While the housing market continues to underperform its potential by 7.2 percent, the gap between actual existing home sales and the market potential for home sales narrowed by 1 percent in September compared with August, according to our Potential Homes Sales model. However, even though the performance gap narrowed a bit, the housing market still has the potential to support more than 440,000 additional home sales at a seasonally adjusted annualized rate (SAAR).

“The recent dramatic spike in tenure length is reflected in the growing performance gap between market potential and actual existing-home sales, which is up 48 percent since the end of 2017. Homeowners are staying in their homes longer than ever, limiting supply and slowing home sales.”

The primary culprit for the housing market’s performance gap remains severe supply shortages – home buyers can’t buy what’s not for sale. Rising interest rates create a financial disincentive that prevents existing homeowners with low mortgage rates from selling their homes, further limiting supply and restricting existing-home sales from reaching their potential.

Rates Up, Sales Down

Mortgage rates have been steadily increasing for the past year and the consensus among economists is mortgage rates will continue to rise, increasing from the current rate of 4.9 percent for a 30-year, fixed-rate mortgage to an average of 5 percent in 2019. The 30-year, fixed rate mortgage hasn’t hit five percent since 2009.

Homeowners with mortgage rates below the current rate may be reluctant to give them up for a higher rate, a phenomenon known as the “rate lock-in effect.” There is less incentive to sell your home if borrowing the same amount from the bank at today’s rates will be more expensive than your existing monthly mortgage payment. As rates rise, many existing homeowners are increasingly financially imprisoned in their own home by their historically low mortgage rate.

