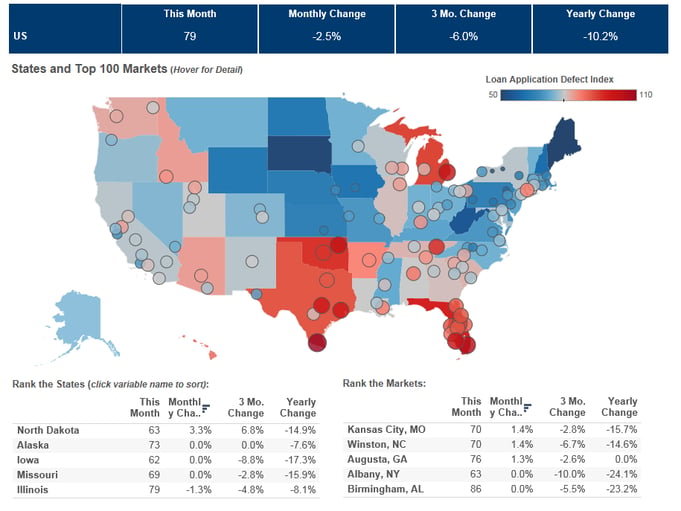

We’ve posted the October First American Loan Application Defect Index, which estimates the frequency of defects, fraudulence and misrepresentation in the information submitted in mortgage loan applications. Overall, the index fell 2.5 percent in October as compared with September and decreased by 10.2 percent as compared with October 2014.

New to the Defect Index this month are two new risk categories – employment- and income-related defect, fraud and misrepresentation.

“One of the clearest benefits of more stringent underwriting standards related to the ability of a borrower to sustainably pay their mortgage can clearly be seen in the improvement in the income-specific defect risk index. Income-related defect, misrepresentation and fraud risk is down 49 percent from its peak in December 2012,” said Fleming. “Given the heightened scrutiny of a borrower’s ability to pay, intentionally misrepresenting one’s income for fraudulent gain is more likely to get caught.”

For this information, the top five states and markets where defect risk is increasing or decreasing, and more, please visit the Loan Application Defect Index.