From February 2020 to May 2022, investor purchases of single-family homes grew nationwide, increasing from an average share[1] of 12.4 percent of homes purchased across the largest 50 metropolitan markets to 20.4 percent. Over the past year, however, as interest rates rose and house prices declined, investors pulled back from many single-family ...

Read More ›Recent Posts by Xander Snyder

You Can’t Build What You Can’t Fund

Securing commercial real estate (CRE) financing in today’s market is no easy task. After the three bank failures this year, which triggered increased regulatory scrutiny of bank-held CRE loans, banks have pulled back on lending. This is especially true for riskier varieties of lending, such as construction loans, which involve assets that are not ...

Read More ›Bank Pull Back Creates Construction Lending Opportunity for Debt Investors

Building a property from the ground up entails substantially more risk than purchasing an existing building that is already generating income. Likewise, financing construction is riskier than lending against existing structures since development projects don’t generate income to pay loan interest until they are completed. For this reason, most ...

Read More ›Uncertain Economic Outlook Keeps Renters Where They Are, Pushing Cap Rates Up

In times of economic uncertainty, people tend to stay put. After all, why take on new financial obligations, like an apartment lease, when the future is less certain? Today, though unemployment remains low, inflation remains high, and the recent slew of layoffs at tech companies has many worried about their own financial position. The recent, ...

Read More ›CRE X-Factor: For Commercial Real Estate, Banks Aren’t the Only Lender in Town

When most people think of a loan, they think of a bank. Banks take deposits from customers in return for interest payments or other services. The bank then invests those deposits in loans, such as commercial real estate (CRE) loans, and securities that pay a higher interest rate than the bank is paying on the deposits. However, a bank is not the ...

Read More ›Where is the Risk Exposure to Commercial Real Estate?

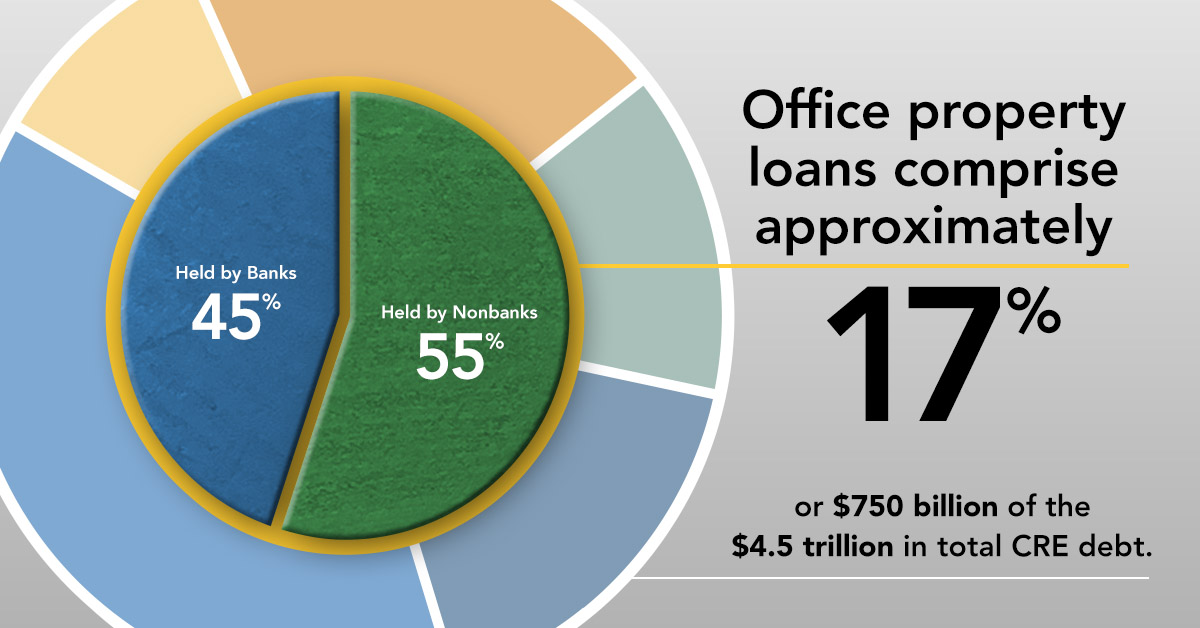

After the recent bank failures, a good deal of attention has been paid to commercial real estate (CRE) debt held by banks of different sizes. But banks aren’t the only CRE lenders. Insurance companies, mortgage REITs, and private debt funds that lend investors’ money also regularly make CRE loans. Taken together, banks of all sizes only account ...