The Proof is in the Tenure

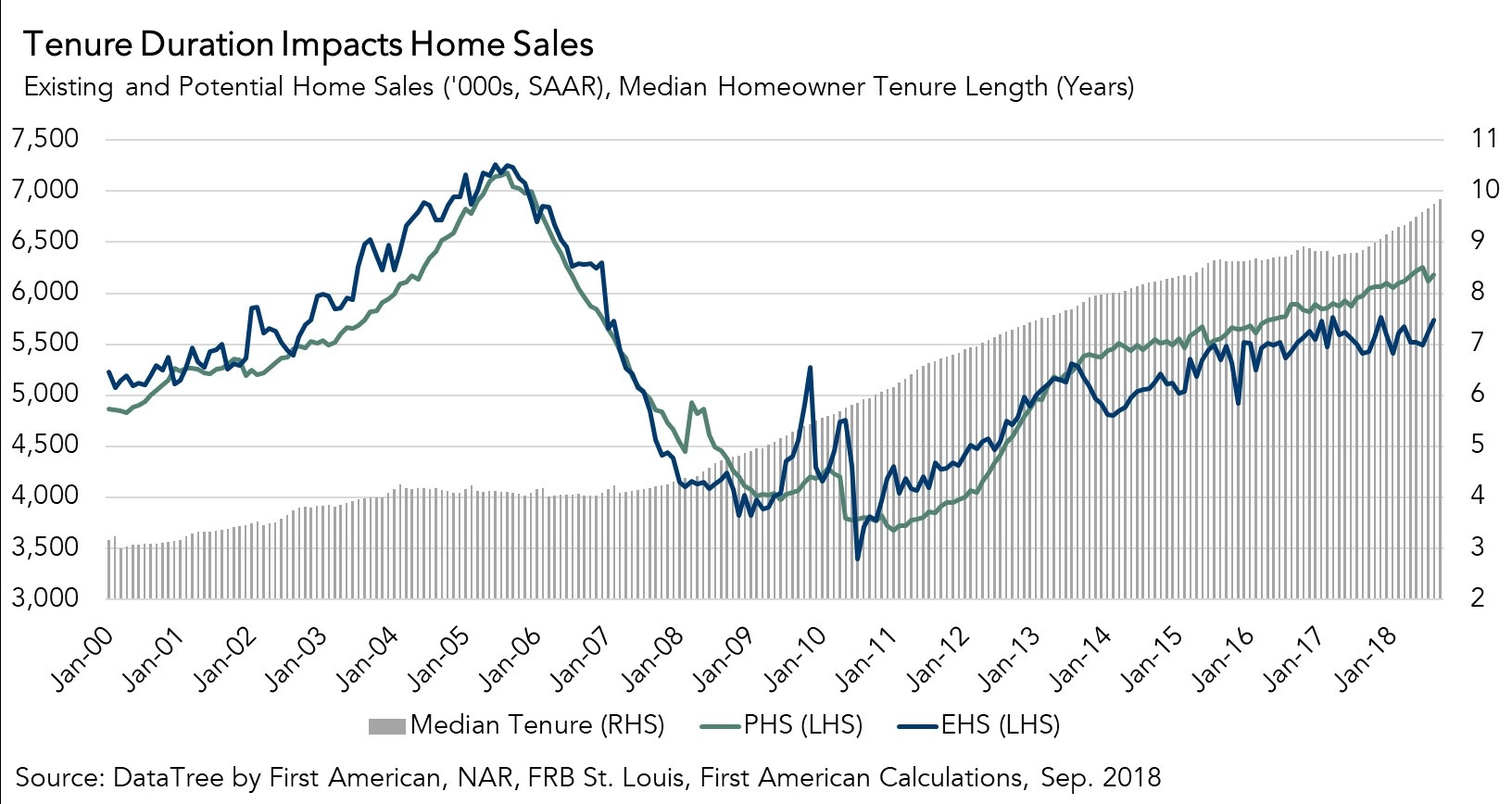

Examining median tenure length, how long homeowners typically own their homes, demonstrates the impact of rising rates on homeowners’ decision to sell. For example, just prior to the housing downturn in 2007, homeowners typically stayed in their homes for four years, according to median homeowner tenure data from DataTree by First American. In the aftermath of the housing market crash (2008-2016), median homeowner tenure increased to approximately seven years. Many people remained in their homes because their mortgage balances exceeded their property values during this time, so they would have lost money by selling their homes.

However, as home prices have recovered over the last 10 years, many homeowners have accumulated enough equity to sell their homes at a profit. Despite the increase in equity, median tenure length jumped to 10 years in September 2018, a 10 percent year-over-year increase. Since the crisis, we had a brief period of rising rates between April 2013 and April 2014, and tenure lengths increased 6 percent during that 12-month window. The recent dramatic spike in tenure length is reflected in the growing performance gap between market potential and actual existing-home sales, which is up 48 percent since the end of 2017. Homeowners are staying in their homes longer than ever, limiting supply and slowing home sales.

September 2018 Potential Home Sales

For the month of August, First American updated its proprietary Potential Home Sales model to show that:

- Potential existing-home sales increased to a 6.18 million seasonally adjusted annualized rate (SAAR), a 0.9 percent month-over-month increase.

- This represents a 65.4 percent increase from the market potential low point reached in February 2011.

- The market potential for existing-home sales increased by 3.5 percent compared with a year ago, a gain of 209,600 (SAAR) sales.

- Currently, potential existing-home sales is 1.11 million (SAAR), or 15.2 percent below the pre-recession peak of market potential, which occurred in July 2005.

Market Performance Gap

- The market for existing-home sales is underperforming its potential by 7.2 percent or an estimated 445,200 (SAAR) sales.

- The market performance gap decreased by an estimated 55,900 (SAAR) sales between August 2018 and September 2018.

What Insight Does the Potential Home Sales Model Reveal?

When considering the right time to buy or sell a home, an important factor in the decision should be the market’s overall health, which is largely a function of supply and demand. Knowing how close the market is to a healthy level of activity can help consumers determine if it is a good time to buy or sell, and what might happen to the market in the future. That is difficult to assess when looking at the number of homes sold at a particular point in time without understanding the health of the market at that time. Historical context is critically important. Our potential home sales model measures what we believe a healthy market level of home sales should be based on the economic, demographic and housing market environments.

About the Potential Home Sales Model

Potential home sales measures existing-homes sales, which include single-family homes, townhomes, condominiums and co-ops on a seasonally adjusted annualized rate based on the historical relationship between existing-home sales and U.S. population demographic data, income and labor market conditions in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. When the actual level of existing-home sales are significantly above potential home sales, the pace of turnover is not supported by market fundamentals and there is an increased likelihood of a market correction. Conversely, seasonally adjusted, annualized rates of actual existing-home sales below the level of potential existing-home sales indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted annualized existing-home sales may exceed or fall short of the potential rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent potential home sale estimates are subject to revision in order to reflect the most up-to-date information available on the economy, housing market and financial conditions. The Potential Home Sales model is published prior to the National Association of Realtors’ Existing-Home Sales report each month.