In times of economic uncertainty, people tend to stay put. After all, why take on new financial obligations, like an apartment lease, when the future is less certain? Today, though unemployment remains low, inflation remains high, and the recent slew of layoffs at tech companies has many worried about their own financial position. The recent, highly publicized bank failures only further cloud the outlook for many who might otherwise explore moving into a new apartment. All of these factors lead to slower household formation, which has real implications for multifamily commercial real estate, including multifamily capitalization (cap) [1] rates.

“In the short run, slow renter household formation is putting upward pressure on cap rates, but in the long run this dynamic is likely to reverse.”

Should I Stay or Should I Go?

Over the last year, growing macroeconomic uncertainty has contributed to a slowdown in renter household formation, which is a primary driver of apartment leasing demand. For this reason, renter household formation is also a key component of First American’s Multifamily Potential Cap Rate (PCR) Model, which estimates a national multifamily cap rate based on market fundamentals. Generally speaking, as the number of renter households grows, the demand to lease apartments increases. Higher rates of renter household formation can reduce the risk associated with a multifamily property investment, since greater apartment demand usually translates into lower vacancy rates and improved cash flow. With reduced leasing risk, multifamily buyers are generally willing to pay a higher price for an asset.

Conversely, lower rates of renter household formation tend to put upward pressure on multifamily cap rates. Fewer renter households means decreased demand to rent apartments, which increases the risk of higher vacancy rates and, therefore, impaired cash flows for owners.

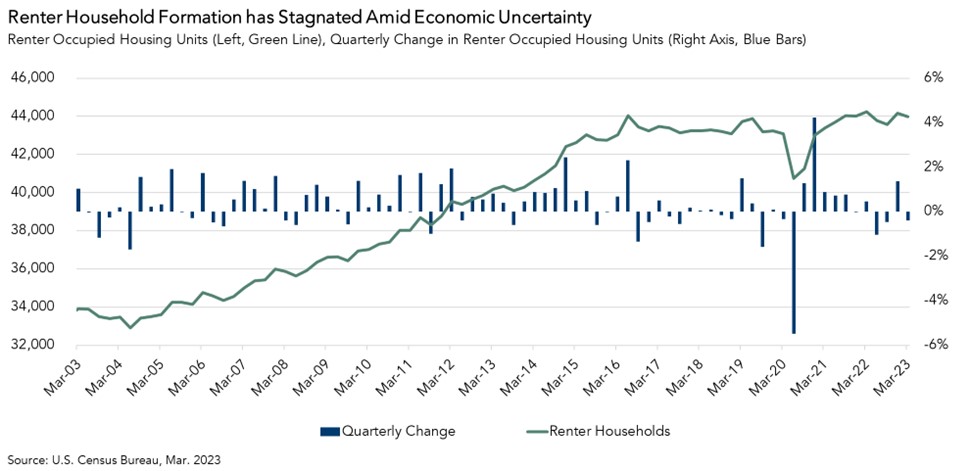

Renter household formation cratered in the early stages of the pandemic. Unsure of how long new quarantine measures would last and with unemployment soaring, many potential renters moved in with family members. Later in 2020, as it became clear that the pandemic and, therefore, remote work would persist, people began moving back out and setting up their own households. This resurgence in renter household formation lasted for a little over a year, bringing the total number of renter-occupied households to an all-time high of 44.2 million in the first quarter of 2022, the same quarter that the multifamily PCR troughed.

Over the past year, renter household formation has stagnated amid heightened economic uncertainty, declining by 0.4 percent in the first quarter of 2023 compared with the first quarter of 2022. This decline contributed to a 0.3 percentage point annual increase in the multifamily PCR to 4.6 percent in the first quarter of 2023.

Short Run Versus Long Run

Though less certain economic conditions have dampened renter household growth following the mid-pandemic surge, high mortgage rates are keeping homeownership out of reach for many. Additionally, long-term demographic trends are expected to add to the number of renter households in the coming years.

