Industrial space remains in high demand across the country, despite announcements of tabled expansion plans from eCommerce companies and retail store closures. That strong demand has fueled record levels of construction that will ease price and rent growth to more moderate, single-digit rates as the new industrial supply comes to market. The growing need for industrial space also powered record levels of transaction volumes throughout 2021 and early 2022, but the industrial market is now moderating.

“Supply and demand dynamics in industrial real estate support a moderating, but still strong outlook for the sector. While supply and demand trends will vary meaningfully by market, industrial assets remain in-demand to both lease and own.”

Strong Demand to Lease Industrial Space Will Absorb Much of the Under-Construction Inventory

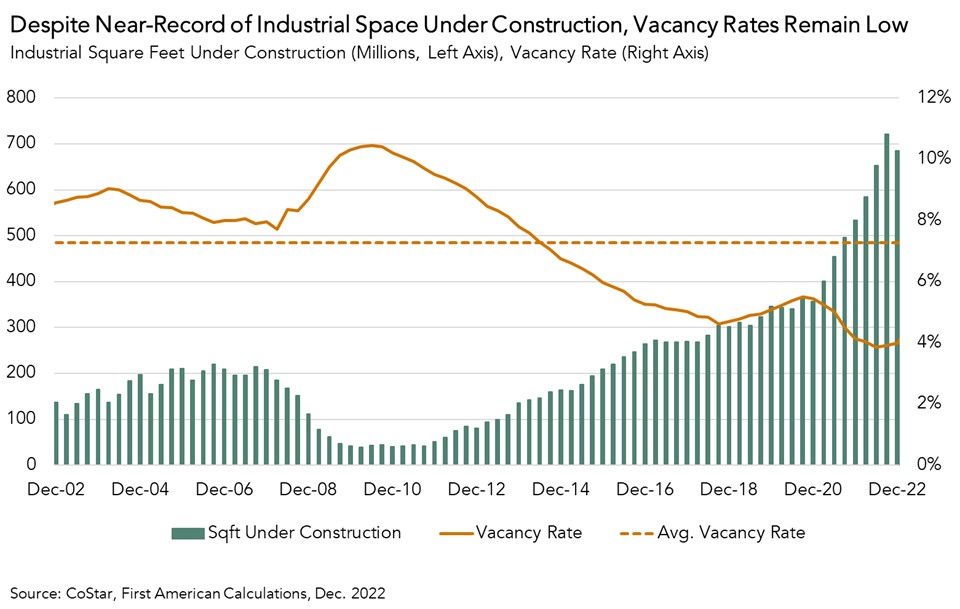

Industrial real estate is arguably the most in-favor commercial asset class among investors today, driven by strong leasing demand. In response to the leasing demand, construction has surged, with a near-record 650 million square feet of industrial space currently under construction nationally. However, industrial vacancy rates remain near all-time lows, and far below the 20-year average of 7.3 percent. Net absorption, a measure of leasing demand relative to available space, in the fourth quarter of 2022 was the fourth highest quarter on record. The still-strong net absorption rate indicates that there is sufficient leasing demand to absorb enough of the upcoming industrial space currently under construction without significant declines to rent or property prices.

