We’ve posted the September First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index decreased 1.2 percent as compared with the previous month, and increased 20.3 percent as compared to September 2016. The Defect Index is down 18.6 percent from the high point of risk in October 2013.

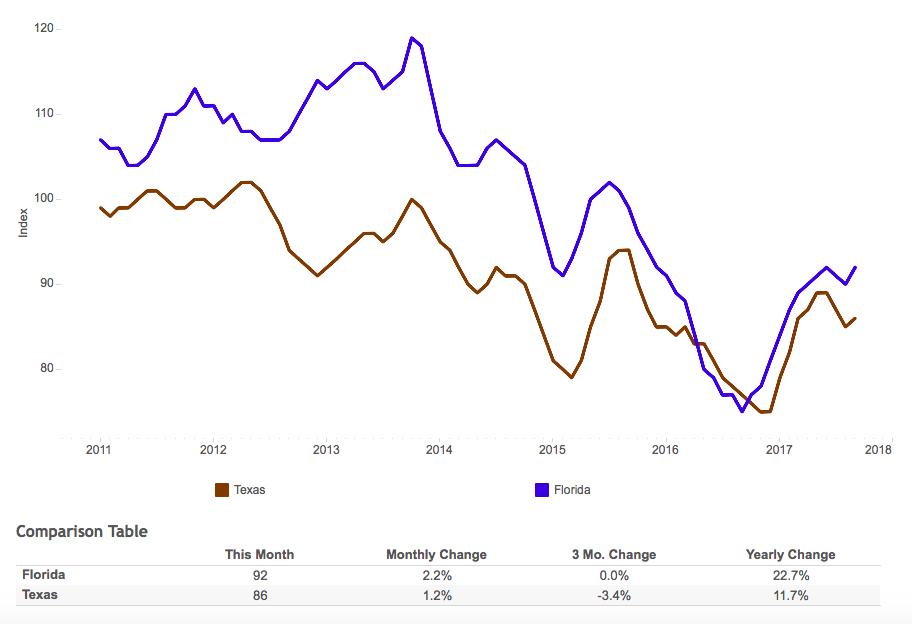

“In September, the overall risk of defects, fraud and misrepresentation declined for the first time this year, although there are regions with higher defect risk due to recent natural disasters. Unfortunately, historical data indicates that natural disasters and loan application defect risk go hand-in-hand,” said Mark Fleming, chief economist at First American. “The defect index identified signs of this risk trend in Texas and Florida this month and particularly in Houston, where risk increased the most among all the major markets we track.”

For the list of high risk markets with the fastest growing defect risk, the top five states and markets where defect risk is increasing or decreasing, and more, please visit the Loan Application Defect Index.