After hitting its highest point since 2007 last month, housing market potential fell modestly in March, according to our Potential Home Sales Model. Housing market potential remains near the 13-year high point, but the severely limited supply of homes for sale and an uptick in mortgage rates pulled market potential for existing-home sales off its February peak. Annual comparisons of housing market potential will be very large for the next few months, as the housing market came to a halt last year at this time when the pandemic shut down the economy. However, housing market potential is 16.5 percent higher than two years ago and will remain strong due to a demographic-fueled shift away from renting to home owning driven by millennials aging into homeownership and accelerated by still low mortgage rates.

“If you think modestly higher mortgage rates will substantially cool a hot spring home-buying season, you’re overlooking a key driver of housing demand: demographics.”

What’s the Deal with Rising Mortgage Rates?

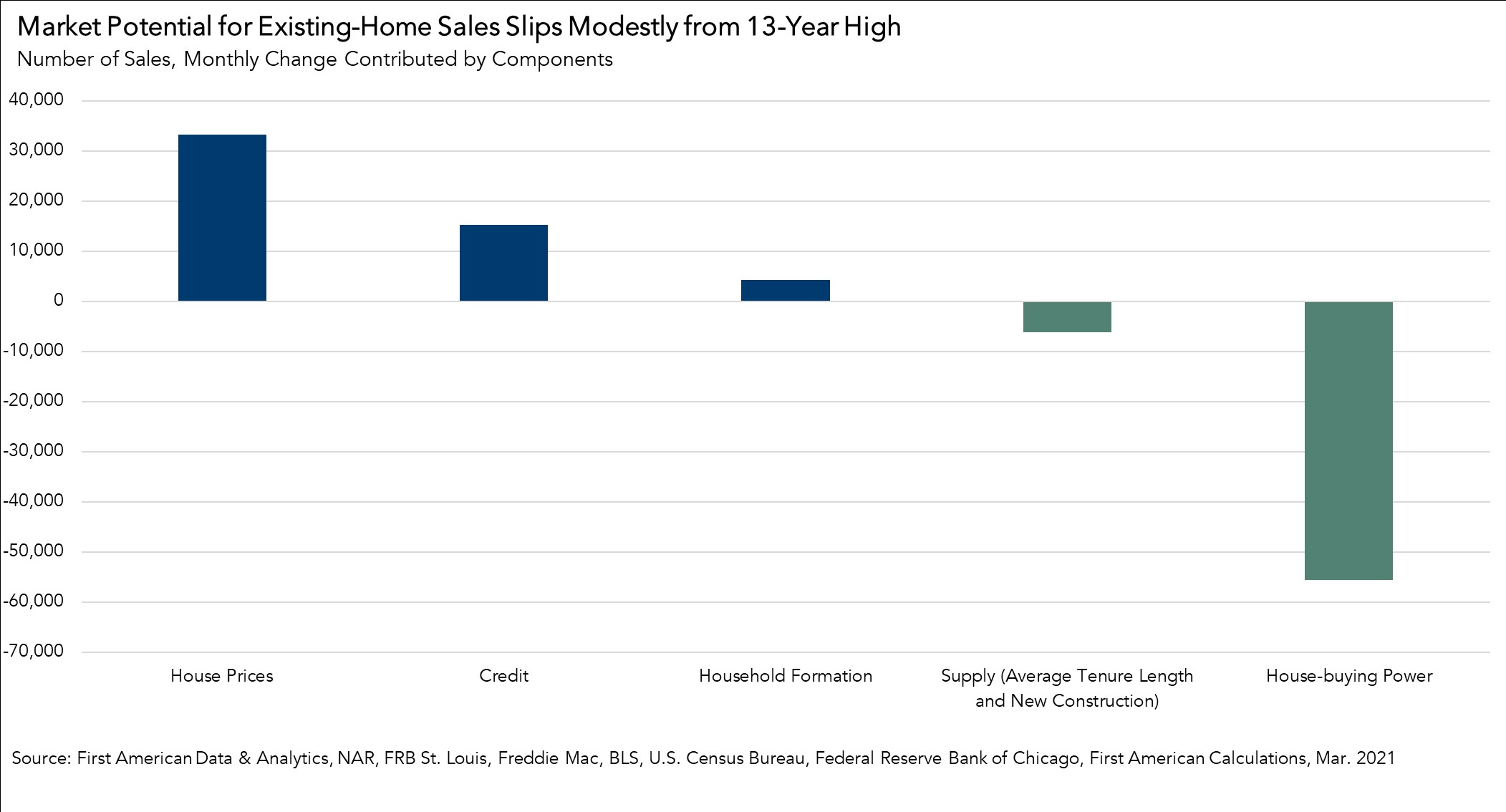

On a month-over-month basis, mortgage rates increased by the greatest amount since February 2018, contributing to a $13,000 decline in house-buying power nationally. Historically and relative to one year ago, mortgage rates remain low. Yet, for homeowners who locked in rates below 3 percent, modestly higher rates in a historically low inventory environment may disincentivize some from selling their homes thus preventing more supply from reaching the market. In March, the dip in house-buying power resulted in a decline of 55,600 potential home sales.

