Five-years ago this week, Dodd-Frank was signed into law, ushering in a new era in mortgage lending. While the merits of the bill are still being weighed, mortgage originators and title and settlement service providers are grappling with the implementation of one component of Dodd-Frank – TILA-RESPA Integrated Disclosure (TRID). TRID is part of a broader regulatory trend requiring, and incenting the mortgage industry to improve the loan manufacturing process and reduce the amount of inaccurate, misrepresentative and fraudulent loans. In fact, many of the repurchases and bulk repurchase settlements that cost the industry billions of dollars in recent years have been the result of poor quality control in the loan manufacturing process.

"The Defect Index, which reflects estimated mortgage loan defect rates over time, by geography, and by loan type, is down 21.4 percent from the high point of risk in September 2013."

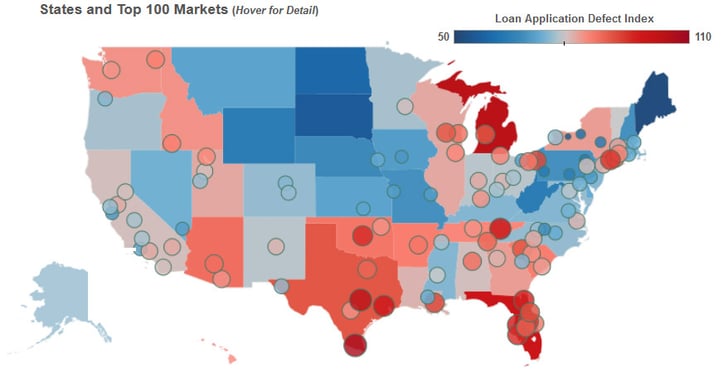

In response to the market’s heightened focus on the cost of loan defects, the First American Economics team is very excited to introduce today the First American Loan Application Defect Index! This new index and interactive tool measures the frequency of defects (inaccurate, misrepresentative or fraudulent) in the information submitted in mortgage loan applications.

We’ve launched with June 2015 data and it reports that nationally loan application defect incidence fell 5.8 percent. We hope you take a moment to test drive the interactive tool that can be tailored to showcase trends by category including amortization type, lien position, loan purpose, property and transaction types, as well as state and market-level comparisons of levels of mortgage loan defects.

Every month, we’ll post a new index and interactive tool with updated data.

Take a look under the hood and let us know what you think about the trends in defect risk in your state or market.