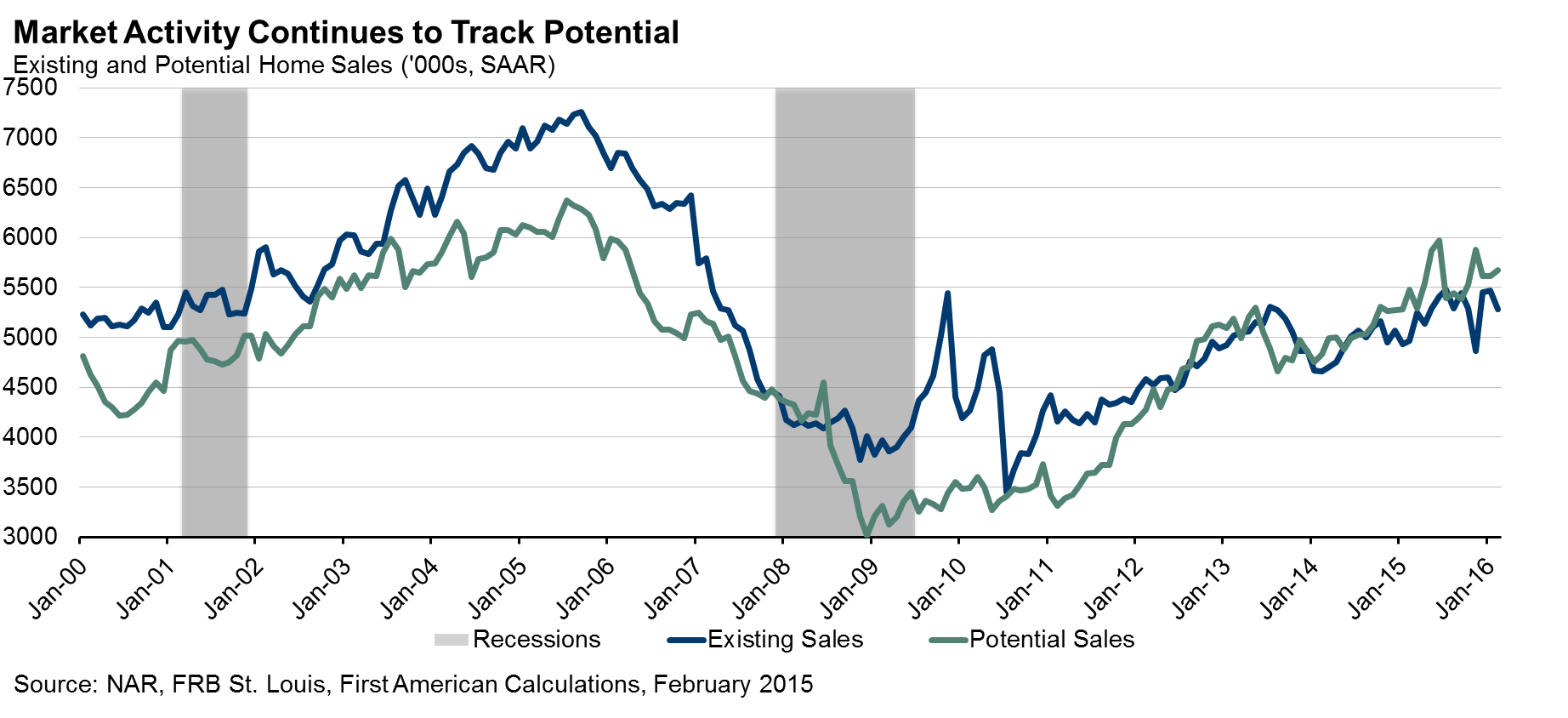

For the month of February, First American’s proprietary Potential Home Sales model showed that the market potential for existing-home sales grew by 1.0 percent compared with January and increased by 3.6 percent compared with a year ago. The Potential Home Sales model provides a gauge on whether existing-home sales are under or over their long-run potential level based on current market fundamentals.

"Actual existing-home sales are expected to show a decline in February compared to January, while still showing positive year-over-year growth," says Chief Economist Mark Fleming

According to the model, the seasonally adjusted, annualized rate (SAAR) of potential existing-home sales is up 88.1 percent from the low point reached in December 2008*. The rate of potential home sales in the model increased by 55,000 (SAAR) in February. The potential home sales rate is down 703,000 (SAAR) from the pre-recession peak, which occurred in July 2005.