Potential home buyers ready to make the switch from renting to owning may need to adjust their price points given modestly higher mortgage rates. But rates aren’t everything. Buying a home is a lifestyle choice and a large cohort of millennials are reaching prime buying age, and the new normal likely includes more work-from-home options, giving potential home buyers more geographic flexibility, helping to boost home sales. In March, household formation contributed to a gain of approximately 4,300 potential home sales. This demographic tailwind is expected to persist.

Adding fuel to the housing demand fire is the increase in the personal savings rate, which climbed to an all-time high in April and remains above the historical average as pandemic-driven restrictions have limited discretionary spending. For young people that are still employed, increased savings can be used as a down payment, which is typically the biggest hurdle for first-time home buyers.

The Problem is Supply

Existing homeowners today are sitting on record amounts of equity, which could be used to move out and move up. Rising house appreciation contributed to a gain of approximately 33,300 potential home sales in March. However, while many homeowners may want to use their equity to buy something bigger and better, they first must find something to buy. The fear of not finding something to buy in an environment of historically low inventory is one reason tenure length reached a high of just over 10.5 years. In March, homeowners staying put and a lack of new construction collectively contributed to a loss of just over 6,100 potential home sales.

Spring Market Housing Market Will Remain Hot

While the market potential for existing-home sales slipped off its 13-year high, the housing market remains hot as the spring home-buying season hits its stride. According to the most recent NAR existing-home sales report, homes in February were selling at the fastest pace on record, and house price appreciation is accelerating. The rapid pace of sales and rising prices indicate that the month-over-month moderation is due to the lack of supply, not a lack of demand. The issue is inventory – you can’t buy what’s not for sale.

However, as widespread vaccinations prompt the economic recovery to pick up speed, consumers and lenders will likely grow more confident. Similarly, a safer environment may prompt equity-rich homeowners who were unwilling to open their homes to showings during the peak of the pandemic, to finally put their homes on the market. More supply will help ease this super sellers’ market. But, if you think modestly higher mortgage rates will substantially cool a hot spring home-buying season, you’re overlooking a key driver of housing demand: demographics.

March 2021 Potential Home Sales

For the month of March, First American updated its proprietary Potential Home Sales Model to show that:

- Potential existing-home sales decreased to a 6.26 million seasonally adjusted annualized rate (SAAR), a -0.1 percent month-over-month decrease.

- This represents a 79.7 percent increase from the market potential low point reached in February 1993.

- The market potential for existing-home sales increased 23.6 percent compared with a year ago, a gain of 1,197,267 (SAAR) sales. Year-over-year comparisons will be very large in the months to come, as the housing market came to a halt last year at this time when the pandemic shut down the economy. Housing rebounded sharply in the summer.

- Currently, potential existing-home sales is 527,022 million (SAAR), or 7.8 percent below the pre-recession peak of market potential, which occurred in April 2006.

Market Performance Gap

- The market for existing-home sales outperformed its potential by 5.6 percent or an estimated 348,600 (SAAR) sales.

- The market performance gap increased by an estimated 146,600 (SAAR) sales between February 2021 and March 2021.

First American Deputy Chief Economist Odeta Kushi contributed to this post.

What Insight Does the Potential Home Sales Model Reveal?

When considering the right time to buy or sell a home, an important factor in the decision should be the market’s overall health, which is largely a function of supply and demand. Knowing how close the market is to a healthy level of activity can help consumers determine if it is a good time to buy or sell, and what might happen to the market in the future. That is difficult to assess when looking at the number of homes sold at a particular point in time without understanding the health of the market at that time. Historical context is critically important. Our potential home sales model measures what we believe a healthy market level of home sales should be based on the economic, demographic and housing market environments.

About the Potential Home Sales Model

Potential home sales measures existing-home sales, which include single-family homes, townhomes, condominiums and co-ops on a seasonally adjusted annualized rate based on the historical relationship between existing-home sales and U.S. population demographic data, homeowner tenure, house-buying power in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. When the actual level of existing-home sales are significantly above potential home sales, the pace of turnover is not supported by market fundamentals and there is an increased likelihood of a market correction. Conversely, seasonally adjusted, annualized rates of actual existing-home sales below the level of potential existing-home sales indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted annualized existing-home sales may exceed or fall short of the potential rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent potential home sale estimates are subject to revision to reflect the most up-to-date information available on the economy, housing market and financial conditions. The Potential Home Sales model is published prior to the National Association of Realtors’ Existing-Home Sales report each month.

.jpg)