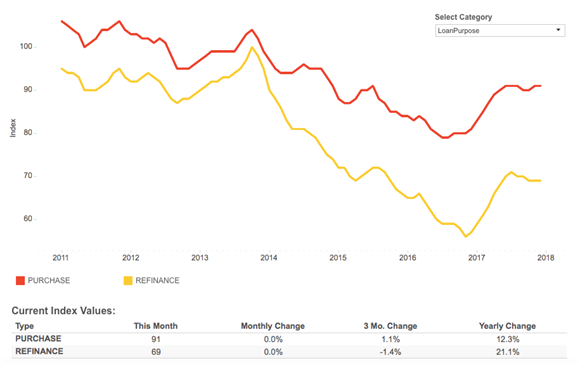

We’ve posted the December First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. The Defect Index remains the same as compared with the previous month, and increased 20.3 percent as compared with December 2016. The Defect Index is down 18.6 percent from the high point of risk in October 2013.

“We have seen this before, in 2013, as mortgage rates rise, so does overall defect, fraud and misrepresentation risk.”

“As the benefit of refinancing a mortgage declines for many consumers, the share of refinance loan transactions will likely decrease and the share of purchase transactions will increase,” said Mark Fleming, chief economist at First American. “We have seen this before, in 2013, as mortgage rates rise, so does overall defect, fraud and misrepresentation risk.

“The Defect Index illustrates the distinct difference in risk between refinance and purchase loan transactions, a distinction that has been consistent over time. Refinance loan transactions have always been less risky than purchase transactions, and this difference is more pronounced today than six years ago,” added Fleming.

For the list of high risk markets with the fastest growing defect risk, the top five states and markets where defect risk is increasing or decreasing, and more, please visit the Loan Application Defect Index.