Nominal house prices have been increasing nationally in the US for several years, and some markets have seen significant appreciation in nominal house prices. But, nominal house prices are not adjusted for any inflation. The price of a house today is not directly comparable to the price of that same house 30 years ago because of the long-run influence of inflation in the economy.

“Simply looking at house price changes without considering the changes in consumer house-buying power misrepresents the real change in prices.”

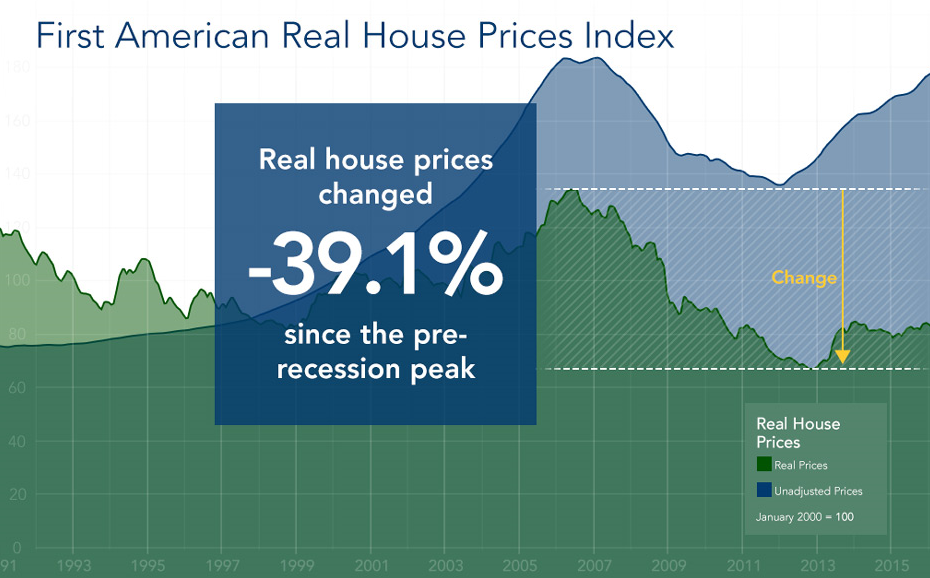

Changing household incomes and interest rates either increase or decrease consumer house-buying power or affordability. When incomes rise and/or mortgage rates fall, consumer house-buying power increases, so what would house prices look like if adjusted for income and interest rates? Enter the First American Real House Price Index (RHPI).

The RHPI offers an alternative view of the change over time of house prices at the national, state and metropolitan area level. It measures the price changes of single-family properties throughout the U.S. adjusted for the impact of income and interest rate changes on consumer house-buying power. Because the RHPI adjusts for house-buying power, it is also a measure of housing affordability.

“Simply looking at house price changes without considering the changes in consumer house-buying power misrepresents the real change in prices,” said Mark Fleming, chief economist at First American.

So, what does the RHPI tell us? After adjusting for increased consumer house-buying power, real house prices are significantly lower than they were prior to the housing boom. Real house prices are 39.1 percent below their housing-boom peak in July 2006 and 18 percent below the level of prices in January 2000.

Visit the RHPI research page for in-depth analysis of real house prices, including a counter-intuitive comparison of the change in real house prices in San Francisco and Detroit since their pre-recession peak in house prices.

The RHPI will be updated monthly with new data, so look for the next edition of the RHPI on June 9.