Key Points: Prices have stabilized and sales activity is rising, signaling that buyers are returning and confidence is improving. Refinancing and lending activity have rebounded, with most lender groups re-engaging as liquidity continues to improve. Distress is nearing its peak, and as the market works through it, more capital should free up, ...

Read More ›2026 CRE Outlook: Five Forces Forge a Favorable Foundation for CRE

Commercial Real Estate Industrial Real Estate Retail Multifamily

Industrial CRE: From Pandemic Darling to the Goldilocks Era

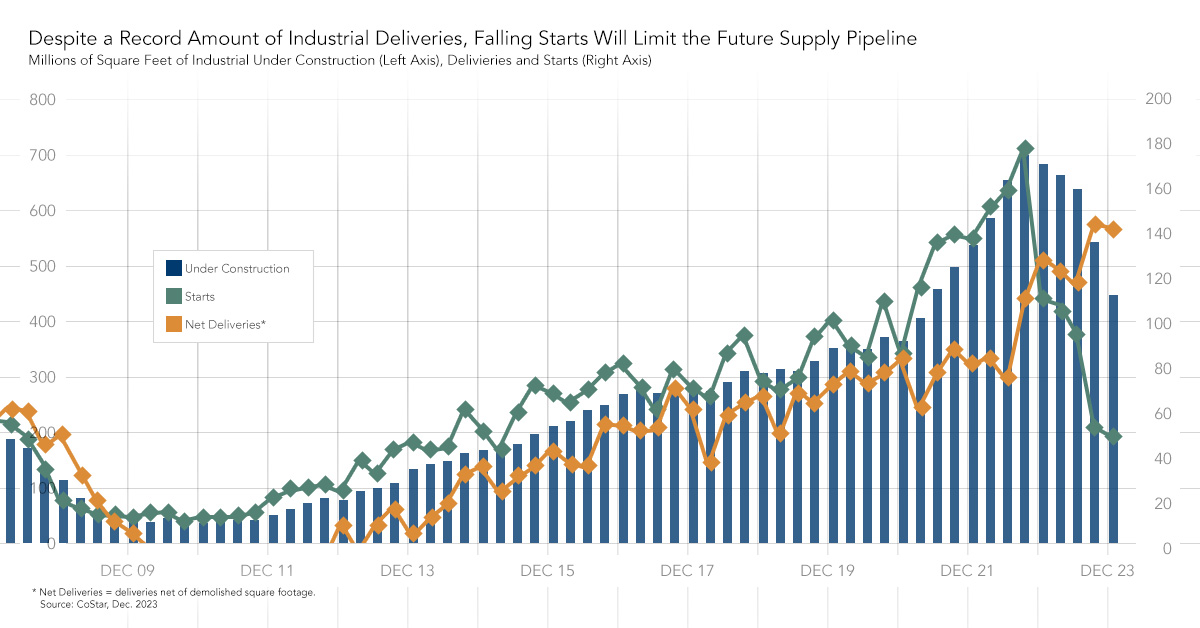

Key Points: The industrial real estate market is stabilizing after a period of rapid growth, with supply outpacing demand, leading to higher vacancy rates and more tenant-friendly conditions through 2025. Construction of new industrial space has slowed significantly, which will allow demand to gradually catch up and prevent prolonged oversupply. ...

Read More ›Commercial Real Estate Industrial Real Estate Potential Cap Rate Model

What’s Behind the Surge in Industrial Cap Rates?

Though the industrial market is softening compared to the pandemic days of double-digit rent growth and record-low vacancy, it is far from weak. Despite slowing rent growth and modestly rising vacancies, demand to lease industrial space remains strong, driven by long-term trends such as rising eCommerce sales, retailers’ need for modern logistics ...

Read More ›Commercial Real Estate Industrial Real Estate Potential Cap Rate Model

CRE X-Factor: Outlook for Industrial Real Estate Remains Positive, Despite Dip from Record-Setting 2021

Industrial space remains in high demand across the country, despite announcements of tabled expansion plans from eCommerce companies and retail store closures. That strong demand has fueled record levels of construction that will ease price and rent growth to more moderate, single-digit rates as the new industrial supply comes to market. The ...

Read More ›Supply Chain Lessons Shape Long-Term Industrial Real Estate Demand

Demand to lease and own industrial space remains robust, despite a general cooling of commercial real estate (CRE) activity occurring across asset classes. Net absorption, a measure of leasing demand relative to available space, remained high in the fourth quarter of last year compared with historical levels, at 112 million square feet. Though ...

Read More ›

.jpg)