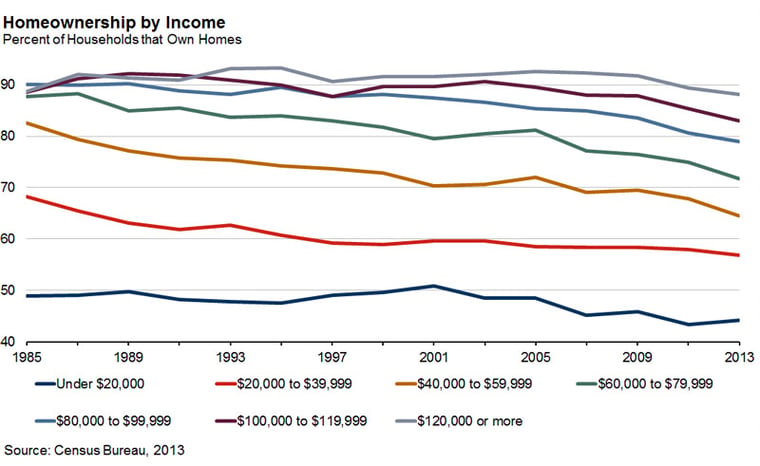

In a previous blog post, we explored the relationship between the age of the US Hispanic population and its homeownership rate; now, let’s examine a second factor: income. As shown in the first figure, higher income clearly correlates with higher rates of homeownership. Just like our measure of age and homeownership in the last post, the biggest gaps are between the lower brackets, with the higher bracket gaps progressively diminishing in difference. This should be a fairly intuitive conclusion. However, what might not be as obvious is the underlying cause of income differences.

Enter the educational factor.

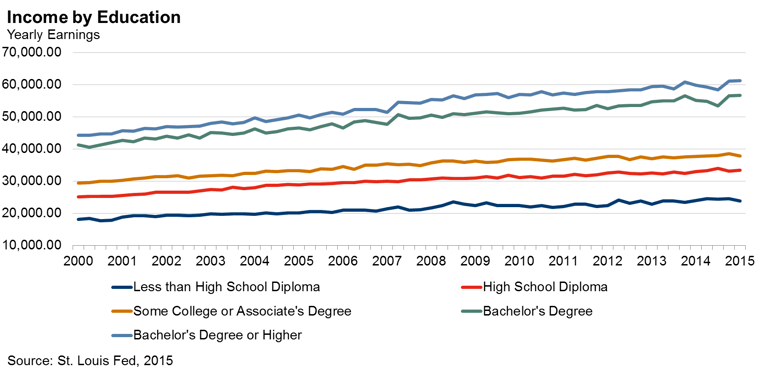

One of the strongest indicators of income levels is educational attainment, as evidenced by the second figure. Incomes rise with every step up the educational ladder. The most significant of these steps is the completion of a bachelor’s degree, representing an average difference of about $10,000 in annual income relative to some college or an associate degree. So the question is, how does education level impact our focus demographic, Hispanics? Where do they fall on this scale?

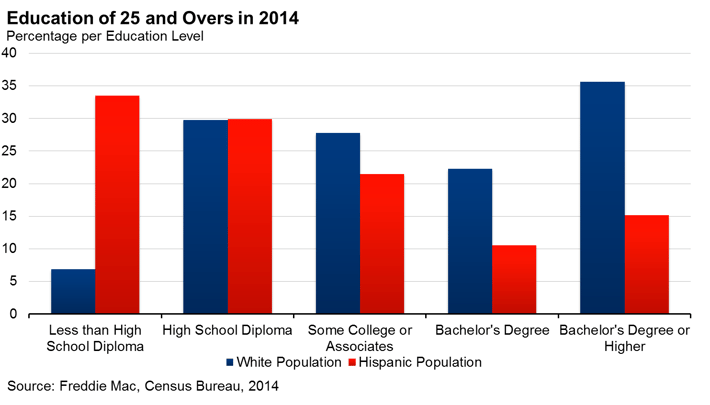

If we examine the educational levels of the Hispanic population over 25 years old, contrasted with the white population over 25 years old, we notice some stark differences. As can be seen in figure 3, Hispanics have much stronger representation on the lower end of this educational scale, with about three times as many Hispanics not completing high school as achieving a bachelor’s degree. This is almost a mirror opposite to whites who have approximately three times as many holders of bachelor’s degrees as high school dropouts. A clear pattern emerges. Lower levels of educational attainment correspond with lower levels of income, which, in turn, correspond with lower homeownership rates. This pattern helps shed some explanatory light on the causes behind the relatively low rates of homeownership in the U.S. Hispanic population.

So, what can be done?

Given our two underlying determinants of homeownership, age and education, the answer is twofold with respect to the U.S. Hispanic population. The first is to wait. As the population ages, its homeownership rate will rise with it. The second is to emphasize the necessity of education and the income benefits that accrue to it. In this day and age, college level education is becoming increasingly important for employment and should be highly supported and encouraged. It may not completely explain the difference in homeownership rates among different ethnic groups. However, if we can meet the demands of these two principal influences on homeownership, we can expect to see Hispanic homeownership rates increase in the coming years.

Connor Currie contributed to this post.