The housing market is struggling to gain momentum with mortgage rates above their levels from a year ago. Higher rates have a dual impact on sales – pricing out buyers who lose purchasing power and keeping some potential sellers rate-locked in.

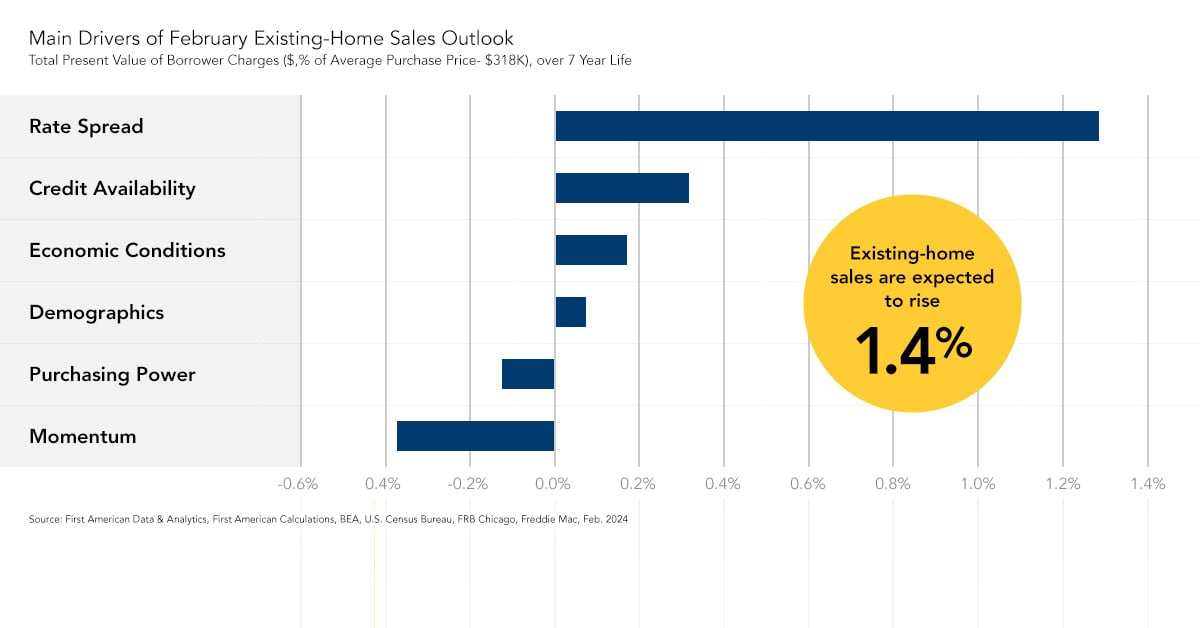

Our Existing-Home Sales Outlook Report ‘nowcasts’ existing-home sales based on the historical relationship between sales, demographic trends, house-buying power, and the prevailing financial and economic conditions. Based on our nowcast, we expect May existing-home sales will fall year over year, and remain flat compared with April.

There are plenty of potential buyers sitting on the sidelines, but more inventory and improved affordability are necessary to coax them into the market.

“For the remainder of 2024, existing-home sales may increase slightly over last year, especially if mortgage rates fall and inventory continues to rise. However, without a boost in affordability and more existing-home inventory any sales momentum is likely to stall.”

Double-Edged Rates

Mortgage rates reached a recent peak of 7.6 percent in October of last year, dipped earlier this year, and then climbed above 7 percent again in May. As a result, excluding the fall of 2023, affordability in May was the lowest in over three decades. Additionally, according to a recent survey, 77 percent of survey participants reported a housing affordability crisis in the communities where they lived. While mortgage rates are not the only variable in the affordability equation, they are one of the primary forces dragging overall affordability lower, along with higher house prices.

