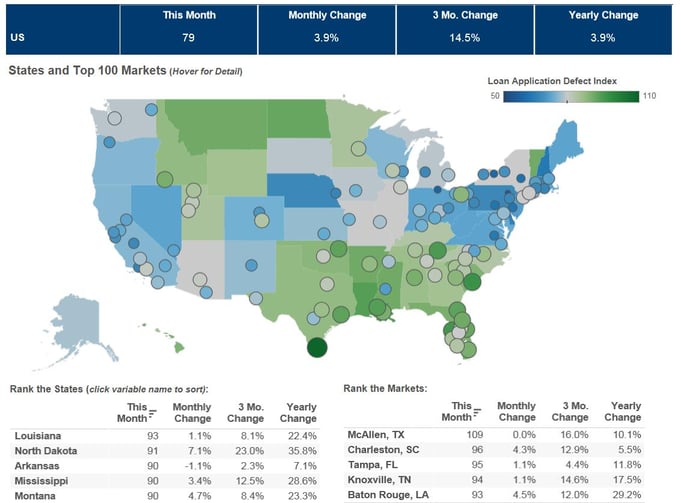

We’ve posted the March First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index increased 3.9 percent in March 2017 as compared with the previous month, and increased 3.9 percent as compared to March 2016. The Defect Index is down 22.5 percent from the high point of risk in October 2013.

“We are experiencing one of the strongest sellers’ markets in recent memory and the ‘speed-buying’ that is required for home buyers to make an offer and win a bid for homes they like may be contributing to the increase in defect, misrepresentation and fraud risk that we are observing,” said Mark Fleming, chief economist at First American.

“Defect, fraud and misrepresentation risk is increasingly becoming a regional phenomenon. The risk is concentrating in attractive local markets where housing demand is the strongest, primarily in the South,” added Fleming.

For this information, the top five states and markets where defect risk is increasing or decreasing, and more, please visit the Loan Application Defect Index.