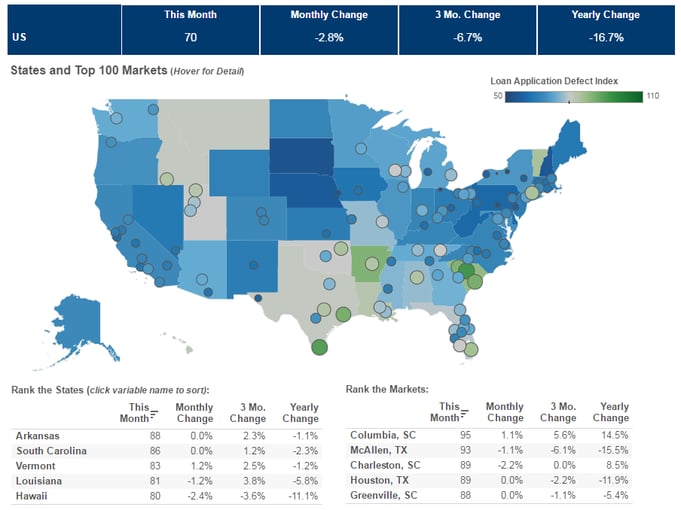

We’ve posted the July First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index decreased 2.8 percent in July as compared with June and decreased 16.7 percent as compared with July 2015. The Defect Index is down 31.4 percent from the high point of risk in October 2013.

“Refinance activity, fueled by historically low mortgage rates, combined with improved loan manufacturing processes are producing the lowest level of loan defects and misrepresentation that we have seen in recent history.”

“The Defect Index continues to improve as the share of refinance activity in the market remains strong. According to the latest MBA mortgage applications survey, the refinance share of mortgage applications remains above 60 percent. The housing market continues to benefit from historically low mortgage rates, which are driving lower defect-risk refinance activity,” said Mark Fleming, chief economist at First American.

“The benefits in compliant loan production processes are becoming more clearly evident, particularly for refinance transactions, in the big declines we are observing in loan application and mortgage defect risk,” said Fleming. “Refinance activity, fueled by historically low mortgage rates, combined with improved loan manufacturing processes are resulting in higher quality loan applications with the lowest level of defects and misrepresentation that we have seen in recent history.”

For this information, the top five states and markets where defect risk is increasing or decreasing, and more, please visit the Loan Application Defect Index.