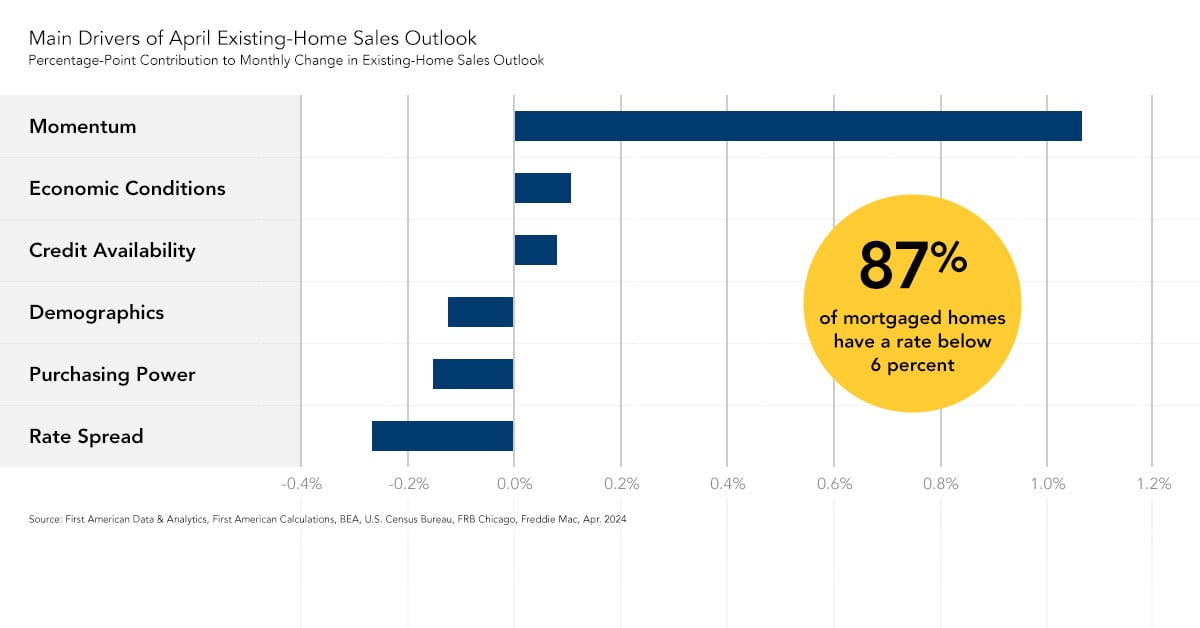

Higher rates are also keeping house prices elevated by preventing more supply from hitting the market. According to fourth quarter 2023 data from the Federal Housing Finance Agency’s National Mortgage Database (NMDB), 87 percent of mortgaged homes have a rate below 6 percent. With mortgage rates surpassing 7 percent, the bulk of existing homeowners face a financial disincentive to sell their home – what’s known as the rate lock-in effect.

We can estimate the strength of this rate lock-in effect using the difference between the prevailing market mortgage rate and the average rate for all outstanding mortgages. As the prevailing market mortgage rate rises further above the average rate for all outstanding mortgages, the greater the number of existing homeowners that are rate-locked in. The lock-in effect has weakened modestly since mortgage rates peaked in October 2023, but will continue to limit market potential until rates either decline sufficiently to unlock a substantial number of homeowners, or remain elevated long enough that a significant portion of borrowers lock into these higher rates.

Double Whammy

While new listings have increased compared to one year ago, supply remains restricted relative to historical norms. Potential buyers are feeling the double whammy of near record-low affordability and still-limited supply, which is smothering sales activity. For the remainder of 2024, existing-home sales may increase slightly over last year, especially if mortgage rates fall and inventory continues to rise. However, without a boost in affordability and more existing-home inventory any sales momentum is likely to stall.

May 2024 Existing-Home Sales Outlook

For the month of May, First American updated its Existing-Home Sales Outlook to show that:

- Existing-home sales for May are expected to increase 0.09 percent from April’s pace of sales, but will be down 10 percent compared with the predicted pace of sales a year ago.

- The largest contributors to the projected monthly change are a boost in economic conditions (+0.13 percentage points), sales momentum (+0.1 percentage points), and greater credit availability (+0.1 percentage points).

Methodology

Our Existing-Home Sales Outlook Report ‘nowcasts’ existing-home sales, which include single-family homes, townhomes, condominiums, and co-ops on a seasonally adjusted annualized rate based on the historical relationship between existing-home sales, U.S. demographic trends, house-buying power, and the prevailing financial and economic conditions, as well as momentum, a weight assigned to past values. Please note that the Existing-Home Sales Outlook Report is based on assumptions about demographic, economic and financial conditions. Actual values may differ from those projected. Recent existing-home sales estimates are subject to revision to reflect the most up-to-date information available on the economy, housing market and financial conditions.