When determining where to set the federal funds rate, the Federal Reserve studies a multitude of models and analyses, including the neutral rate of interest. The neutral “what” you ask? The neutral rate of interest is the short-term interest rate that would prevail when the economy is at full employment and stable inflation. The Fed may choose to set the benchmark federal funds rate above the neutral rate in order to cool the economy, or it could set the federal funds rate below the neutral rate to stimulate the economy.

“The price of capital – the neutral rate of interest – is low because the economy is in a new era of secular stagnation.”

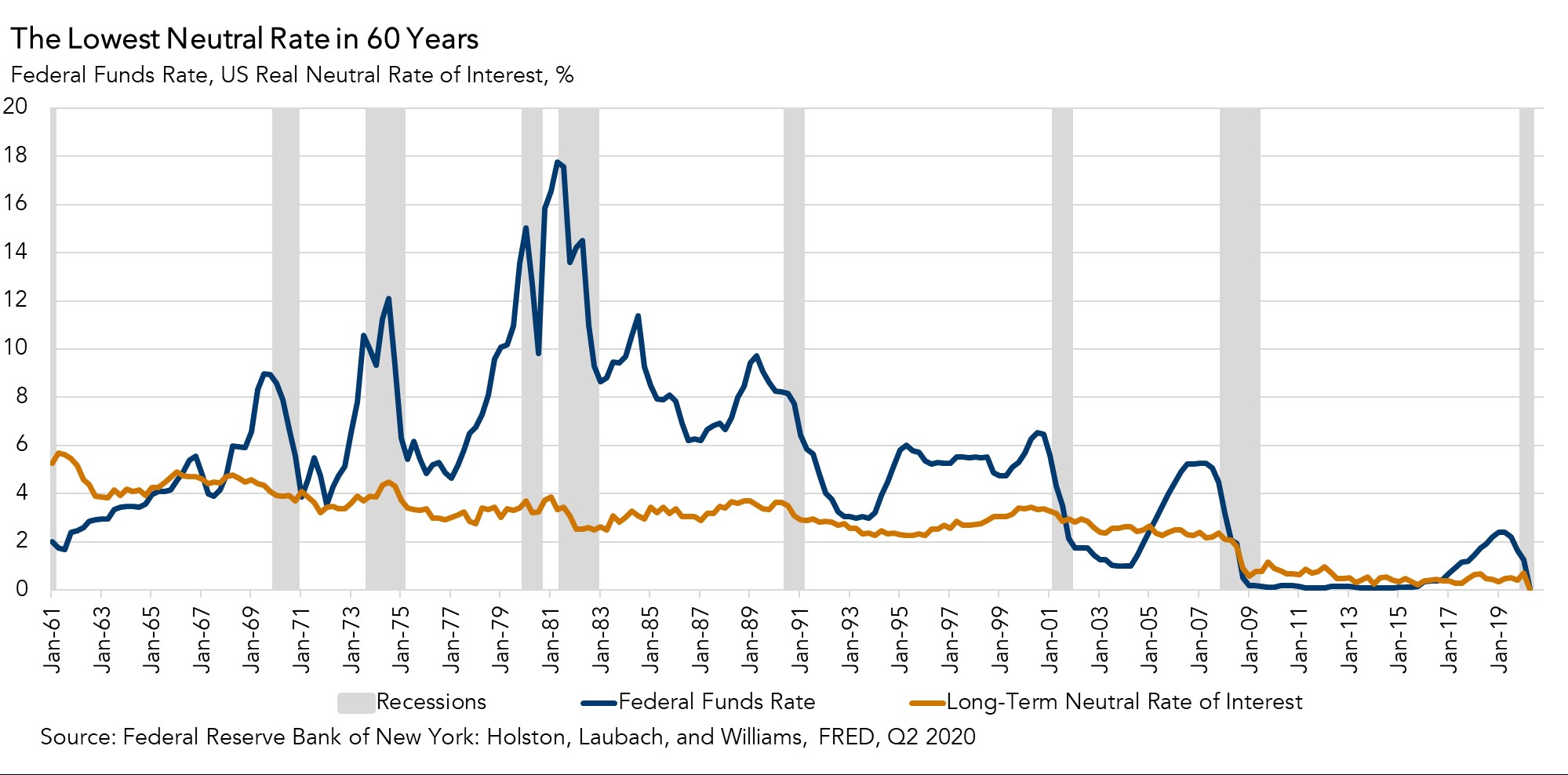

The chart below shows the Holston, Laubach and Williams estimate of the neutral rate of interest against the effective federal funds rate. The most recent neutral rate update in the second quarter of 2020 indicates the neutral rate is at a 60 year low, and slightly below the federal funds rate. The neutral rate of interest is significantly lower today than prior to the Global Financial Crisis (GFC) and has been this low for many years. The very low neutral rate phenomenon is not contained to the U.S., it is similar for other advanced economies including the United Kingdom, Canada, and the Euro area.

*Owing to the extraordinary volatility in GDP related to the COVID-19 pandemic, there have been no further updates of the HLW model estimates since Q2 2020.

Several Factors Drive the “Price” of Capital Down

One possible explanation for why the neutral rate of interest is at a historically low level today is because there is an excess of global savings relative to the demand for that money for investments. The neutral rate of interest is the “price” for capital, which is determined by the supply of savings and the demand for savings (capital investment). Several factors impact this supply and demand dynamic.

- Global Graying: The world old-age dependency ratio – the ratio of the number of older people who are generally economically inactive (i.e. aged 65 and over), compared with the number of people of working age – was nearly 14 percent in 2019, the highest since the beginning of the series in 1960. The U.S. old-age dependency ratio increased dramatically post-GFC, reaching a high of 25 percent in 2019. An aging population limits the supply of workers in an economy and reduces the output of an economy. Excluding the 2020 recession, the U.S. workforce has grown just 0.5 percent a year, on average, for the past decade — barely one-third the pace of its growth in the 1980s and 1990s. Fewer workers to supply with capital investment means less demand for new investment, pushing down the neutral rate of interest. At the same time, increasing life expectancy in advanced economies means people are saving more in anticipation for retirement, increasing the supply of savings and also driving down the neutral rate of interest.

- Slower Productivity Growth: The expansion in the aftermath of the GFC was the longest, but also the slowest in terms of cumulative GDP growth since the start of the expansion. Similarly, productivity growth has been quite slow in the aftermath of the GFC. Real output per hour (a measure of productivity) expanded at an average rate of 1.4 percent a year since the recession ended in 2009, which is well below the 2.3 percent annual productivity growth rate during the 1990s expansion. Lower productivity growth means less demand for new capital investments, pushing down the neutral rate of interest.

- Flight to Safety: Our domestic economy is more globally interconnected than ever before. One outcome of this globally connected financial market is that when uncertainty increases globally, the demand for safe harbor assets, like U.S. Treasuries, increases. Put another way, global uncertainty creates a flight to the safety and security of U.S. government long-term Treasury bonds, which increases the supply of capital domestically and drives down the neutral rate of interest.

Economist Alvin Hansen coined the term secular stagnation in the 1930s, following the Great Depression. He used it to describe a chronic lack of investment demand relative to capital supply. In this context, “secular” referred to the long-term nature of the stagnation. Today, secular stagnation refers to a long period of high global capital savings relative to low demand for capital investment. Global graying has resulted in excess savings, while slower productivity growth reduces demand for capital investment. The U.S. serving as a safe haven for foreign assets exacerbates the savings glut domestically. The result? The price of capital – the neutral rate of interest – is low because the economy is in a new era of secular stagnation.