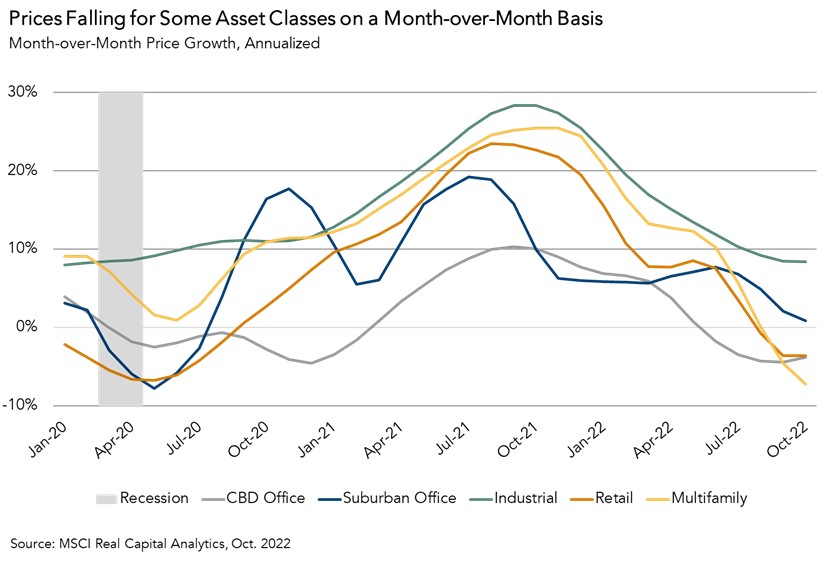

Several commercial real estate (CRE) fundamentals continued to soften in October. It was the second consecutive month where prices for multifamily, retail, and central business district (CBD) office sectors all declined on a month-over-month basis, though prices remain higher for all asset classes compared to October 2021.

"In 2023, the CRE market will be defined by greater price disconnects between buyers and sellers, and since deals only happen when a price is agreed upon, this dynamic will likely limit transaction volumes until financing costs retreat or property prices come down."

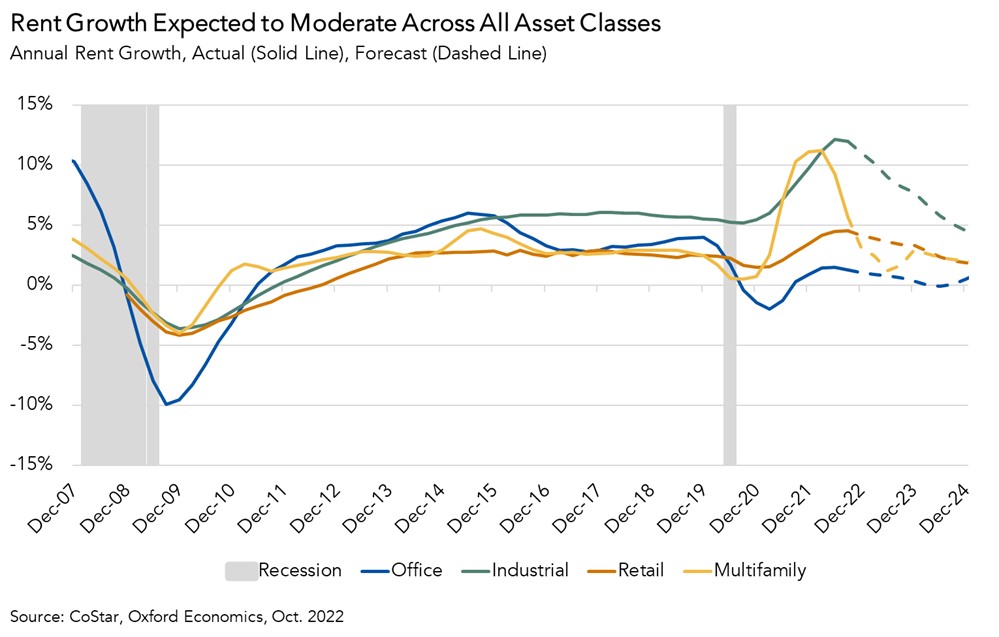

Higher interest rates, disconnects between buyers and sellers on price, and softening demand for certain assets are driving the decline in prices. In multifamily, for example, softening rental housing demand is contributing to still positive, but decelerating, annual rent growth.