The model’s current underperformance gap is an estimated 388,000 (SAAR), which is significantly less than the sales potential gap of 850,000 existing-home sales in July 2005.

Analysis: Market Potential Remains Strong, Dip in Sales Expected in February

Actual existing-home sales held steady in January, with a reported level of 5.47 million (SAAR), up slightly from 5.45 million sales in December. The market stability in January was a welcome sign indicating continued strength and resilience after the substantial drop in sales in November caused by closing delays due to the implementation of the Know-Before-You-Owe-Rule, also referred to as the TILA-RESPA Integrated Disclosure rule. We continue to see no indications of any fundamental changes in market conditions and January was no exception, showing an existing home sales market in line with expectations for sales activity.

This month, our model continued to show potential home sales at the 5.7 million (SAAR) level, increasing the underperformance gap between our forecasted February actual existing-home sales level and potential existing-home sales in February to 388,000 sales. As implied by the 2.5 percent decrease in January in the NAR Pending Home Sales Index, actual existing-home sales are expected to show a decline in February compared to January, while still showing positive year-over-year growth compared to February 2015. This is due in large part to tight inventories, which is keeping the market from aligning with its potential. However, this is expected to be a temporary condition and should reverse course as inventories increase with the start of the spring home-buying season.

Mortgage rates continued to decline in the first half of February due to the high degree of market volatility and the ‘flight to safety’ that drove down long-term treasury yields, the benchmark underpinning long-term mortgage rates. While rates started to increase during the second half of the month, they still remained below 4 percent, continuing to provide consumers with strengthened purchasing power.

While house price appreciation continues to cool modestly, the historically low rates mean borrowers can bid more for housing. In this current market, the limited supply combined with leverage-assisted demand is driving prices higher. Actual price appreciation is currently stronger than what is fundamentally supported by market conditions. This leverage-assisted housing inflation could persist if rates remain low.

Last month, we mentioned that the likelihood of modest mortgage rate increases seems less likely now due to the global economic uncertainty and depressed energy markets. However, conditions have recently stabilized, if not improved slightly. Even though the Federal Reserve did not raise the benchmark Federal Funds Rate this week, they did indicate that it is likely we shall see an increase in the Federal Funds Rate later this year. Regardless of the rate hike path, we expect mortgage rates to increase modestly as investor demand for the 10-year Treasury bill, which truly drives mortgage rates, fades with a more certain global economic outlook. This has the potential to impact many aspects of the housing market, from affordability to inventories, and is something that will be watched with peaked interest over the course of 2016.

Next Potential Home Sales release: April 14, 2016 for March data

*Previous Potential Home Sales releases referred to February 2009 as the low point of sales. The model used to generate existing-home sales potential has been updated with more recent data to more accurately reflect the dynamic relationships between sales, prices, interest rates and the user-cost of housing, resulting in a model that more accurately reflects past conditions.

About the Potential Home Sales Model

First American’s proprietary Potential Home Sales model provides a gauge on whether existing-homes sales are under or over long-run potential based on current market circumstances. The model’s potential home sales seasonally adjusted annualized rate provides a measure on whether existing-homes sales, which include single-family homes, townhomes, condominiums and co-ops, are outperforming or underperforming based on current market fundamentals. The Potential Home Sales model estimates the historical relationship between existing-home sales and U.S. population demographic data, income and labor market conditions in the U.S. economy, price trends in the U.S. housing market, and conditions in the financial market. For example, seasonally adjusted, annualized rates of actual existing-home sales above the level of potential home sales indicate market turnover is outperforming the rate fundamentally supported by the current conditions. Conversely, seasonally adjusted, annualized rates of actual existing-home sales below the level of potential existing-home sales indicate market turnover is underperforming the rate fundamentally supported by the current conditions. Actual seasonally adjusted, annualized existing-home sales may exceed or fall short of the potential rate of sales for a variety of reasons, including non-traditional market conditions, policy constraints and market participant behavior. Recent potential home sale estimates are subject to revision in order to reflect the most up-to-date information available on the economy, housing market and financial conditions. The Potential Home Sales model will be published prior to the National Association of Realtors’ Existing-Home Sales report each month.