From February 2020 to May 2022, investor purchases of single-family homes grew nationwide, increasing from an average share[1] of 12.4 percent of homes purchased across the largest 50 metropolitan markets to 20.4 percent. Over the past year, however, as interest rates rose and house prices declined, investors pulled back from many single-family rental (SFR) markets and investor share fell to 16.2 percent. Though investor participation in the SFR market varies meaningfully by market, some regional trends are emerging.

"Despite some regional variation, investor participation has declined nationally and, in general, the markets that drew greater investor interest during the pandemic have had the greatest correction. What went up is now trending down."

Where’s Everyone Gone?

Several factors have driven the decline in investor participation. Investors are responsive to evolving market conditions and likely took the growing uncertainty in real estate valuations and yields as an opportunity to re-evaluate their portfolio allocation to SFR. Further, rising interest rates have made it more costly to acquire investment properties, which has muted commercial real estate transaction volume generally and has spilled over into the SFR market as well.

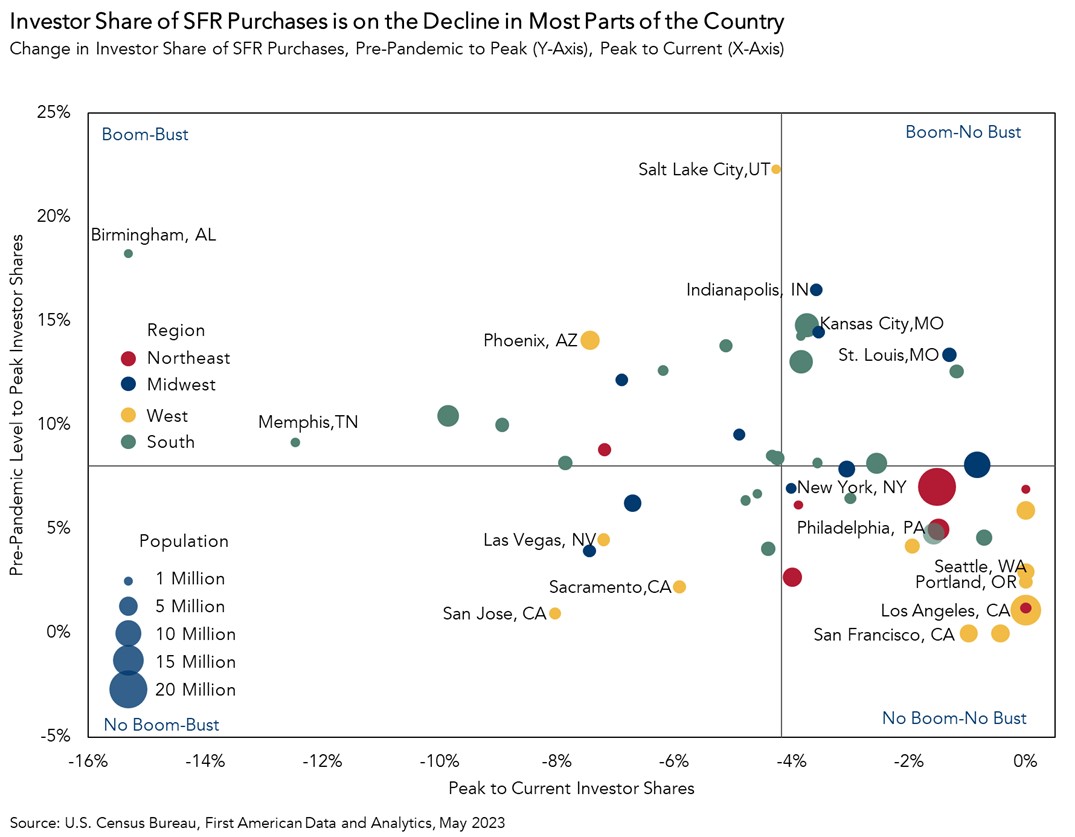

To understand how much investor participation in specific markets has retreated from recent peaks, markets can be placed into one of four categories: Boom-Bust, Boom-No Bust, No Boom-Bust, and No Boom-No Bust. Boom cities are those where investor participation increased more than average during the pandemic, and bust cities are those where investor participation has declined more than average from peak.

Boom-Bust

Memphis and Birmingham are two examples of the several Southeastern markets where investor activity boomed during the pandemic. Since then, however, investor activity has retreated significantly in these markets. This boom-bust pattern was most discernable in mid-sized markets that became destinations for people leaving bigger markets. Between Birmingham’s peak investor share to the most recent measure in May 2023, investor participation has dropped roughly 15 percent, while the investor share in Memphis declined by 12 percent. Investors who got in on the ground floor, so to speak, were able to capitalize on the increase in demand from pandemic migration patterns that favored suburban re-settlement. Since then, however, higher interest rates and inflation in property maintenance expenses, combined with higher home prices, have likely compressed profit margins and limited the upside available to investors in several of these markets.

Boom – No Bust

Attractive home prices and increased housing demand helped drive the boom in investor share in half of all Midwestern markets analyzed. In fact, some of the largest increases in investor activity during the pandemic occurred in smaller Midwestern locales. As people sought out more affordable accommodations during the pandemic, the shift in housing demand to the Midwest drew investors to the SFR market. Investor participation rates have remained within 3 percent of peak in markets like Indianapolis and St. Louis as steep costs of living in many coastal markets have pushed investors towards the up-and-coming Midwestern rental market. Compared to peak, investor activity increased in Indianapolis and Kansas City, but has not yet undergone a bust.

No Boom – Bust

Western markets largely missed the pandemic-era boom in investor SFR purchases, except for Salt Lake City and Phoenix. In Las Vegas, San Jose and Sacramento, the investor share decline from peak exceeded the pandemic increase, resulting in a net decline in investor participation compared with pre-pandemic levels.

One possible explanation for this exception is the pre-existing priciness of many Western markets. Generally, it’s harder for investors to earn a return on an investment if they have to buy at a higher price, and higher prices are more prevalent in less affordable markets like those found in California. What’s more, pandemic-era demographic tended to shift demand away from these pricier markets to less expensive ones from which people could now work remotely. It makes some sense that investors increased their SFR purchases in places that were more affordable and in higher demand.

No Boom – No Bust

While west coast markets like Seattle and Portland are currently at their peak of investor participation, several northeastern markets like Philadelphia and New York experienced no significant accelerated investor participation during the pre-pandemic to peak period or a meaningful subsequent decline.

Will Tomorrow Look Like Yesterday?

The pandemic changed how we use and demand space. With work from home now an option, residential space can substitute for office space. People began adjusting to this new reality by moving around the country looking for living options that were more suitable or affordable than what was available in their current location. Investors took notice, and purchased SFRs where, generally, prices were affordable and demand for housing was increasing.

Despite some regional variation, investor participation has declined nationally and, in general, the markets that drew greater investor interest during the pandemic have had the greatest correction. What went up is now trending down.

Juliette Barragan contributed to this post.

[1] The investor share is the share of all residential sales to buyers whose name includes keywords such as Corp, Inc, LLC, Trust, or other identifiable business names.