Housing market potential strengthened modestly in September, increasing a 0.4 percent compared with August, according to our Potential Home Sales Model. The slight increase means that on a year-over-year basis, housing market potential is now nearly 9 percent higher than in September 2020, when the housing market’s summer rebound was accelerating, following the initial pandemic-driven decline in the spring.

“You can’t buy what’s not for sale, even if you can afford it, and why move out if you must move “down” or pay more to move up?”

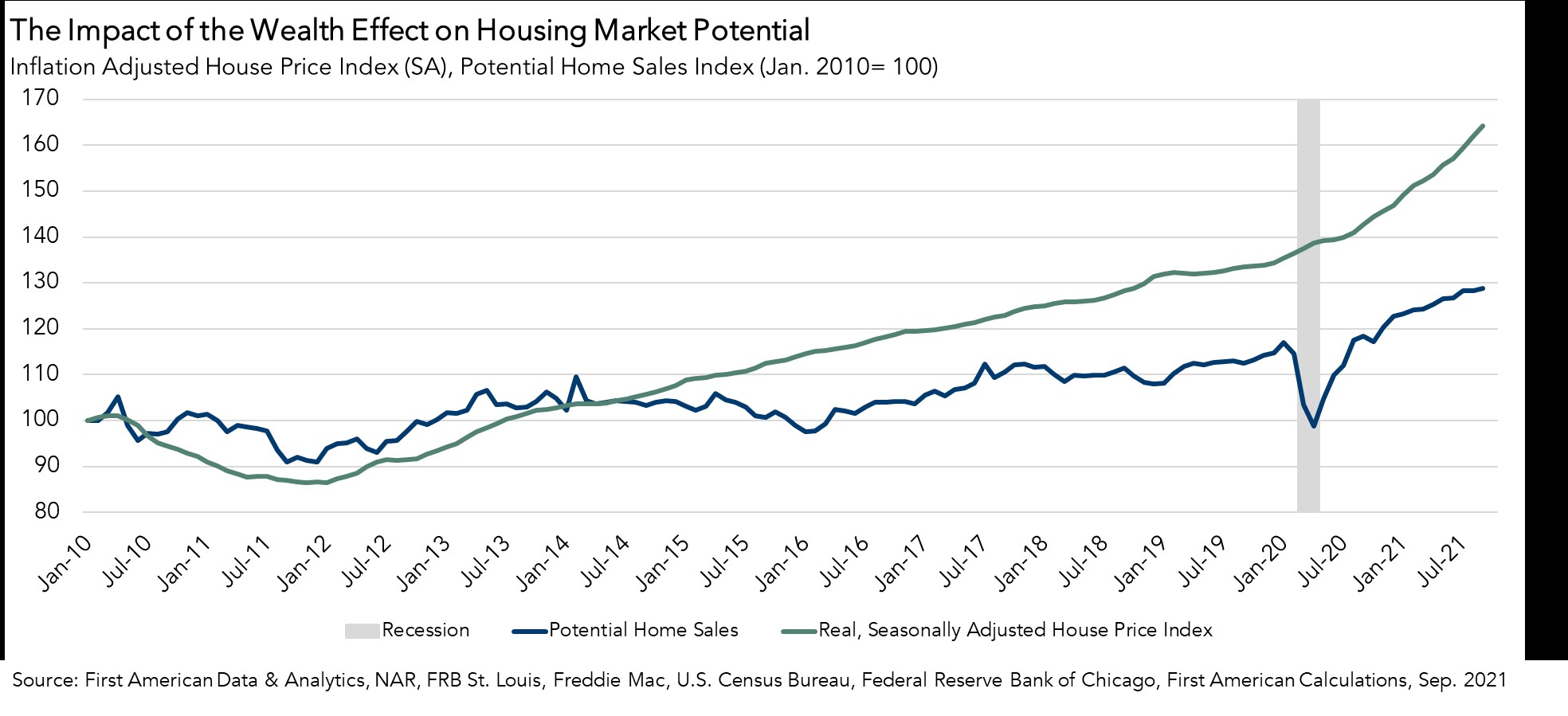

Potential home sales measures what the healthy market level of home sales should be based on economic, demographic, and housing market fundamentals. Actual existing-home sales have oscillated up and down on a month-to-month basis, while housing market potential has been consistently rising all year largely as a result of increasing house price appreciation. Historically, house prices and home sales have demonstrated a strong positive relationship – when house prices rise, so do home sales. But this relationship is not so straightforward.

Wealth Effect or Not? That Is the Question

In today’s housing market, strong demand in combination with the historically low supply of homes for sale has fueled record house price appreciation. On a month-over-month basis, the 1.4 percent increase in inflation-adjusted house price growth boosted housing market potential by more than 28,000 potential home sales relative to August. In fact, this was one of the few market fundamentals driving housing market potential higher. Declining house-buying power and other factors dragged market potential down in September.

