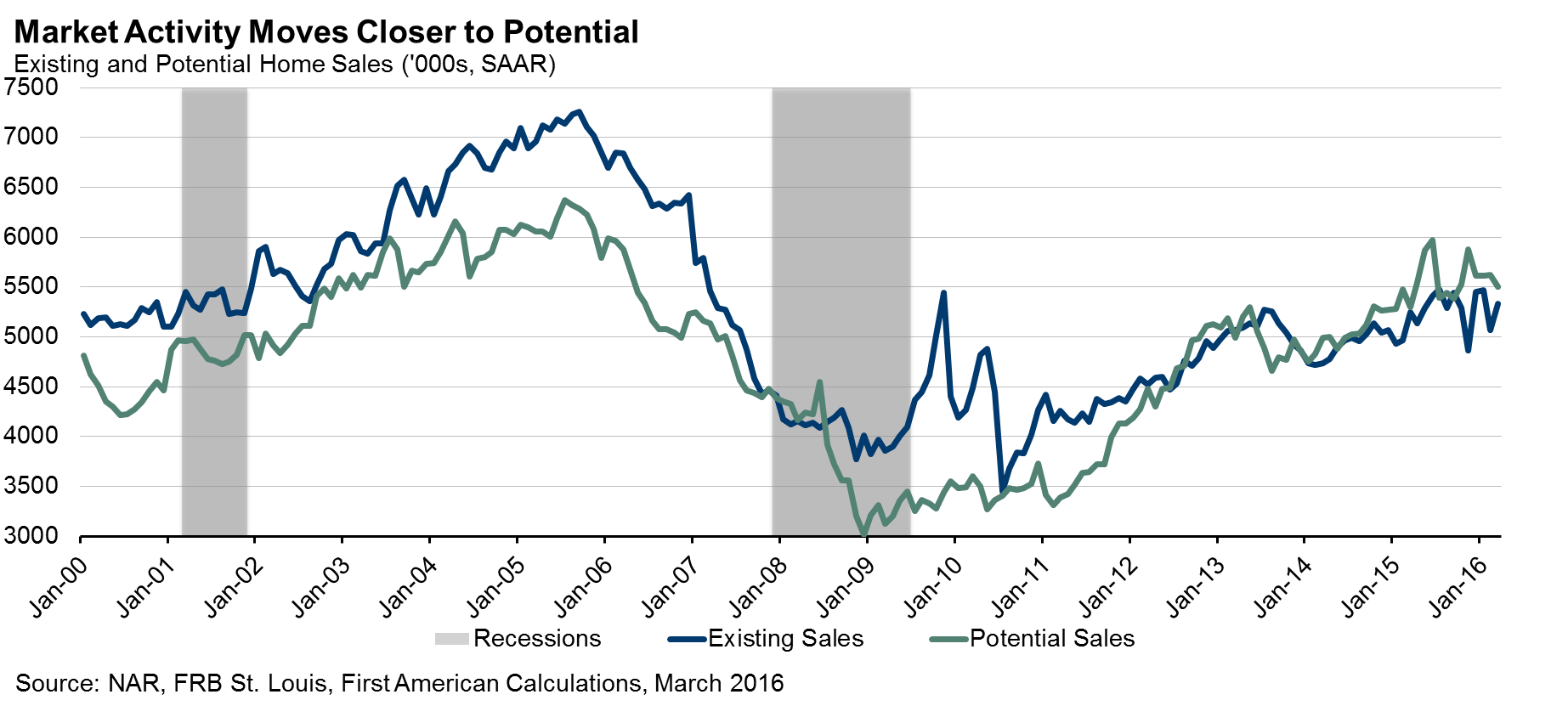

For the month of April, First American’s proprietary Potential Home Sales model showed that the market for existing-home sales is underperforming its potential by 4.1 percent or an estimated 232,000 seasonally adjusted, annualized rate (SAAR) of sales, an improvement over the last month’s revised performance gap of -7.6 percent or 418,000 (SAAR) sales. The Potential Home Sales model provides a gauge on whether existing-home sales are under or over their long-run potential level based on current market fundamentals. In April, the market potential for existing-home sales grew by 2.2 percent compared to March, an increase of 122,000 (SAAR) sales, and grew by 1.5 percent compared to a year ago.

