by comparing data on home sale transactions from First American Data & Analytics to the median renter’s house-buying power.

Nationally, renter house-buying power jumped up by 14 percent on a year-over-year basis in the third quarter of 2021, from $290,000 to $331,000, driven in large part by falling mortgage rates. Yet, despite the increase in house-buying power, annual house price appreciation hit record levels in 2021 and eroded affordability. The result? The share of homes for sale that a median renter could afford shrank on a year-over-year basis. Nationally, the median renter could afford 53 percent of the homes for sale in the third quarter of 2021, down from 58 percent in the third quarter of 2020.

What Can Buffalo, Pittsburgh and Oklahoma City Offer First-Time Home Buyers?

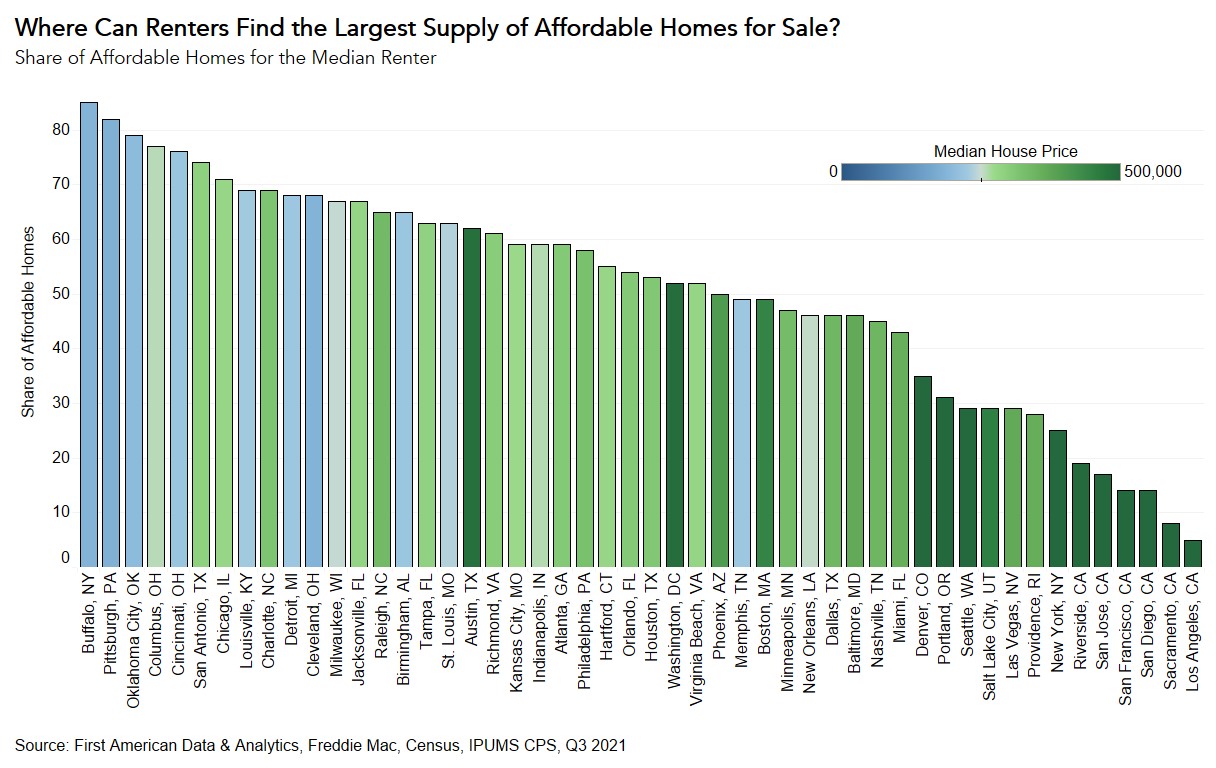

Examining first-time home buyer affordability at the national level is useful, but in practice each market is vastly different. Regional differences in house-buying power and house prices create varying levels of affordability. The chart below indicates where the median renter can find the greatest share of affordable homes among the 50 largest U.S. markets.

In the third quarter of 2021, the market with the greatest share of affordable homes for the median renter was Buffalo, N.Y., where the median renter could afford 85 percent of all homes for sale. In Buffalo, house-buying power for the median renter was $339,000, well above the $185,000 median home price in the market for the quarter.

Los Angeles was once again the least affordable market, where the median renter could only afford 5 percent of the homes for sale. Even though the median renter’s house-buying power in Los Angeles is $406,000, the median sale price averaged $828,000 in the third quarter of 2021.

Markets with large shares of affordable homes for sale tended to have lower median house prices, but the trend was not universal. Some markets with relatively high median house prices, such as Charlotte, N.C. and Austin, Texas, were considered affordable, while lower-priced markets, such as Memphis, Tenn. and New Orleans, were less affordable. Home prices alone do not accurately indicate affordability – it's all about the share of homes for sale that are within the renter’s house-buying power.

What is the Affordability Outlook for First-Time Home Buyers in 2022?

Mortgage rates, housing supply, and house price appreciation trends will drive first-time home buyer affordability in 2022. Mortgage rates are expected to increase by the end of the year, which will dampen house-buying power, all else held equal. Housing supply is likely to remain tight, which will continue to drive house price appreciation, though likely at a more moderate pace than the frenzy last year. In other words, the housing market in the year ahead may look very similar to 2021. Of course, real estate is a local phenomenon and there are cities, such as Buffalo, Pittsburgh, and Oklahoma City, where the dream of homeownership for renters may be more attainable than many realize.

Data Sources:

About the First-Time Home Buyer Outlook Report

Housing affordability is often reduced to a comparison of household income to house prices. This overlooks what matters to potential buyers – their house-buying power. First American’s proprietary First-Time Home Buyer Outlook Report examines first-time home buyer affordability by considering the share of homes for sale that are within the renter’s house-buying power. The larger the share of homes for sale that first-time home buyers can afford to buy, the more affordable the market.

First-time home buyer house-buying power is based on the median renter household’s income, the prevailing 30-year, fixed mortgage rate, the most recent year’s property tax rate for the geography of the renter, and assumes a fixed cost for private mortgage insurance, a 5 percent down payment and that one-third of their pre-tax income is used for the mortgage. The share of homes for sale is based on First American Data & Analytics’ aggregation of publicly recorded home sales. The median renter household’s income is derived from the 2021 Annual Social and Economic Supplement (ASEC) of the Current Population Survey, reporting income for the year 2020. It was assumed that household income increased by 4.8 percent between 2020 and 2021, based on the average annual percent increase in median renter household income between 2013 and 2017.

.jpg)