In the short run, slow renter household formation is putting upward pressure on cap rates, but in the long run this dynamic is likely to reverse. When economic uncertainty clears, fewer people will remain risk-averse with respect to their living situation. When this happens, renter household formation will likely accelerate.

First Quarter 2023 Multifamily Potential Cap Rate (PCR) Model

- The multifamily PCR was 4.6 percent, an increase of 0.1 percentage points as compared with the fourth quarter of 2022.

- The multifamily PCR increased by 3 percentage points as compared with one year ago. The first quarter of 2022 represented the multifamily PCR’s 20-year low.

Multifamily Cap Rate Outlook Gap

- The gap between the actual multifamily cap rate and the multifamily PCR provides insight into the likelihood of shifts in the actual cap rate. If the multifamily PCR is below the actual multifamily cap rate, it indicates that fundamentals supported lower cap rates than were observed. If the multifamily PCR is above the actual multifamily cap rate, it indicates that fundamentals supported higher cap rates than were observed.

- In the first quarter of 2023, the actual national multifamily cap rate was4 percentage points higher than the potential cap rate, indicating that market fundamentals supported a lower cap rate than was observed in the first quarter. Both the actual and potential multifamily cap rate, however, are increasing.

First Quarter 2023 All-Asset PCR Model

First American’s All-Asset PCR Model estimates a potential national cap rate for all asset classes based on several CRE market fundamentals, including rental income, prevailing occupancy rates, interest rates, the amount of commercial mortgage debt in the economy, and recent property price trends.

- The all-asset PCR was 5.5 percent in the first quarter of 2023, an increase of 0.5 percentage points as compared with the fourth quarter of 2022.

- The all-asset PCR increased by 1.3 percentage points as compared with the first quarter of 2022.

- In the first quarter of 2023, the all-asset PCR was 1.3 percentage points above its 20-year low of 4.2 percent, which occurred in the in the first quarter of 2022, and 3.4 percentage points below its third quarter 2001 peak of 8.9 percent.

All-Asset PCR Model Outlook Gap

- The all-asset actual cap rate was 0.2 percentage points higher than the potential cap rate, which suggests that market fundamentals in the fourth quarter supported lower actual cap rates than were observed.

- The gap between the actual all-asset cap rate and the potential all-asset cap rate contracted in the fourth quarter to 2 percent from 0.5 percent in the third quarter of 2022. Though the PCR remains below the actual all-asset cap rate, this gap has been shrinking since the first quarter of 2022, signaling that market fundamentals are increasingly supporting higher cap rates.

About the Multifamily Potential Cap Rate Model

The multifamily Potential Cap Rate (PCR) Model estimates cap rates based on the historical relationship between multifamily transaction volume, annual changes in renter household formation, and multifamily mortgage flows. The multifamily PCR Model uses these metrics to establish a potential cap rate level that is supported by these market fundamentals. When actual multifamily cap rates are significantly above the multifamily PCR, it indicates that market fundamentals supported lower cap rates than were observed. Conversely, when actual cap rates are significantly below the potential cap rate level, market fundamentals supported higher cap rates than were observed. Multifamily cap rates are aggregated nationally, and the PCR Model is updated quarterly.

A cap rate is a measure of estimated yield, or the return, on an investment property assuming no debt is used to purchase it. Cap rates are calculated by dividing an asset’s net operating income (NOI) by its value. NOI is an asset owner’s remaining income after covering operating expenses, but before servicing debt. Since cap rates do not take debt service into consideration, cap rates are a measure of what is called unlevered yield.

[1] A cap rate is one measure of return on investment provided by a building and is equal to the net operating income (“NOI”) generated by the building divided by the price of the building. For example, a multifamily property purchase for $100,000 that generates income of $10,000 a year has a cap rate of 10 percent. Higher cap rates represent higher rates of return, and vice versa.