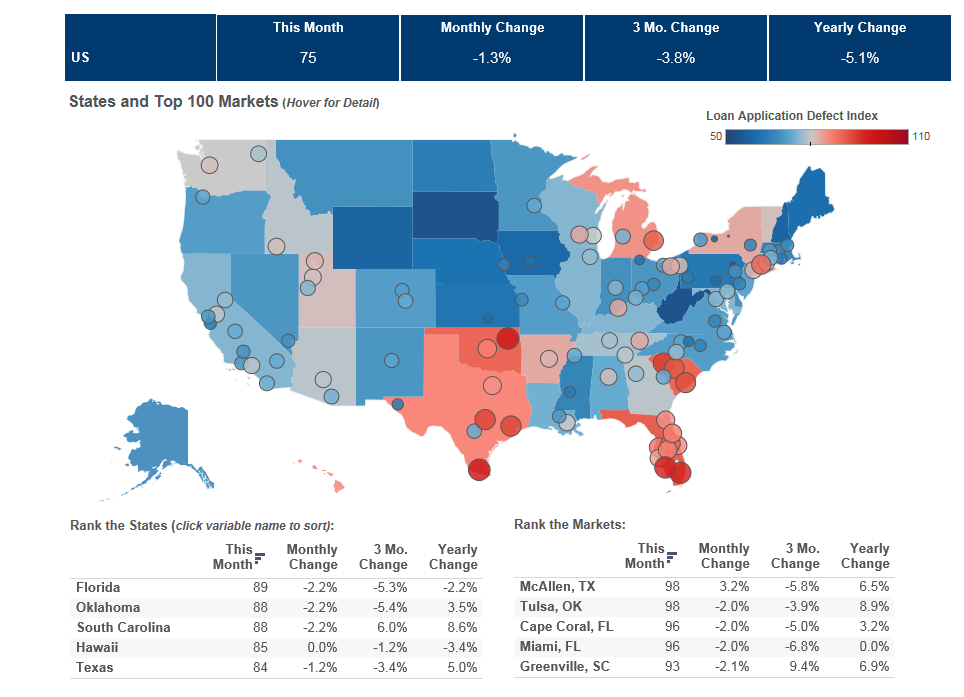

We’ve posted the February First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index decreased 1.3 percent in February as compared with January and decreased by 5.1 percent as compared with February 2015. The Defect Index has fallen 3.8 percent over the last three months, and February was the seventh consecutive month without an increase in defect and misrepresentation risk. The index is at the lowest point since its inception.

"The investments to improve compliance are producing real benefits in the form of higher quality loan manufacturing processes with fewer defects and less misrepresentation."

According to the MBA, loan production expenses have been increasing, which reflects the industry’s investment in technology and improved standards, as well as greater demand for compliant loan production processes. However, one benefit of these investments is declining loan application defect and misrepresentation risk.

“The continued decline in loan application and mortgage defect risk is indicative of the benefits the industry is accruing from investments in technology and improved production standards,” said Mark Fleming, chief economist at First American. “The investments to improve compliance are producing real benefits in the form of higher quality loan manufacturing processes with fewer defects and less misrepresentation.”

For this information, the top five states and markets where defect risk is increasing or decreasing, and more, please visit the Loan Application Defect Index.