Homeownership is a goal shared among all people, regardless of race or ethnicity, and remains the main driver of wealth creation for the majority of households in the United States. That is why it is vital to understand the underlying characteristics that influence the probability of homeownership. Over the last several months, my research has explored the influence of marital status and family formation, education, income and economic factors on homeownership rates. Today, I examine how ethnicity impacts the probability of homeownership.

Not surprisingly, ethnicity and homeownership rates is a frequent topic of research and often that research identifies homeownership gaps among ethnicities. In 2015, I released a report entitled “The State of Homeownership – Homeownership, Economic Mobility and the Challenges Facing the Nation’s Latino and African American Communities,” which showed that there are clear and consistent differences between the homeownership rates of different ethnicities, even when age is held constant. Other reports by the National Association of Hispanic Real Estate Professionals (NAHREP), the National Association of Real Estate Brokers (NAREB), and the Asian Real Estate Association of America (AREAA) also show the existence of homeownership gaps.

Since homeownership is one of the key components of achieving the “American Dream,” understanding the observable differences in homeownership rates by ethnicity may help identify ways to advance the prospects for homeownership across all ethnicities.

Correlation or Causation

As mentioned in previous research, differences in homeownership rates can be attributed to many household characteristics, making it difficult to make broad conclusions. For example, a lower homeownership rate in a particular ethnic group may be the result of economic, demographic and educational factors that are causally related to homeownership, but only correlated with ethnicity.

“Even after accounting for all of the other important factors influencing homeownership rates, substantial unexplained gaps in homeownership rates between ethnicities remain.”

Let’s consider education. Earning a bachelor’s degree significantly improves one’s ability to become a homeowner. In 2015, a Census study showed that 15 percent of Hispanics had a bachelor’s degree compared to 22 percent of African-Americans – a difference of 7 percentage points. The education gap between Whites and African-Americans remained stable, between 11 and 14 percentage points from 1988 to 2015. Since greater educational attainment typically leads to greater income, these ethnic differences in educational attainment levels also influence income disparities across ethnicities. So, one reason a homeownership gap between different ethnicities exists is because disparities in educational attainment levels and, subsequently, income levels, also exist. It’s important to identify the relationship between ethnicity and homeownership after controlling for the directly attributable economic, demographic and educational relationships that are also correlated with ethnicity.

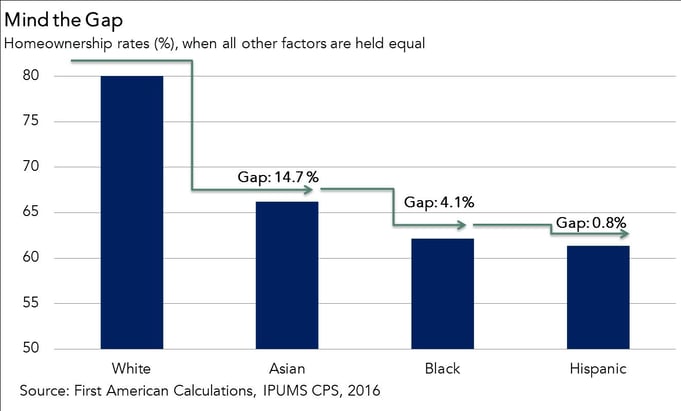

Using the same model we used to isolate and analyze other household characteristics on homeownership, Figure 1 below shows the gap in homeownership rates by ethnicity, when all other factors are held constant. The result is clear – ethnic homeownership differences remain, even after controlling for age, marital status, the number of children in the household, education, income and the impact of economic conditions. In fact, Hispanic households have a 19.6 percent lower homeownership rate compared to White American households. Homeownership among African-American households is 18.8 percent lower than White households and Asian-American households have a 14.7 percent lower homeownership rate than White households when all else is held constant.

All Else Equal, Or Not

How do these homeownership gaps compare to the more often cited differences that don’t remove the influence of other characteristics related to homeownership? According to the latest NAHREP report, the homeownership difference between Hispanic and White households is 25.9 percent. A report from NAREB identified a 27.3 percent difference in homeownership rates between African-American and White households. And, according to the most recent AREAA report, the homeownership gap between Whites and Asian-Americans is 17 percent.

Controlling for other homeownership-related characteristics reduces the homeownership gap for all ethnicities, but it does not remove the gaps all together. Even after accounting for all of the other important factors influencing homeownership rates, substantial unexplained gaps in homeownership rates between ethnicities remain.

The real challenge is to better understand why this gap persists. After accounting for all the other factors, are the differences in the homeownership rate by ethnicity due to the challenges of raising a down payment, access to credit, or the impact of more or less financial obligations to extended family members? This research can’t answer that question, but it does help to inform the policy discussion about where one might look to further understand why homeownership gaps by ethnicity exist.

Here’s some good news. The measurable attributes that we know promote homeownership are on the rise across ethnic and racial groups – particularly improvement in educational attainment levels. Between 1995 and 2015, educational attainment rates among 25- to 29-year-olds increased. The percentage who had received at least a high school diploma or its equivalent increased from 87 to 91 percent, with most of the change occurring between 2005 and 2015. From 1995 to 2015, the percentage of 25- to 29-year-olds who had attained a bachelor’s degree or higher increased for Whites (from 29 to 43 percent), African-Americans (from 15 to 22 percent), Hispanics (from 9 to 15 percent), and Asian/Pacific Islanders (from 43 to 63 percent). Education is on the rise, and we can expect that incomes (and subsequently thoughts of buying that first home) are likely to follow.

America is changing demographically in significant ways. Millennials are aging into their desire to become homeowners, and are the most ethnically diverse generation the housing market has ever experienced. The importance of homeownership as part of the fabric of the “American Dream” has been recognized by generation after generation. President Franklin Delano Roosevelt believed that “a nation of homeowners is unconquerable.” President Ronald Reagan stated “the love of home is one of the finest ideals of our people.” There are real homeownership gaps among ethnicities that deserve attention, so we can provide all Americans with the opportunity to pursue homeownership.

Leaders of Ethnic Real Estate Professional Associations React

Gary Acosta, Co-founder and CEO, National Association of Hispanic Real Estate Professionals

“This analysis from First American validates the fact that there is tremendous opportunity for the industry to work to develop solutions that address the homeownership gap for our diverse communities. While the issues are complicated, efforts to close the knowledge gap will likely yield some of the best outcomes. Most people acquire the initial information to become homeowners from family, friends and other trusted advisors. Increasing the number of culturally competent real estate and mortgage professionals would have a material impact in closing the homeownership gap in America.”

Ron Cooper, President, National Association of Real Estate Brokers (NAREB)

“This analysis of homeownership gaps by ethnicity highlights the challenge that African-American households face when attempting to achieve the dream of homeownership. The substantial, unexplained gap in the homeownership rate for African-Americans can be improved with the adoption in alternative credit models, addressing risk-sharing imbalances in mortgage underwriting, regulatory clarity and improved community knowledge of the process of home buying with more African-Americans in all levels of the mortgage industry."

Jim Park, National Chairman Emeritus, Asian Real Estate Association of American

“The industry must continue to put a spotlight on the persistent homeownership gap facing minority communities. This type of analysis ensures that we have fact-based dialogues and constructive initiatives to truly close the homeownership and wealth gap. As Dr. Fleming indicates, the variations in social economic conditions alone does not explain the wide gap facing the minority community. Those ‘unexplainable’ gaps must be tackled together to ensure broad access to mortgage lending and homeownership in America.”