Affordability in the U.S. fell in 2021 on a year-over-year basis, as house-buying power was unable to keep up with red-hot nominal house price growth. The decline in affordability was broad based as affordability fell in most major markets across the U.S., yet some markets remain more affordable than others for potential first-time home buyers. Affordability for a potential first-time home buyer can be defined as the share of homes for sale that are within the median renter’s house-buying power. The amount of house-buying power that a renter has relative to nominal house prices in any market greatly influences the supply of homes they can afford.

“As millennials continue to age into their prime home-buying years and the opportunity to work remotely becomes more common, it may be time to update the age-old real estate adage to location, location, relocation.”

The pandemic has untethered many workers from their offices, providing some renters the opportunity to pursue homeownership in cities that may be more affordable. Where one lives today is less correlated with where they work, and one study suggests that even once the pandemic wanes, 20 percent of full workdays will be completed from home. Consequently, the widespread acceptance of remote work has triggered greater interest in relocating to less expensive markets.

Relocation Nation?

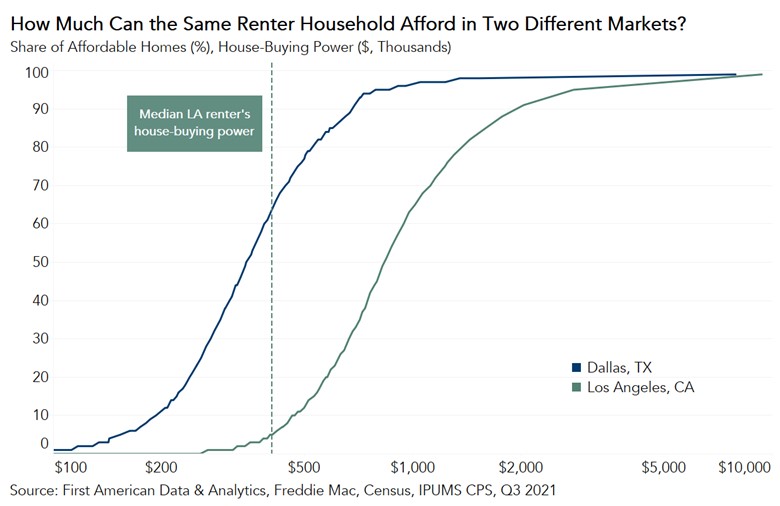

For example, the median renter in Los Angeles with a household income of approximately $59,000 had $406,000 of house-buying power in the third quarter of 2021. That renter could only afford 5 percent of the homes for sale in Los Angeles, the least affordable of the top 50 U.S. markets in 2021. The draw of greater affordability elsewhere may be one reason why some have left Los Angeles over the last five years. According to the American Enterprise Institute’s Housing Arbitrage Index, the top destinations for people leaving Los Angeles between January 2018 and April 2021 were Riverside, Calif. (an outer suburb of Los Angeles), Phoenix, Las Vegas, and Dallas.

In Dallas, a Los Angeles renter with a house-buying power of $406,000 can afford 63 percent of the homes for sale, which is dramatically more than the 5 percent of homes affordable to that renter in Los Angeles.

For potential first-time home buyers, leveraging their house-buying power in more affordable markets can also help them buy more attractive homes – more square footage and rooms, more options for different home styles and neighborhood amenities – increasing the opportunity to find a home that suits their preferences. The table below shows the type of house the median renter from Los Angeles could afford in each of the four most popular destination markets for Los Angeles residents that have relocated.

|

Market |

Share of Affordable Homes for the Median Renter |

Average Home Size (Sq. Ft.) |

Average Number of Bedrooms |

Average Number of Bathrooms |

|

Los Angeles, CA |

5 |

1,097 |

2.3 |

1.7 |

|

Riverside, CA |

31 |

1,570 |

3.0 |

2.1 |

|

Phoenix, AZ |

50 |

1,824 |

3.3 |

2.4 |

|

Las Vegas, NV |

61 |

1,876 |

3.3 |

2.2 |

|

Dallas, TX |

63 |

2,284 |

3.5 |

2.3 |

The pandemic and the ability to work from home have prompted many people to seek more space, as their home is now also their office, their gym, and their daycare center. If they can’t afford a home that fits their needs in their own market, one solution is to move to a market where they can. In the coming years, many workers may leverage their ability to work remotely and their house-buying power to become homeowners in more affordable markets. As millennials continue to age into their prime home-buying years and the opportunity to work remotely becomes more common, it may be time to update the age-old real estate adage to location, location, relocation.

.jpg)