This month, the seasonally adjusted, annualized rate of potential existing-home sales is 5.63 million. This represents an 86.5 percent increase from the market potential low point reached in December 2008*, but is down 751,000 (SAAR), or 11.8 percent, from the pre-recession peak of market potential, which occurred in July 2005.

"Although the market has moved closer to its potential, low inventories of homes for sale and tighter credit availability continue to constrain market activity, even with improving labor, wage and mortgage rate conditions."

Analysis: Sellers are Increasingly Bullish on the Housing Market, But Buyers are More Bearish

Existing-home sales rebounded in March, with a reported level of 5.33 million (SAAR), after dropping sharply in February to 5.07 million (SAAR), according to the National Association of Realtors (NAR). The 5.1 percent month-over-month increase and 1.5 percent annual increase were driven mainly by gains in the Northeast and Midwest. The increases further illustrate how volatile the housing market has been over the past few quarters, as a variety of competing economic forces has pulled the market in different directions. Although the market has moved closer to its potential, low inventories of homes for sale and tighter credit availability continue to constrain market activity, even with improving labor, wage and mortgage rate conditions.

The number of available homes for sale remains at depressed levels, although there was some slight relief in March as the housing inventory increased to a 4.5 month supply of homes for sale, up from a 4.4 month supply in February. Fannie Mae’s April Home Purchase Sentiment Index suggests that increasing inventories will continue into the heart of the spring buying season with an encouraging 3.5 point increase between March and April driven solely by a large increase in seller sentiment. The net percentage of those who said now was a good time to sell jumped from -1 percent to an all-time survey high of 15 percent. This is in contrast to the net percentage of those who believe that now is a good time to buy, which fell to an all-time survey low of 30 percent, dropping 3 percentage points from March to April and 5 percentage points from April 2015.

Tightening credit availability is potentially contributing to the decrease in homebuyer sentiment. The Mortgage Bankers Association (MBA) reported a monthly drop in its Mortgage Credit Availability Index (MCAI) in April of 0.9 percent, indicating tightening lending standards among mortgage originators. The index has decreased 4.7 percent since October 2015, with the greatest concentration of reduced credit availability seen in the Jumbo and Conventional mortgage markets. The timing of the decrease suggests that lenders began implementing tighter lending standards in response to the implementation of the Know-Before-You-Owe rule, particularly for loan products that the private secondary market is rejecting more frequently for Know-Before-You-Owe compliance issues. Counteracting this trend is a loosening of lending standards targeted at first-time homebuyers, such as the increasingly popular GSE low-down-payment program.

While low inventories, tight credit conditions and rising prices are keeping the market from achieving its potential, the market is benefiting from positive job growth, increasing wages and persistently low mortgage rates. The unemployment rate has been holding steady at 5.0 percent and inflation-adjusted average hourly wages have seen positive month-over-month growth for the past four consecutive months, growing 0.8 percent between December 2015 and March 2016, and 1.5 percent between March 2015 and March 2016. Mortgage rates continue to trend lower, with the average rate on a conventional 30-year, fixed mortgage hitting 3.61 percent in April, a spring housewarming present for homebuyers with the ability to further leverage their income into continued strong and even increasing home-buying power. Given that it is looking less and less likely that a Fed Rate hike will come in June, homebuyers should benefit from low rates and increased home-buying power throughout the spring home-buying season.

Next Potential Home Sales release: June 16, 2016 for May data

About the Potential Home Sales Model

First American’s proprietary Potential Home Sales model provides a gauge on whether existing-homes sales are under or over long-run potential based on current market circumstances. The model’s potential home sales seasonally adjusted annualized rate provides a measure on whether existing-homes sales, which include single-family homes, townhomes, condominiums and co-ops, are outperforming or underperforming based on current market fundamentals. The Potential Home Sales model estimates the historical relationship between existing-home sales and U.S. population demographic data, income and labor market conditions in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. For example, seasonally adjusted, annualized rates of actual existing-home sales above the level of potential home sales indicate market turnover is outperforming the rate fundamentally supported by the current conditions. Conversely, seasonally adjusted, annualized rates of actual existing-home sales below the level of potential existing-home sales indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted, annualized existing-home sales may exceed or fall short of the potential rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent potential home sale estimates are subject to revision in order to reflect the most up-to-date information available on the economy, housing market and financial conditions. The Potential Home Sales model will be published prior to the National Association of Realtors’ Existing-Home Sales report each month.