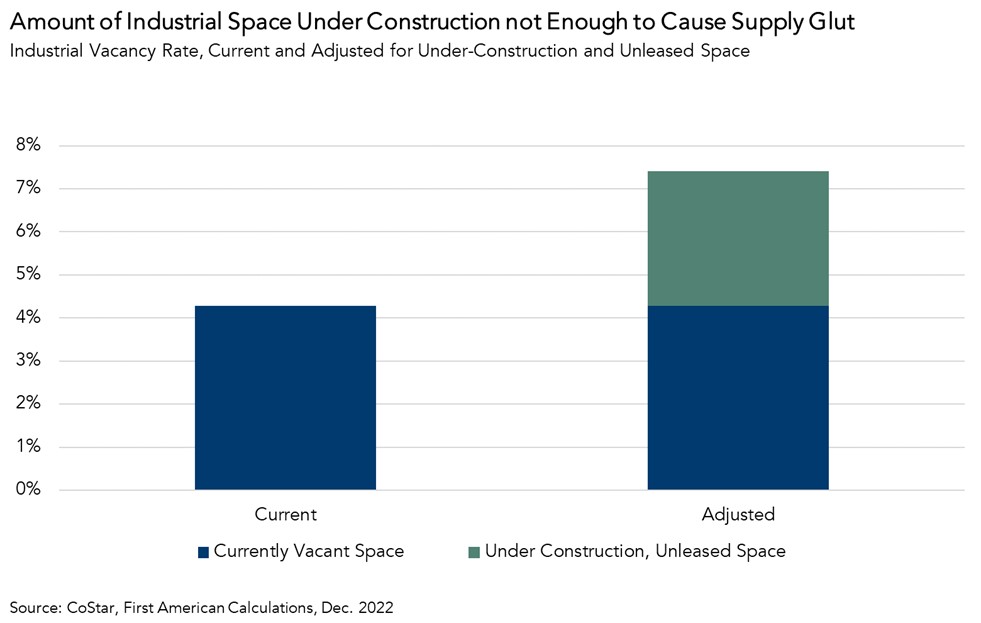

Industrial Supply Glut Unlikely Despite New Supply Under Construction

The supply of new industrial inventory coming to market is unlikely to cause a glut, despite the surge in industrial construction. Consider that if all of the under-construction, unleased industrial space (approximately 600 million square feet, according to data from CoStar) were delivered tomorrow, and all of that space remained vacant, then the national industrial vacancy rate would increase from its current rate of 4.3 percent to 7.4 percent, roughly equivalent to the 20-year average vacancy rate for industrial space of 7.3 percent. Of course, based on the prevailing strong leasing demand for the asset class, it’s exceedingly unlikely that all of this new, unleased space would remain vacant.

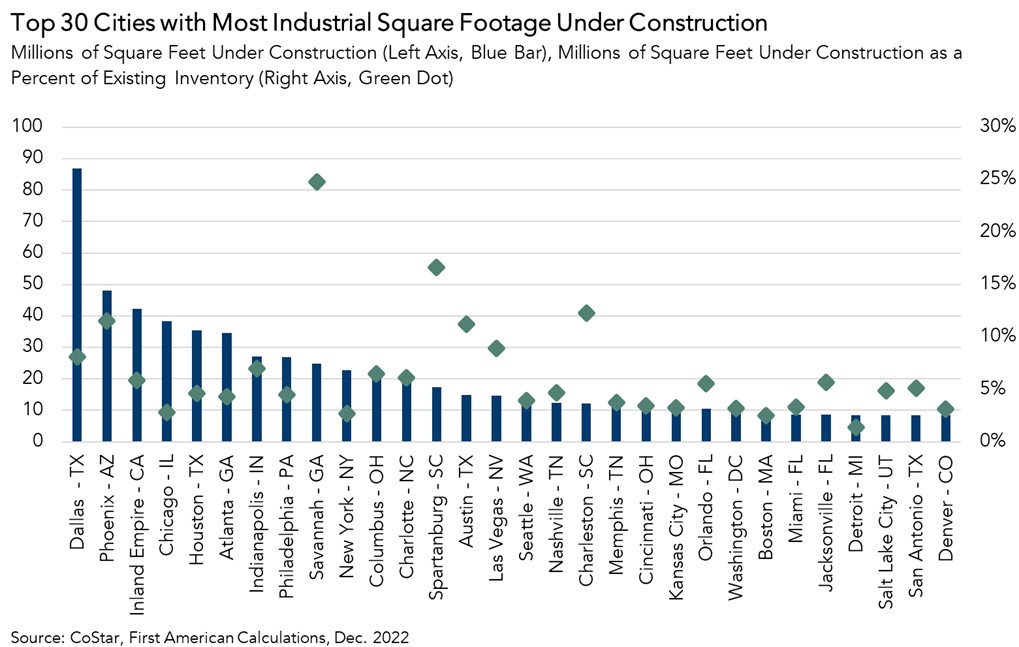

New Industrial Construction Concentrated in Texas, Southwest

New industrial construction is underway across the country. However, approximately 40 percent of that space is concentrated in Texas and the Southwest (Phoenix, Las Vegas, Salt Lake City, Denver, and California’s Inland Empire). Dallas alone accounts for 13 percent of total national construction underway.

