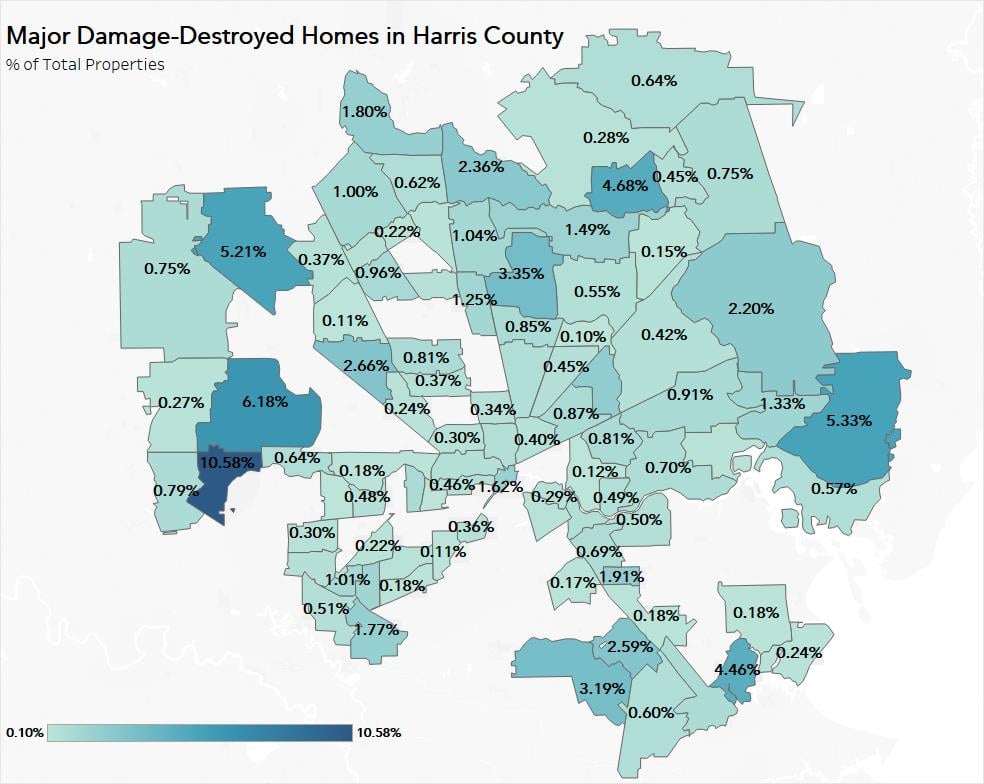

As Hurricane Harvey’s flood waters finally recede, the degree of damage is becoming more apparent. The most recent estimates indicate that flood damage could be assessed as high as $37 billion and that 70 percent of that damage is to property that is uninsured. According to the Federal Emergency Management Agency (FEMA), more than 30 counties and more than 100,000 properties have been impacted in some way. Harris County alone accounts for 68 percent of the affected or damaged properties. FEMA estimates that more than 12,000 properties in Harris County have major damage or are destroyed. When the flood waters are finally gone and all the costs are accounted for, Harvey is likely to be the costliest hurricane in U.S. history.

“We know, from experience with Katrina, that housing markets respond to supply shocks with fast-rising prices that can be followed by swift corrections.”

While it’s very hard to know exactly how the damage from Harvey will impact the housing and mortgage markets in Southeast Texas and the Gulf Coast, the parallels to Hurricane Katrina are striking. Although years apart, the hurricanes took place within a few days of each other on the calendar and both made landfall with similarly powerful windspeeds, Katrina at 125 mph and Harvey at 130 mph. But, the extensive flooding caused by the hurricanes and subsequent damage to the local housing stock had the most impact on the housing and mortgage markets in New Orleans and now presumably will in Houston. Because of these similarities, reviewing the housing market response to Katrina may offer clues to what we might expect as a result of Harvey. In particular, it’s interesting to examine the market’s response to an immediate housing supply shortage.

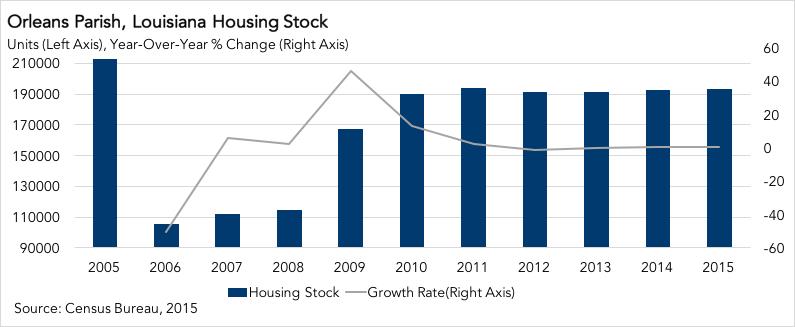

Based on Census Bureau data, Katrina reduced the housing stock in the Orleans Parish by a shocking 50 percent. It wasn’t until 2009 that the housing stock materially rebounded and, as a result of migration away, New Orleans is a smaller city today than it was prior to Katrina.

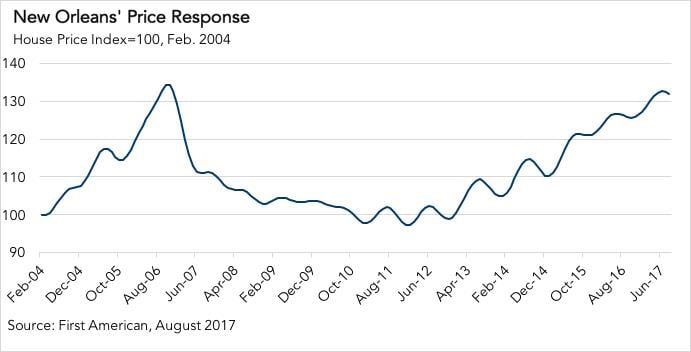

The reduction in housing stock due to Katrina caused a significant increase in house price appreciation for a full year after the hurricane, according to DataTree by First American. Between November 2005, after the initial pause in the housing market for immediate recovery efforts, and November 2006, house prices increased by 17 precent. The gain made in 2006 was then quickly lost in 2007.

The assessment of the damage to the housing stock along the Gulf Coast is already becoming apparent. Thankfully, it is unlikely the damage to the housing stock will be as bad as in New Orleans after Katrina because Houston has a much greater supply of homes. While more than 100,000 properties have been adversely impacted by Harvey across the entire region (74,000 in Harris County), there are more than 3 million properties in the entire region. Yet, the burden is not shared equally geographically. Harris County accounts for almost half of the affected region’s housing stock with 1.4 million properties. While 74,000 properties have been adversely impacted in Harris County, they represent only 5 percent of the entire stock of homes that have been affected or damaged to some extent. Only 1 percent of the housing stock in the county is estimated to have major damage or have been destroyed. Delving deeper into Harris County, a sizeable share of the homes that were destroyed or incurred major damage is largely concentrated in just a handful of zip codes.

We know, from experience with Katrina, that housing markets respond to supply shocks with fast-rising prices that can be followed by swift corrections. The expected magnitude of property loss due to Harvey will be proportionally less than what New Orleans experienced with Katrina. The strength of the overall Houston economy and the fact that before the storm it was one of the strongest homebuilding markets in the country bode well for the housing stock recovery. Nonetheless, the Houston real estate market should expect increased price volatility in the coming weeks and months. And, it’s likely the price volatility may be more dramatic in the neighborhoods that have been the most devastated.