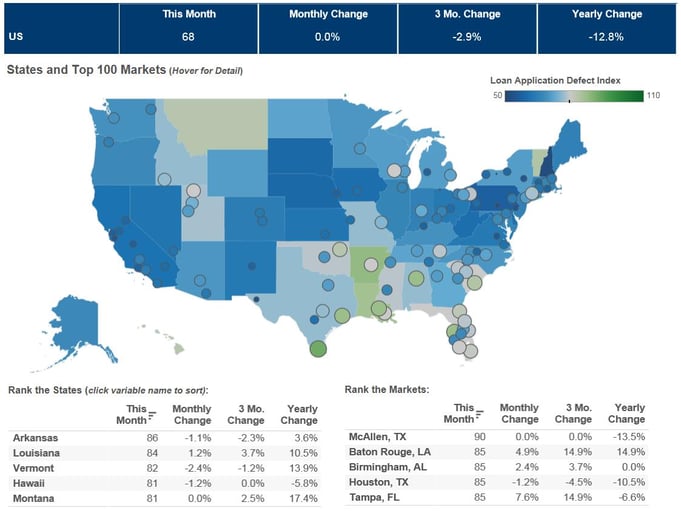

We’ve posted the November First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index remained unchanged in November as compared with October and decreased by 12.8 percent as compared to November 2015. The Defect Index is down 33.3 percent from the high point of risk in October 2013.

“The Day 1 Certainty initiative at Fannie Mae and incorporation of similar automated verification tools at Freddie Mac are likely to have a significant positive impact on mortgage loan application defect and misrepresentation risk in the next year.”

“The long and consistent downward trend in loan application defect and misrepresentation risk paused this month, after falling in seven of the last eight months. Yet, I expect the risk trend to continue its downward trajectory in 2017,” said Mark Fleming, chief economist at First American. “The Day 1 Certainty initiative at Fannie Mae and incorporation of similar automated verification tools at Freddie Mac are likely to have a significant positive impact on mortgage loan application defect and misrepresentation risk in the next year.”

In his analysis of the November Defect Index data, Fleming also points out the expected impact of rising rates on the demand for adjustable rate mortgages (ARMs).

For this information, the top five states and markets where defect risk is increasing or decreasing, and more, please visit the Loan Application Defect Index.