Read More ›Why it’s So Hard to Convert Offices into Housing

At first glance, converting old office buildings into apartments seems like an obvious solution to two pressing real estate challenges. There’s a national housing shortage of several millions of housing units, and office space is substantially underutilized due to the adoption of remote work. Declining office use is a significant risk to office ...

Read More ›CRE X-Factor: Retail’s Tailwinds Turn to Headwinds

Retail real estate remains a challenged asset class, although locations catering to experiential services so far appear to be more resilient than others. Even before the onset of the pandemic, the rise of eCommerce and the shift away from mall culture created an uncertain outlook for many types of retail locations. In this month’s X-Factor, let’s ...

Read More ›What Does Consumer Spending Signal about the Health of Retail Real Estate?

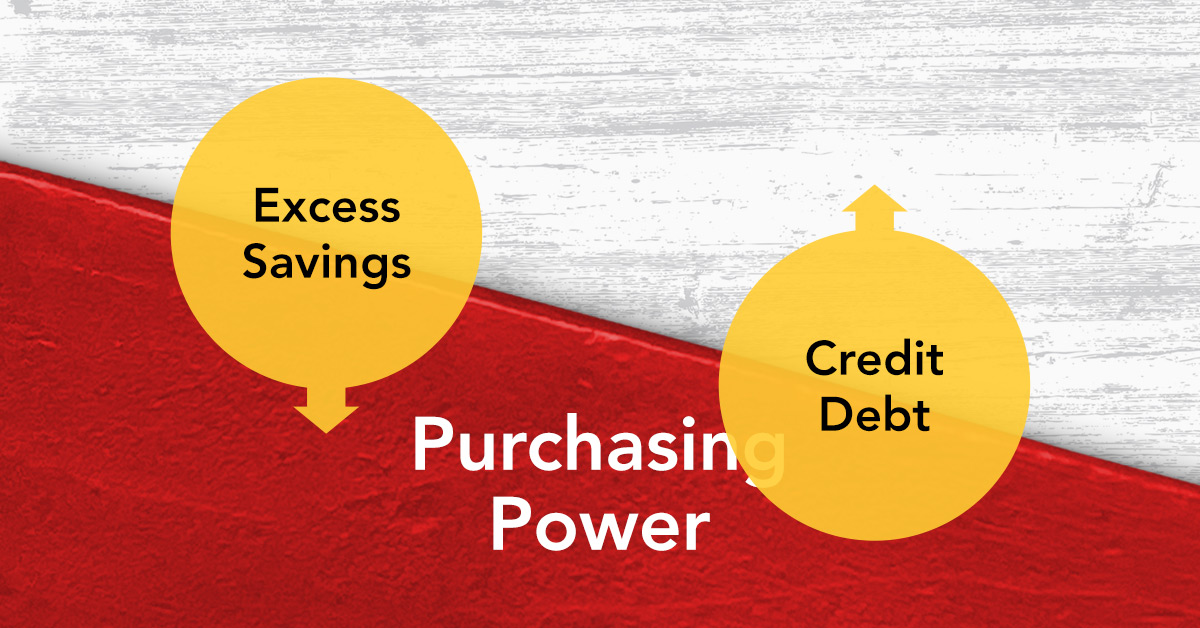

The performance of retail real estate is closely tied to consumer spending trends. Over the last year, consumers have benefitted from meaningful wage growth, but inflation has erased most of those gains. Similarly, despite nominal retail sales growing by approximately 5.4 percent in February, retail spending in real terms has fallen over the last ...

Read More ›CRE X-Factor: Outlook for Industrial Real Estate Remains Positive, Despite Dip from Record-Setting 2021

Industrial space remains in high demand across the country, despite announcements of tabled expansion plans from eCommerce companies and retail store closures. That strong demand has fueled record levels of construction that will ease price and rent growth to more moderate, single-digit rates as the new industrial supply comes to market. The ...

Read More ›