Hard to believe that we’re releasing today the fourth iteration of the monthly First American Loan Application Defect Index, which estimates the frequency of defects in the information submitted in mortgage loan applications.

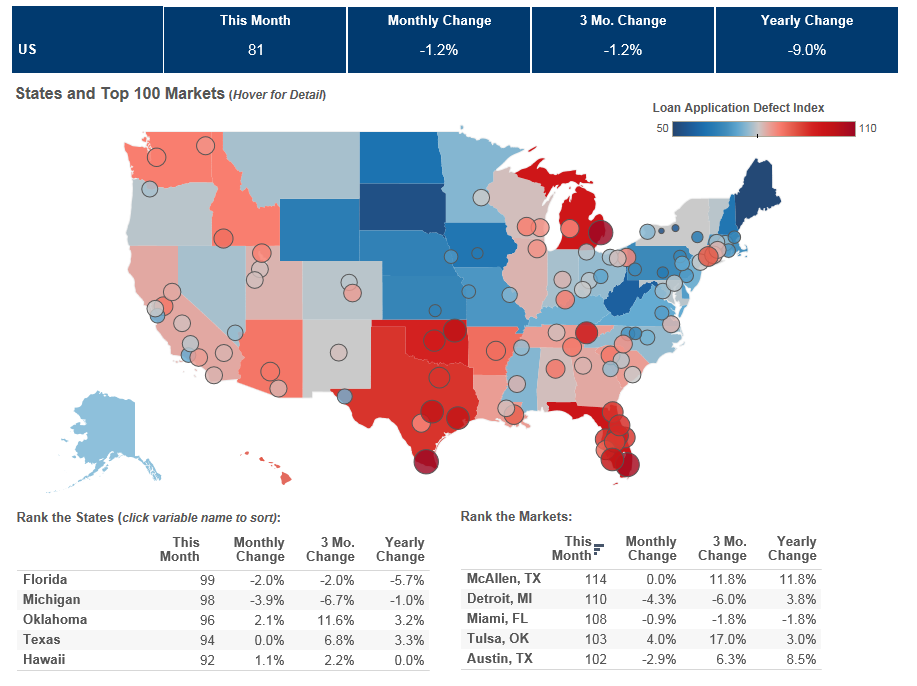

"Markets in Texas, Oklahoma, and Florida are emerging defect ‘hot spots.’ A gap is growing between the low defect risk ‘cool spots’ and the high defect risk ‘hot spots.’"

Overall, the index fell 1.2 percent in September as compared with August and decreased by 9 percent as compared with September 2014. Interestingly, this is the third month in a row that defect and misrepresentation risk has declined, returning the Defect Index to the level reported in May 2015 and reversing the upward trend in the first half of the year. The Defect Index has fallen more than three percent over the last three months.

Our "Monthly Market Close Up" looks at the amount of variation in defect risk across the top 100 Core Based Statistical Areas using our new market risk dispersion index.

For this information, the top five states and markets where defect risk is increasing or decreasing, and more, please visit the Loan Application Defect Index.