Does it make sense that rising house prices can help spur more home sales? It depends. It is economically rational to expect that record levels of equity may prompt homeowners to use that equity to purchase larger and more attractive homes -- a dynamic known as the wealth effect of rising equity. In August’s existing-home sales report, the increase in home sales relative to one year ago was strongest at the upper end of the market, as sales of homes priced between $750,000 and $1 million increased 40.3 percent, followed closely by homes over $1 million, which increased 40 percent nationally. Since first-time home buyers generally don’t purchase at the higher end of the market, the home sales at these price points are typically occurring among existing homeowners, who are playing “housing musical chairs” by selling to each other. But it’s not so simple.

While an existing homeowner may have more purchasing power because the equity in their home has surged as prices appreciated, the price of the bigger and better home they are interested in has also increased. And even if the owner has the purchasing power, it’s hard to buy what’s not for sale. While inventory for new and existing homes has modestly increased in recent months, it remains near historic lows. Existing homeowners considering the possibility of listing their home for sale today must first contend with the prospect of finding something to buy. The fear of not finding something to buy in a housing market with historically low inventory is one reason the average length of time homeowners live in their home has reached a high of nearly 10.7 years. In September, homeowners staying put contributed to a loss of nearly 2,200 potential home sales. So, the “wealth effect” may not always be enough to encourage existing owners to sell.

If Not Equity, Then What?

There is something else that may encourage an existing homeowner to move, and that is falling mortgage rates. When rates fall, an existing homeowner can buy the same amount of home for a lower monthly payment or buy more home for the same monthly payment, because the lower rates boost their house-buying power. However, rates are expected to rise in the coming months as the economy continues to improve.

While existing homeowners are sitting on record levels of equity, many of these owners have also secured historically low fixed mortgage rates. There is a financial “lock-in” effect that increases as mortgage rates rise and as the size of a mortgage increases. Rising mortgage rates means it costs more to borrow the same amount that the homeowner owes on their existing mortgage. The more the prevailing market mortgage rate exceeds the homeowner’s existing mortgage rate, the larger the lock-in effect. Why move out if you must move “down” or pay more to move up?

So, if two-thirds of Americans are homeowners and many have record levels of equity, should we expect them all to tap their equity and sell? Don’t count on it, because you can’t buy what’s not for sale, even if you can afford it, and why move out if you must move “down” or pay more to move up.

September 2021 Potential Home Sales[1]

For the month of September, First American updated its proprietary Potential Home Sales Model to show that:

- Potential existing-home sales increased to a 6.24 million seasonally adjusted annualized rate (SAAR), a 0.4 percent month-over-month increase.

- This represents a 79.1 percent increase from the market potential low point reached in February 1993.

- The market potential for existing-home sales increased 8.7 percent compared with a year ago, a gain of 501,020 (SAAR) sales.

- Currently, potential existing-home sales is 545,800 (SAAR), or 8.0 percent below the pre-recession peak of market potential, which occurred in April 2006.

Market Performance Gap

- The market for existing-home sales outperformed its potential by 8.1 percent or an estimated 506,050 (SAAR) sales.

- The market performance gap increased by an estimated 89,340 (SAAR) sales between August 2021 and September 2021.

First American Deputy Chief Economist Odeta Kushi contributed to this post.

What Insight Does the Potential Home Sales Model Reveal?

When considering the right time to buy or sell a home, an important factor in the decision should be the market’s overall health, which is largely a function of supply and demand. Knowing how close the market is to a healthy level of activity can help consumers determine if it is a good time to buy or sell, and what might happen to the market in the future. That is difficult to assess when looking at the number of homes sold at a particular point in time without understanding the health of the market at that time. Historical context is critically important. Our potential home sales model measures what we believe a healthy market level of home sales should be based on the economic, demographic, and housing market environments.

About the Potential Home Sales Model

Potential home sales measures existing-home sales, which include single-family homes, townhomes, condominiums and co-ops on a seasonally adjusted annualized rate based on the historical relationship between existing-home sales and U.S. population demographic data, homeowner tenure, house-buying power in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. When the actual level of existing-home sales are significantly above potential home sales, the pace of turnover is not supported by market fundamentals and there is an increased likelihood of a market correction. Conversely, seasonally adjusted, annualized rates of actual existing-home sales below the level of potential existing-home sales indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted annualized existing-home sales may exceed or fall short of the potential rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent potential home sale estimates are subject to revision to reflect the most up-to-date information available on the economy, housing market and financial conditions. The Potential Home Sales model is published prior to the National Association of Realtors’ Existing-Home Sales report each month.

[1] This release includes a revision to the annual income series using the 2020 Current Population Survey Annual Social and Economic Supplement (CPS ASEC)

.jpg)