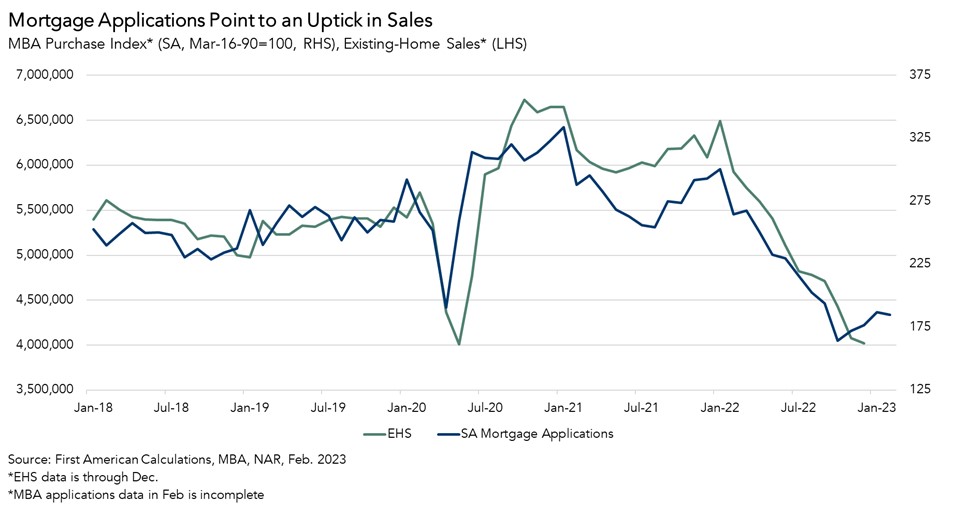

There’s no question that the housing market fell into a deep freeze in the second half of 2022. Excluding the early months of the pandemic, the pace of existing-home sales fell below 5 million seasonally adjusted sales for the first time since 2014. Yet, signs have emerged that sales activity may pick up in the months ahead. Purchase mortgage applications, pending home sales, and builder confidence are all leading indicators of future sales activity, and each metric has ticked up in recent months.

“Our Potential Home Sales Model has now increased for three months in a row, confirming that housing market potential has started to improve alongside lower mortgage rates.”

While mortgage rates remain significantly higher compared with one year ago, they have retreated for three consecutive months, improving affordability and encouraging buyers and sellers to jump back into the market. Our Potential Home Sales Model, which measures what we believe a healthy market level of home sales should be based on the economic, demographic and housing market environments, has now increased for three months in a row, confirming that housing market potential has started to improve alongside lower mortgage rates.

Heightened Mortgage Rate Sensitivity

Higher mortgage rates and tight housing supply increased homeowner tenure to the highest level in recorded history and contributed to the sharp slowdown in existing-home sales in 2022. The rapid rise in mortgage rates in 2022, the steepest annual increase since 1981, has left existing homeowners, as well as first-time home buyers, increasingly “mortgage-rate sensitive.” However, in the last three months, the 30-year, fixed mortgage rate has declined by 0.6 percentage points and seasonally adjusted purchase mortgage applications have increased steadily over that same period. The decline in mortgage rates has encouraged some, who previously felt “rate locked-in,” to re-enter the market in addition to increasing house-buying power, thereby providing an affordability boost for potential first-time buyers.

Six More Months of Housing Winter or Early Spring-Home Buying?

We’re all familiar with the Groundhog’s Day folklore, when the groundhog, Punxsutawney Phil, exits his home to “predict” the weather – if he sees his shadow, there will be six more months of winter; if he does not, then spring is on the way. A few weeks ago, Punxsutawney Phil predicted six more weeks of winter, but would his housing market forecast be the same for the early spring home-buying season?

We’re likely to see a modest, seasonal increase in home-buying demand, but whether that demand can be sustained depends on the outlook for mortgage rates. While mortgage rates have trended downward this year, thanks to favorable inflation data, rates have jumped up in the last two weeks due to market expectations that inflation will persist, thereby requiring the Federal Reserve to remain restrictive for longer. As a result, purchase applications have dipped, an indication of mortgage-rate sensitivity among home buyers.

Higher rates don’t just reduce house-buying power, they may keep existing homeowners rate locked-in, preventing more supply from reaching the market, and you can’t buy what’s not for sale. Leading indicators, such as purchase mortgage applications data, suggest that Punxsutawney Phil may not have seen his “housing” shadow, and the green shoots of spring home-buying are beginning to sprout, but the recent uptick in mortgage rates may have clouded that outlook.

January 2023 Potential Home Sales

For the month of January, First American updated its proprietary Potential Home Sales Model to show that:

- Potential existing-home sales increased to a 5.32 million seasonally adjusted annualized rate (SAAR), a 0.6 percent month-over-month increase.

- This represents a 53 percent increase from the market potential low point reached in February 1993.

- The market potential for existing-home sales decreased 16 percent compared with a year ago, a loss of 1,005,500 (SAAR) sales.

- Currently, potential existing-home sales is 1,468,500 (SAAR), or 21.6 percent below the pre-recession peak of market potential, which occurred in April 2006.

First American Deputy Chief Economist Odeta Kushi contributed to this post.

What Insight Does the Potential Home Sales Model Reveal?

When considering the right time to buy or sell a home, an important factor in the decision should be the market’s overall health, which is largely a function of supply and demand. Knowing how close the market is to a healthy level of activity can help consumers determine if it is a good time to buy or sell, and what might happen to the market in the future. That is difficult to assess when looking at the number of homes sold at a particular point in time without understanding the health of the market at that time. Historical context is critically important. Our potential home sales model measures what we believe a healthy market level of home sales should be based on the economic, demographic and housing market environments.

About the Potential Home Sales Model

Potential home sales measures existing-home sales, which include single-family homes, townhomes, condominiums and co-ops on a seasonally adjusted annualized rate based on the historical relationship between existing-home sales and U.S. population demographic data, homeowner tenure, house-buying power in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. When the actual level of existing-home sales are significantly above potential home sales, the pace of turnover is not supported by market fundamentals and there is an increased likelihood of a market correction. Conversely, seasonally adjusted, annualized rates of actual existing-home sales below the level of potential existing-home sales indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted annualized existing-home sales may exceed or fall short of the potential rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent potential home sale estimates are subject to revision to reflect the most up-to-date information available on the economy, housing market and financial conditions. The Potential Home Sales model is published prior to the National Association of Realtors’ Existing-Home Sales report each month.