The performance of retail real estate is closely tied to consumer spending trends. Over the last year, consumers have benefitted from meaningful wage growth, but inflation has erased most of those gains. Similarly, despite nominal retail sales growing by approximately 5.4 percent in February, retail spending in real terms has fallen over the last year. In other words, on average people are spending slightly less at retail stores than they were a year ago, and there are signs that retail spending may slow further as the year continues, which carries downside risk for retail real estate.

“Tighter household budgets may even slow experiential retail spending and, in turn, impact retail real estate performance.”

Where are People Really Spending Money?

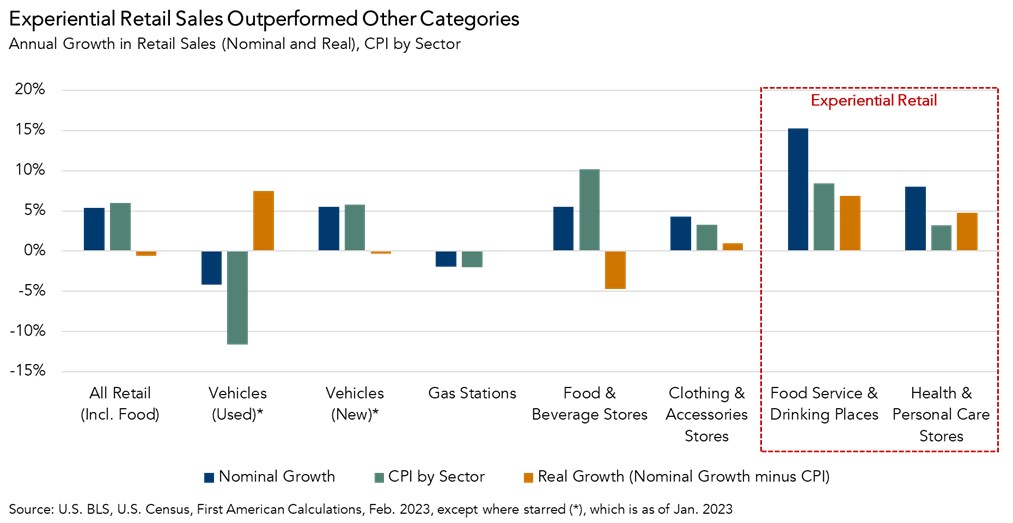

Adjusting retail sales for inflation by category provides insight into where consumer spending is still growing, holding prices constant. Real, inflation-adjusted retail sales declined for most major categories of spending in February, compared with one year ago.

The exceptions to this trend are so-called “experiential” retail locations, which are stores you need to physically visit to receive or “experience” the good or service being purchased. Real retail spending grew at restaurants and bars and health and personal care stores, such as hair salons or pharmacies, by 6.9 percent and 4.8 percent, respectively, year-over-year in January. The ongoing strength in experiential retail demonstrates the ongoing consumer demand for in-person services following several years of pandemic-related isolation. Greater spending on in-person services is a boon for experiential retail locations.

Pandemic-Era Savings are Fading

While experiential retail spending has proven resilient so far, there’s another factor that continues to buoy consumer spending – excess pandemic savings. Consumers accumulated excess savings during the pandemic as saving rates soared in 2020 and 2021. U.S. households accumulated approximately $2.3 trillion in excess savings during the early stages of the pandemic, but have been gradually depleting that wealth since late 2021, when the savings rate fell back below the pre-pandemic average. While estimates of the remaining stock of excess savings vary, one recent report from J.P. Morgan estimated that consumers retained approximately $900 billion of excess savings as of December 2022.

As this excess savings dwindles, consumers will have less to spend. Tighter household budgets may even slow experiential retail spending and, in turn, impact retail real estate performance.