During the Great Recession, the phrase “shadow inventory” referred to the number of foreclosed housing units that had not yet hit the market but could be listed soon. A similar concept can be applied to today’s office vacancy rates. In a number of major cities, office buildings remain half empty and, given the remaining prevalence of hybrid and remote work, it’s unclear if these office buildings will ever fill up, raising the question: should more attention be paid to shadow vacancy, particularly in the office sector?

“Over the next several years, as office debt matures, lenders will be looking for proof that their borrowers can continue to service debt at prevailing interest rates. If U-Shadow vacancy remains as high as it is, they may not find it.”

Leased, But Empty

Shadow vacancy traditionally refers to the difference between office availability rates and “vacancy rates” (the availability rate refers to vacancies plus space that’s listed for sale, lease or sublease). In our new work-from-home reality, the traditional definition of this term doesn’t fully capture the under-utilization of office space across the country. So, we created a metric that does.

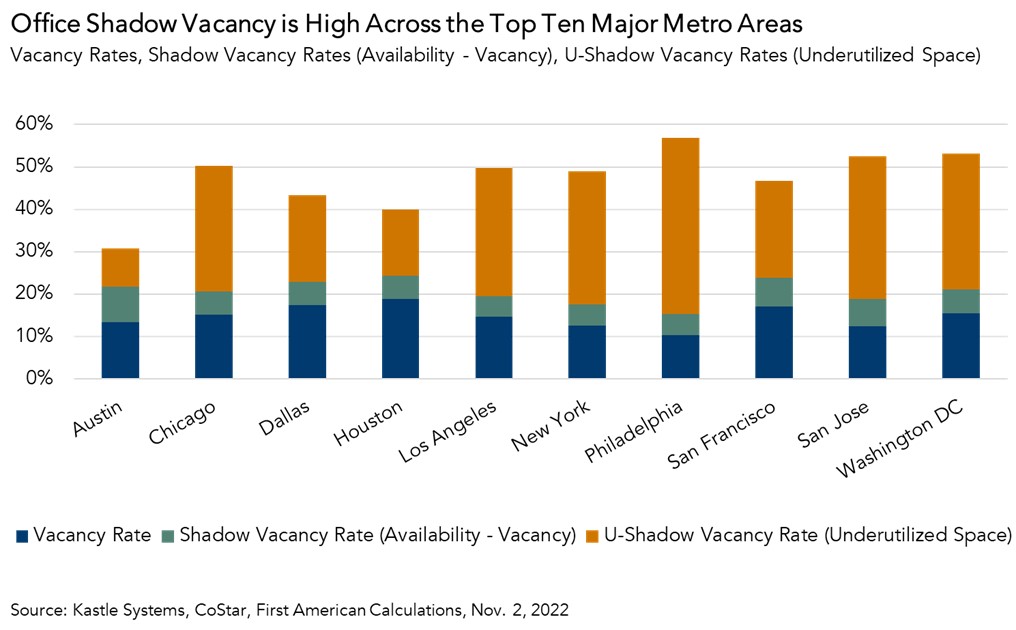

The underutilized shadow (U-Shadow) vacancy rate refers to the increase in physical vacancy rates, as measured by Kastle System’s Back-to-Work Barometer, that cannot be explained by a corresponding increase in office availability rates compared with pre-pandemic benchmarks. Kastle’s Back-to-Work Barometer uses card-swipe data to compare office traffic in 10 major cities to a pre-pandemic benchmark. For example, in Austin physical vacancy was approximately 38 percent in early November, whereas office availability rates in Austin had increased by nearly 7 percent compared with the fourth quarter of 2019. This implies that approximately 31 percent of physical vacancy cannot be explained by increased available space, so 31 percent is the U-Shadow vacancy rate.

More U-Shadow, More Potential Risk to Office Sector

U-Shadow vacancy rates remain high in all 10 metros reported by Kastle Systems, though cities in Texas have the lowest of the 10, as these markets have had more workers in the office. Philadelphia has the largest U-Shadow vacancy rate, followed by San Jose and Washington D.C.

Higher U-Shadow vacancy implies that when office leases in these cities end, they may not be renewed. What’s more, over the next several years, as office debt matures, lenders will be looking for proof that their borrowers can continue to service debt at prevailing interest rates, which are now much higher than when many of those existing office space loans were originated. If U-Shadow vacancy remains as high as it is, they may not find it.

Persistently high U-Shadow vacancy increases the risk of higher leased vacancy and, therefore, lower cash flow. If office vacancy rates continue to increase, lenders will increasingly encounter office buildings that are no longer producing sufficient cash flow to support newly contemplated debt service. This will likely lead to increased distress in the office market, forcing some owners to sell at lower prices than they’d prefer.