The rapid change in the macro-economic environment has resulted in some dire forecasts for multifamily. Higher interest rates, a slowdown in household formation rates from the heady pandemic-era pace, decelerating rent growth, and increasing vacancy rates have already sapped trading activity. In terms of multifamily transaction volume, the fourth quarter of 2022 was the slowest fourth quarter since 2014.

“Though multifamily transaction volumes have fallen, robust long-term demand for housing, coupled with an ongoing supply shortage that will be eased, but not erased, by under-construction apartment units, will continue to attract investor demand for multifamily properties when deal activity rebounds.”

At first glance, these short-term developments may appear concerning, but the long-term fundamentals for multifamily remain positive. In the short run, higher interest rates have increased cost of capital, which has, in turn, created a gap between buyer and seller price expectations. The disconnect between buyers and sellers is one of the underlying drivers of falling transaction volume. As this gap in price expectations narrows, and the market more broadly agrees on asset valuations, uncertainty will ease and transaction volume will rebound.

Multifamily Remains Undersupplied Relative to Demand

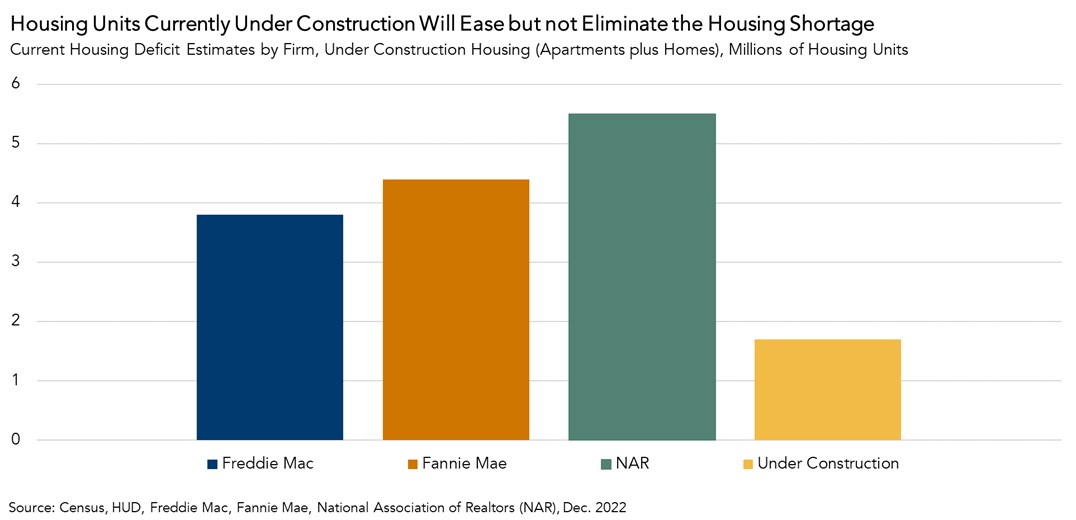

In the long run, however, the U.S. housing market remains structurally undersupplied following a decade of underbuilding. Though estimates vary considerably, most analysts indicate a current housing deficit of between 4 million and 5.5 million housing units nationwide, which includes both apartments and single-family homes. While there is new multifamily supply coming to market, and it will likely put downward pressure on rents, it will not be enough to offset this shortage. Currently, 926,000 apartments and 769,000 single-family homes are under construction – a total of 1.7 million housing units. Even if all of the units currently under construction were completed and came to market tomorrow, and household formation were flat, the housing market would remain undersupplied by millions of housing units.

Though renter household formation has recently slowed in response to the uncertain, high inflation, post-pandemic environment, rental demand is expected to grow in the long run. The National Multifamily Housing Council estimates that rentership rates will increase by 1.4 percent by the end of 2024, which amounts to approximately 1.8 million new renter households. This estimate excludes population growth, so renter demand will probably exceed this total. Given that housing demand is expected to strengthen and that the new housing supply coming to market will fall short of erasing the supply deficit, the housing shortage will likely remain, if not worsen.

Fundamentals Support a Long-Term Positive Outlook

Though multifamily transaction volumes have fallen, robust long-term demand for housing, coupled with an ongoing supply shortage that will be eased, but not erased, by under-construction apartment units, will continue to attract investor demand for multifamily properties when deal activity rebounds.