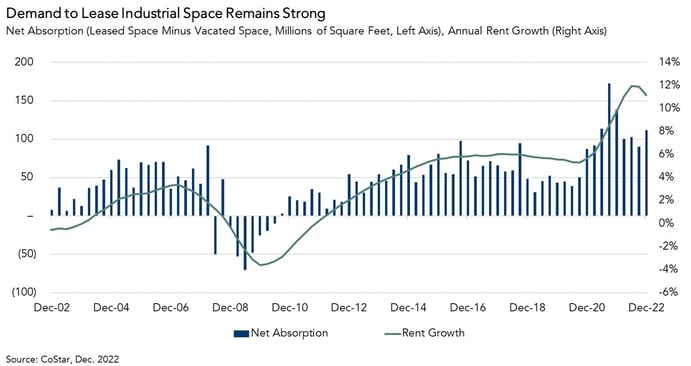

Demand to lease and own industrial space remains robust, despite a general cooling of commercial real estate (CRE) activity occurring across asset classes. Net absorption, a measure of leasing demand relative to available space, remained high in the fourth quarter of last year compared with historical levels, at 112 million square feet. Though down 35 percent from the all-time high reached in the third quarter of 2021, it was still more than double the average absorption rate for industrial space over the last 20 years.

"The rise of eCommerce and increasing demand for inventory storage space will prevent significant declines in industrial rent growth and industrial property prices."

Strong demand for industrial space drove double-digit annual rent growth of approximately 11 percent in the fourth quarter. While rents are expected to moderate as a near-record amount of under-construction industrial space comes to market throughout 2023 and early 2024, current levels of leasing demand are expected to prevent this new supply from becoming a glut.

The Rise of eCommerce is Not the Only Driver of Long-Term Industrial Demand

The shift towards eCommerce is the most discussed driver of industrial demand. But industrial leasing demand does not come solely from pure eCommerce companies. All retailers – online or brick and mortar – need modern logistics and distribution facilities to ensure they have the products that consumers want in stock, and that they can deliver quickly.

Over the last several years, retailers learned that the just-in-time supply chains they relied on pre-pandemic could be disrupted during an unforeseen event and result in a lack of inventory that disrupts sales. As a result, total business inventories have steadily risen throughout 2022, although they sit below the peaks reached in 2020. Given the ongoing geopolitical tension between the U.S. and China and its potential impact to supply chains, retailers will likely continue to store more inventory in warehouses than they did pre-pandemic, at least for the foreseeable future.

The rise of eCommerce and increasing demand for inventory storage space will prevent significant declines in industrial rent growth and industrial property prices.