Over the weekend, Greece signed up for an agreement with the European Union that saved it from a “Grexit” (Greek exit from the Eurozone). In other news, the Chinese stock market has finally stabilized almost a third off its early June peak. Yet this wasn’t necessarily the result of the market alone, but significant intervention on the part of the government. These are both significant global economic events, but do the economic conditions in other countries effect the U.S. economy or even more specifically, given my more specific interests, the U.S. housing market?

Janet Yellen and the Federal Reserve believe so. In fact, they indicated some concerns with China and Greece in their June meeting a month ago, the meeting minutes of which were released this week. Fed Chairwoman Yellen continues to indicate a rate rise is likely this year, especially if the labor force participation rate rises. Yet, the U.S. housing market is currently experiencing the benefit of the ‘flight to safety’ being driven by global economic uncertainty. The yield on the 10-year U.S. Treasury bond dropped 21 basis points from the beginning of the month to a low of 2.22 percent last week. Much of this decline has been attributed to investor demand for the safety of U.S. government debt over the perceived risk of global alternatives.

"Global economic uncertainty could increase U.S. home sales by more than 100,000”

The return an investor can achieve in a “risk free” U.S. government bond heavily influences mortgage rates, which have started to decline as well. According to Freddie Mac, the mortgage rate fell four basis points last week. So, if affordability is improved by the fear of uncertainty, how many more home sales could we expect from a persistent fear depressing mortgage rates?

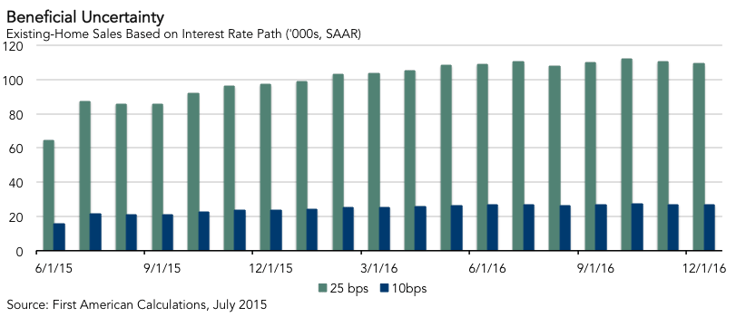

Using our dynamic equilibrium model of the U.S. housing market, we can “ask” exactly these kinds of questions. In this case, what happens to home sales when the fear of uncertainty depresses mortgage rates by 10 or 25 basis points? Not big changes to be sure, but it means the difference between getting a mortgage at 3.85 percent instead of 4.1 percent, which can add up to significant savings over 30 years.

In the figure below, we show the hypothetical result of creating a positive “uncertainty” shock in June and see what that means in terms of the additional amount of existing home sales demand generated by the beneficial impact on affordability. Under the 25 basis point beneficial shock, the impact immediately starts adding an additional 80-100 thousand additional existing-home sales to the seasonally adjusted annualized rate. This would push the current estimate of 5.2 million existing home sales up to 5.3 million. By the middle of 2016, the impact is consistently around an additional 110,000 sales. As expected, the smaller beneficial adjustment also generates a positive impact on the housing market, but of a lower magnitude.

Of course, we cannot be sure how much mortgage rates will fall as a result of the flight to economic certainty. In addition, as I mentioned, a rise in rates in the near future is to be expected based on Ms. Yellen’s comments, yet for now the U.S. housing market is experiencing the benefit of global economic uncertainty. So, in this case, one country’s pain is another one’s gain.