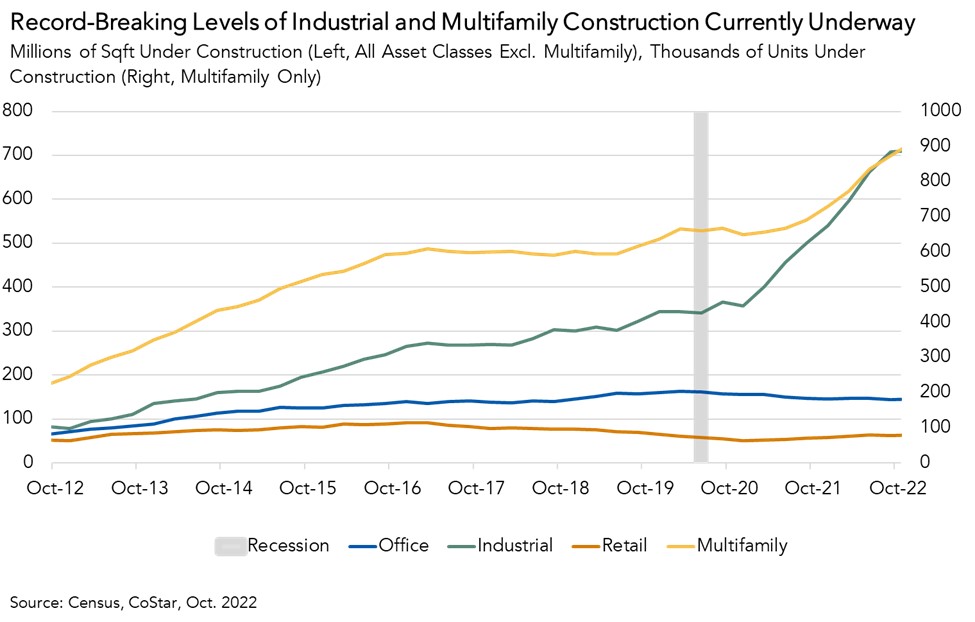

On top of softening rental housing demand, a near-record number of apartments are currently under construction. When these come to market over the course of 2023 and into 2024, they will put additional downward pressure on rental prices.

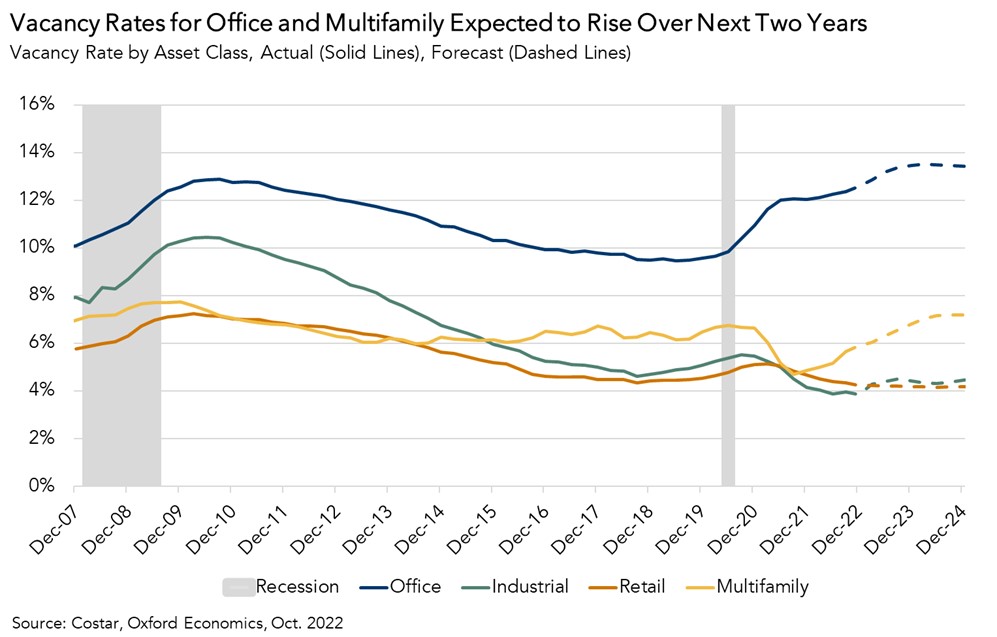

Slowing demand and more supply will likely gradually push up multifamily vacancy rates over the next year. Uncertainty around the future of work is expected to keep office vacancy rates high for the foreseeable future.

As for the other asset classes, industrial vacancy rates are expected to remain low, according to forecasts from Oxford Economics, even as a record quantity of newly constructed industrial properties come to market over the course of the next year. Retail vacancy rates are also expected to remain low, due in part to greater demolition of existing retail buildings compared with other properties.

So, What’s the X-Factor?

Taken together, these trends herald a slowing of CRE deal activity. In 2023, the CRE market will be defined by greater price disconnects between buyers and sellers, and since deals only happen when a price is agreed upon, this dynamic will likely limit transaction volumes until financing costs retreat or property prices come down.