In the chart below, the blue bars represent total square feet under construction (in millions), and the green dot compares that under-construction square footage to existing inventory in each city. The higher the green dot, the greater the new delivery of industrial space will be relative to existing supply. If new construction accounts for a greater proportion of existing inventory, there is a greater likelihood that the new industrial supply will increase local vacancy rates and slow rent growth as it comes to market.

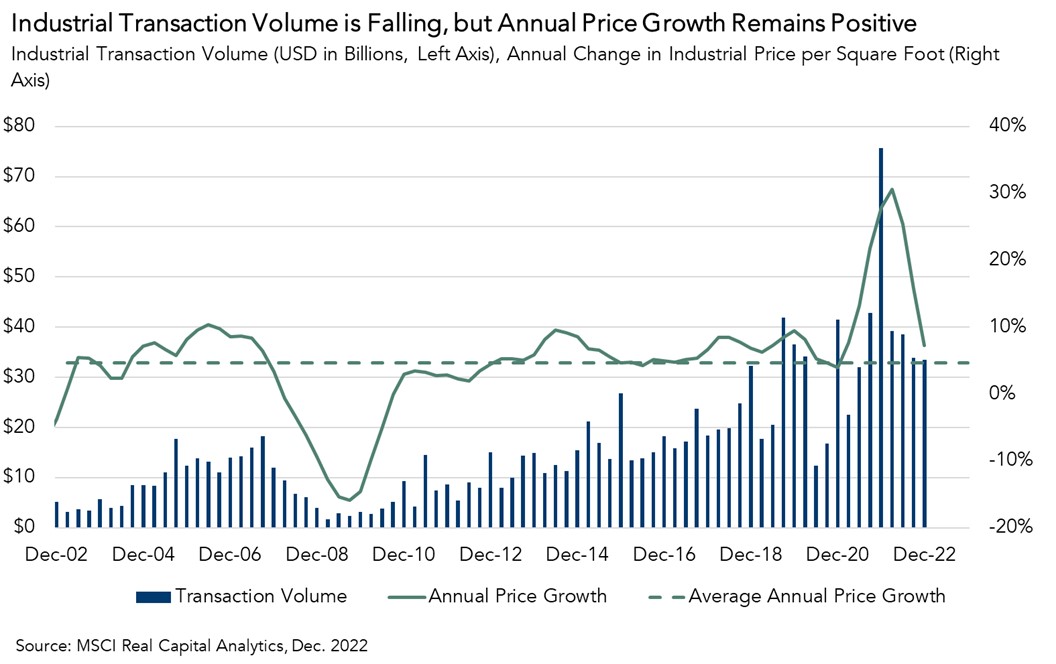

Leasing Demand Fuels Industrial Investor Demand and New Construction

Transaction volume for industrial properties remains high compared with historic levels, but has dipped from the all-time record set in the fourth quarter of 2021. Industrial transaction volume in the fourth quarter of 2022 totaled approximately $34 billion, making it the fourth most active fourth quarter in two decades, despite being a more than 50 percent decline from the record-setting pace of 2021. As transaction volumes fell from peak levels through 2022, price growth decelerated but remained positive and above historical norms.

So, What’s the X-Factor?

Supply and demand dynamics in industrial real estate support a moderating, but still strong outlook for the sector. While supply and demand trends will vary meaningfully by market, industrial assets remain in-demand to both lease and own.