Multifamily transaction volume in the first quarter of 2024 hit the lowest levels observed since the early days of pandemic quarantines. In a recent blog post, we analyzed what types of units were trading in terms of unit quality – that is, Class A, B or C [1]. In this X-Factor, we’ll examine multifamily transaction volume, but from different angles. With interest rates possibly remaining ‘higher for longer’ and levels of transaction volume this low, what types of apartment buildings are trading?

[1] Class A units are typically nicer, newer apartments, possibly luxury apartments, and come with a variety of amenities. Class B units have fewer amenities, may be slightly older than Class A, and are often referred to as “workforce housing.” Class C units are typically older and more affordable, though still market-rate.

“The pre-pandemic polarizing trend toward smaller garden and larger high- and mid-rise properties explains the cranes across the skylines in many markets and a trend toward urban living.”

Apartment Buildings Being Purchased Today are Smaller

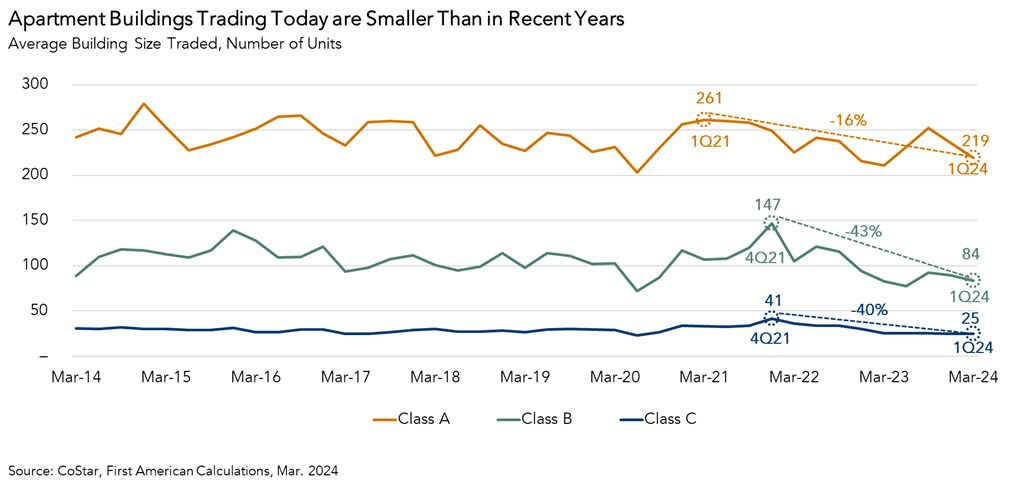

Properties that were bought and sold in the first quarter of 2024 were smaller than those in 2021, when apartment transaction volume peaked. The average size of Class A properties transacted declined by 16 percent, from an average of 261 units per building in the first quarter of 2021 to 219 units per building in the first quarter 2024. The decline in the size of properties transacted for Class B locations was substantially larger.

Compared to the fourth quarter of 2021, when the average size of Class B properties being bought had 147 units, the average building size in the first quarter of 2024 had only 84 units, a 43 percent decline. Average Class C property size declined by a comparable amount as Class B, but the average Class C building is meaningfully smaller than the average Class B building.

Most Properties Bought and Sold are Class C

Fewer apartment buildings traded in the first quarter of 2024 than in any quarter in 2023, which was already down significantly compared to 2021 and 2022. Class C buildings account for most of these apartment transactions, and this hasn’t changed much over the last decade. After all, there are simply more of them. Despite the decline in transactions of all apartment qualities, Class C transactions have remained a relatively constant share of that volume.

Green Thumb or Urban Living?

In addition to unit quality, there are generally two types of apartment property layouts. Mid- and high- rise buildings are more often found in urban cores, and while they can contain Class A or B units, they usually include Class A and rarely include Class C units. Garden properties, by contrast, are typically found in suburbs and exurbs, and though they can be as large as mid- and high- rise building in terms of number of units, they are typically less dense than apartment properties in city centers. Garden buildings can contain units of either Class A, B or C quality.

Garden property units have made up most of the transaction volume over the last two decades. While that remains the case today, the share of mid- and high- rise units purchased, relative to the total, has gradually increased. Only about 14 percent of all multifamily units traded were mid- or high- rise units 20 years ago. Since then, that share has increased steadily to 28 percent. This may reflect a slight shift in demand to own properties that allow for greater density.

In the Long Term, Garden Properties Transacted Have Declined in Size as High- and mid-Rise Sizes Have Increased.

Since 2021, the size of both garden and mid- and high-rise apartment buildings have declined by about a third. However, over the last 20 years, the average size of garden properties has been steadily declining, while the average size of mid- and high-rise properties increased from the end of 2013 until 2021. In other words, the long-term trend before the latest round of interest rate hikes was toward purchases of smaller garden properties and larger mid- and high-rise properties.

So, What’s the X-Factor?

With interest rates meaningfully higher than they were only a few years ago, the composition of apartment buildings being purchased has shifted. Today, though transaction volume is muted for all apartment types, smaller buildings are trading more than larger ones. The majority of these transactions are small Class C properties, with only a few purchases of Class A properties. With uncertainty in valuations, buyers today may be wary of getting locked into high-interest rate loans or overpaying for a property, so they are focusing on smaller investments to limit their downside risk in any single property.

Though the average size of both garden and high- and mid-rise properties has declined, the pre-pandemic polarizing trend toward smaller garden and larger high- and mid-rise properties explains the cranes across the skylines in many markets and a trend toward urban living. How long this trend lasts in this post-pandemic world remains to be seen.